Markets: a bad start

plus: China and stablecoins, what's ahead this week, and more

“Keep the company of those who seek the truth – run from those who have found it.” – Vaclav Havel ||

Helloooo everyone, and welcome to December!!! Those of you that took some time off for Thanksgiving, I hope you got to disconnect and ate some great food – we’re all going to need strength for this last sprint of the year.

🍂 In my latest op-ed for American Banker (paywall, sorry!), I sketch out how stablecoins, with the support of both the US Treasury and the Federal Reserve, will upend banking structures by separating payments from credit creation.

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

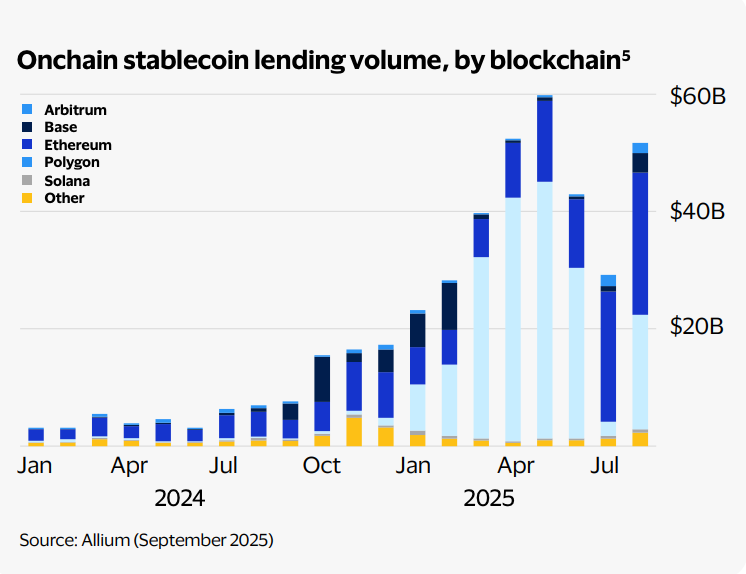

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Coming up this week: US jobs, PCE, economic activity, diplomacy and more

Markets: a bad start

China and stablecoins

Macro-Crypto Bits: a strange divergence, Black Friday and inflation

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes.

WHAT I’M WATCHING:

Coming up this week:

This week, we get a flurry of US economic data including key health indicators for jobs, inflation and manufacturing/services activity. There’s also a ton of intriguing diplomatic criss-crossing.

Today, US special envoy Steve Witkoff heads to Russia to continue peace negotiations – over the weekend, the US team met with the Ukraine team in Miami, and both sides say the discussions were “productive”. Let’s hope the momentum continues, despite Europe’s attempts to slow it down. EU defence ministers meet in Brussels today to discuss aid for Ukraine, even though they probably know full well their countries don’t have the money or even the will.

In the US, we get the November manufacturing PMI data, expected to show a slowdown in activity and a pickup in prices.

Also today, we get Macau casino revenue for November – I watch this as an indicator of Asian risk sentiment.

Tomorrow, the Bank of England releases its annual Financial Stability Report, and Governor Bailey gives a press conference – we just might see/hear some references to stablecoins.

On Wednesday, France’s President Macron is in China to meet with President Xi. There are several interesting twists to this visit. One is that it is at President Xi’s invitation – it’s almost as if he is trying to emphasize and widen internal divisions on the EU’s China stance, with France considerably more conciliatory than the EU Parliament. Another is the timing: while this has been on the calendar for a while, it comes as EU ministers scramble to figure out how to pressure China into pressuring Russia to retreat – we all know that’s not going to happen, and here we have the EU’s second largest economy and its only nuclear power working to strengthen diplomatic and trade relations with a key Russian ally.

And NATO foreign ministers gather in Brussels for their regular bi-annual meeting – only, US Secretary of State Marco Rubio will not be attending. Granted, he’s kind of busy keeping the peace negotiations going.

Also on Wednesday, we get the private US jobs data from ADP for November, expected to show further slowdown: consensus forecasts point to a 19,000 increase, vs 42,000 in October.

Plus, we get the US export and import price indices as well as the US manufacturing and industrial production data for September; and US services PMI for November, expected to be flat to slightly down.

On Thursday, we get data on US job cuts for November.

On Friday, we get the delayed US Personal Consumption Expenditure inflation indicator for September. This is by now old news and unlikely to materially impact the Fed’s thinking on rates. Consensus expectations point to no change in the core inflation rate of 2.9%, and a slight acceleration in the headline rate to 2.8% from 2.7%.

We also get the preliminary read of the University of Michigan Consumer Survey for December.

And Russian President Vladimir Putin visits India as part of the 23rd India-Russia Annual Summit, in his first visit to the country since the invasion of Ukraine. An early prediction for 2026: this relationship will be a key driver of next year’s geopolitical shift. The US wants India to sever ties with Russia, India will fiercely defend its neutrality, and the US will have to back off to avoid pushing India away.

This coming weekend, Qatar hosts the Doha Forum, known as the “Davos of the Middle East” – I haven’t yet seen a list of who’s attending, but there will no doubt be a smattering of prime ministers, foreign secretaries, big-name bankers and high-profile tech leaders.