The race to the digital euro is getting tense

plus: conservative stablecoins, tentative truce, shaky macro and more

“All centuries are dangerous; it is the business of the future to be dangerous.” – Alfred North Whitehead ||

Hi everyone! I hope you’re all doing well.

Today’s send is a bit rushed, apologies, I have to dash out the door at lunchtime – back to usual schedule tomorrow!

Last night on the Bits & Bips livestream, James Seyffart, Alex Kruger and I were joined by Anthony Scaramucci for a fun, macro-heavy conversation with comment on Circle and a key crypto ETF update from James – you can watch the playback here.

IN THIS NEWSLETTER:

The race to the digital euro is getting tense

Fiserv and “conservative” stablecoins

Macro-Crypto Bits: markets, truces, bad price data and more

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

The race to the digital euro is getting tense

A tinge of desperation is creeping in.

Speaking to the European Parliament yesterday, European Central Bank (ECB) President Christine Lagarde urged lawmakers to accelerate approval of the legislation necessary to usher in the digital euro. She reportedly even said “please”.

This is revealing on two fronts:

One is that, as I’ve been saying for a while, the “study period” of two years – during which the central bank would explore the pros and cons of the digital euro while consulting with multiple groups on the potential consequences – is pure theatre. The governing committee was due to make a final decision in October of this year, and until then there was still a chance common sense would prevail and it would be scrapped; now, we have further confirmation the decision was taken a while ago.

We’re told that it’s to protect Europeans from dependence on US and Chinese payment platforms such as Visa, Mastercard and Alipay. We’re also told that it’s to prevent Europeans from becoming too dependent on the obviously unreliable US dollar. And we’re told that this is now urgent given the US push for stablecoins to extend dollar hegemony. The “nationalist” strings are being pulled, which itself carries a tinge of desperation as the EU is not exactly united on much.

But this is just the most recent version of the spin we’ve been sold over the years, starting well before President Trump’s inauguration. The “American threat” narrative feels not so much urgent as merely the latest justification.

What’s more, it’s a justification riddled with inaccuracies. In her speech yesterday, Lagarde reminded everyone that stablecoins “are not always able to maintain their fixed value”, which compromises their utility. In the past, there have been colossal stablecoin collapses – but similarly fragile structures are precluded in current versions of US regulation, and are certainly not the exported dollar stablecoins Lagarde seems to be afraid of. That claim is deliberately misleading.

When asked why Europeans would choose dollar stablecoins over traditional euros, she cited the high interest rates – although under US and European frameworks, dollar stablecoins won’t pay interest.

And the “potential shift in deposits… could adversely affect the transmission of monetary policy”. With impeccable timing, last week the European Parliament Think Tank published a paper demonstrating that foreign (ie. dollar) stablecoins were not a threat to European monetary integrity, and that the digital euro’s low balance limit (as yet undecided but likely to be around €3,000 to keep banks from panicking) will dampen its utility.

The second big message here is that Lagarde is frustrated by what looks like regulatory stonewalling. Lawmakers are understandably concerned. In February, the ECB Target 2 (T2) and Target 2 Securities (T2S) payments systems crashed, leaving transfers frozen for 10 hours and delaying the payment of salaries, pensions, welfare payments and financial trades. Several officials took advantage of the opportunity to publicly question whether the ECB could be trusted to run a digital euro – this has more than a pinch of political grandstanding, but it does highlight the risk in centralization.

Why the urgency now?

It could be to do with the ticking of the clock – Lagarde’s term as ECB President ends in October 2027 and cannot be renewed. She no doubt wants to have the launch as part of her legacy. Last month, reports emerged that she was considering leaving her post early to run the World Economic Forum. She has since insisted that she plans to see out her tenure, but confidence has been dented.

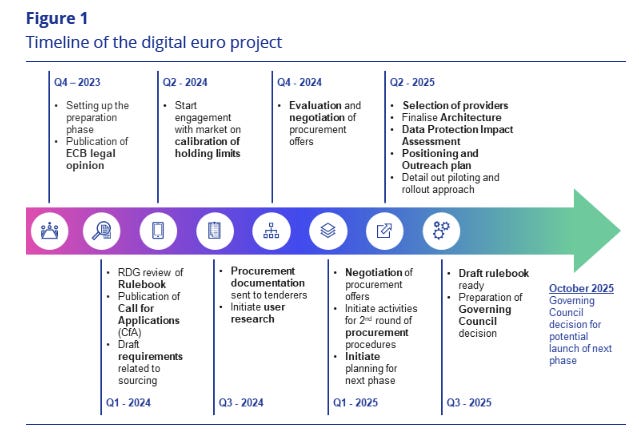

And the digital euro is a complex project that should not be rushed. Assuming launch is announced this October, full implementation will take time. Selection of the developers is due by the end of this month, along with the finalized architecture. But a project this deep and systemic will be tough to spin up in just four months. The announcement of the decision to go ahead does not mean systems will be ready to do so.

(timeline via the European Central Bank)

What’s more, before full launch there will need to be an extended “pilot” with limited roll-out, followed by reports, adjustments as well as more builds and integrations. So, even if the ECB hits the ground running in October (a big if), a complete EU-wide launch is probably a couple of years away, coming right up to the time Lagarde leaves her post. And the ECB can only hit the ground running if the legislation is in place.

It might not be. As I mentioned above, there seems to be some stonewalling. A digital euro framework was first proposed in 2023, and has not progressed much since. In December, Stefan Berger – the European Parliament representative responsible for steering the project through the legislative process – stepped down, citing opposition to the ECB focus on a retail CBDC. His replacement is Fernando Navarrete Rojas, who earlier this year gave a speech in the European Parliament warning of the digital euro risks, and asking deep “but whyyyyy?” questions that as far as I know have not been answered.

And all this is before some territorial legislators start to argue about who should be in charge of the project, as it is not entirely about monetary policy – it directly touches key areas outside the central bank mandate, such as private sector innovation, retail-facing applications and user privacy.

In sum, Lagarde is understandably fretting that typical European inertia will scupper her goal of inserting her central bank into the daily lives of citizens. Of going where the European Central Bank has not gone before. Of potentially changing central bank business models for the digital age, and at the same time setting the base for greater centralized control over payments of any sort.

In sum, there is still a glimmer of hope that it may not happen.

See also:

Fiserv and “conservative” stablecoins

More entrants in the stablecoin rush:

Fiserv, a software provider for banks and payment providers, is launching a digital assets platform and issuing its own stablecoin. The firm is partnering with Paxos and Circle for the technology. FIUSD will initially run on the Solana blockchain, and will be interoperable with PayPal’s PYUSD stablecoin.

This is potentially yet another big deal for stablecoin adoption, in that Fiserv currently works with around 3,000 regional banks in the US, while serving roughly 10,000 financial institutions and over 6 million merchants. Put differently, it can make it easier for small banks and fintechs to spin up stablecoin services for their clients, including wallets, custody and transfer execution. The firm has also said it plans to work with banks on deposit tokens.

And not just banks: Fiserv worked with Walmart to create Walmart Pay. Remember a couple of weeks ago, the Wall Street Journal reported that Walmart and Amazon were looking into issuing stablecoins? And how many responded that they couldn’t because the GENIUS Act limits issuance authorization to financial services firms? Well, this is one way the retail giant could get around that (there are others) – a stablecoin issued by Fiserv for Walmart.

While the move is a big step towards traditional finance validation of the stablecoin concept, there is another traditional finance trend at work here – concentration of service provider platforms. This is natural: when you have the client, you can grow by selling them more services, especially important in times of technological change, and especially in a field (regional banking) not known for its tech expertise.

But it centralizes risk. Fiserv is a long-standing financial technology provider with a good reputation – yet banks relying on one platform for so much may be convenient, but it is also brittle.

And, it dampens the potential innovation. “Faster payments” are the initial gateway for stablecoin adoption, the “obvious” use case that gets even conservative, traditional players interested. But the room for further innovation is huge: new types of payments, conditional transfers, agentic commerce, programmable activations and more. If banks become locked in to a platform with traditional services in its DNA, they are more likely to be overtaken by agile competitors with their own innovation teams and ideas.

I’m not knocking the move, it’s a strong sign finance is changing and we’re here for that. I’m just saying that there are also consequences to how the implementation evolves.

Macro-Crypto Bits:

This section offers brief comment on some of the news items I’ve seen today that are relevant for the macro and crypto narratives I talk about. I’ll try to keep this short, but there is SO MUCH going on.

Markets

It looks like markets, and all of us, can breathe a sigh of relief that the Middle East escalation is now ratcheting down. Or maybe not. One can hope, but…

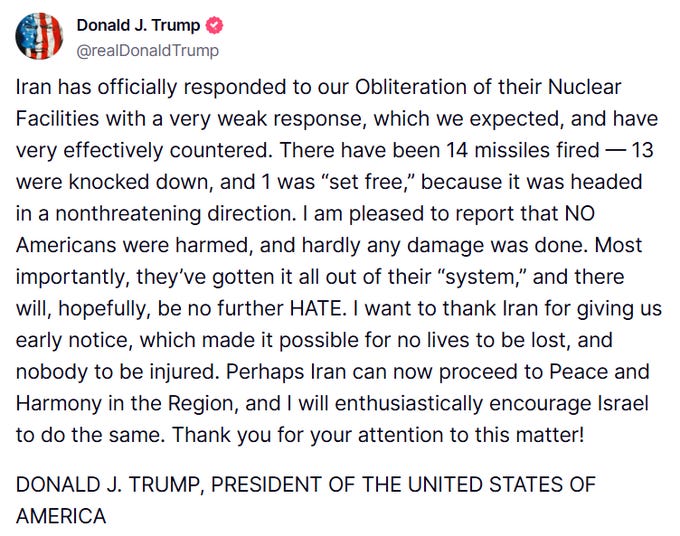

Yesterday, President Trump announced a ceasefire between Iran and Israel, after Iran launched a symbolic attack on a deserted US military base in Qatar.

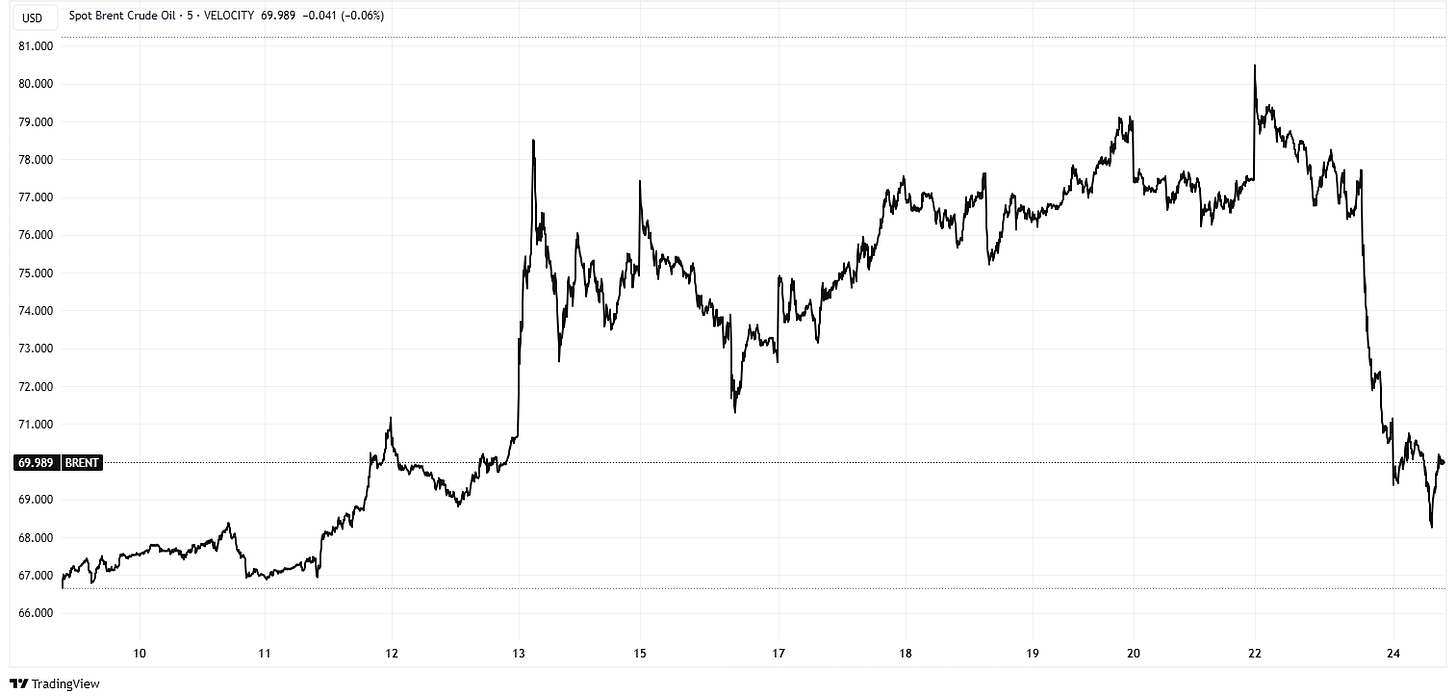

Oil prices dropped, with the Brent crude benchmark almost back to where it was before Israel struck Iran’s leadership and nuclear program on June 12-13. Stock markets rallied, so did crypto.

(chart via TradingView)

Yet Trump’s message did the opposite of helping Iran de-escalate while “saving face”. He referred to their “weak response”, and condescendingly assumed their thwarted attack means that they have “gotten it all out of their ‘system’”.

(screengrab via @StateDept_NEA)

Indeed, earlier today, Israel accused Iran of violating the ceasefire (although Iran has denied this), and Israel’s Defence Minister has responded with threats of “powerful strikes against regime targets in the heart of Tehran”.

In sum, it’s not totally over yet, but markets do not seem to expect renewed hostilities on the scale of last week. Iran has few supporters, and while isolation and desperation can lead to self-destructive acts, the powder kegs for now seem to have had their lids replaced.

Macro

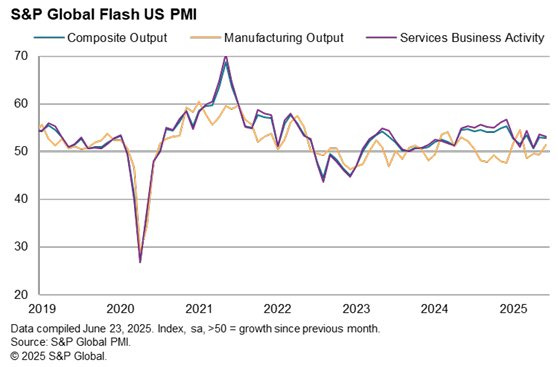

US manufacturing grew at a steady pace in June, with the S&P manufacturing PMI index coming in at 52, slightly above consensus expectations of 51 (anything above 50 denotes expansion). Services growth decelerated slightly, but was still positive.

(chart via @LizAnnSonders)

Worrying signs appeared in price indices, however. Manufacturers’ input and selling prices both rose at rates not seen since July 2022, with evidence of tariff costs being passed on to customers.

And on Friday, the US Conference Board Leading Economic Index (LEI) dropped to the lowest point since April 2015. Yes, even lower than during the depths of the pandemic. Not sure what’s going on there, will dig into it.

(chart via @KevRGordon)

WHAT I’M LISTENING TO: Unexpectedly complex chorals and lyrics – After the Goldrush, by Prelude

If you find Crypto is Macro Now useful, would you mind hitting the like button? ❤ I’m told it feeds the almighty algorithm.

And if your friends and colleagues sign up via your referral link, you get a free month!

REFER

HAVE A GOOD DAY!

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade.