A jittery US dollar

plus, inflation expectations, and US regulatory overreach

“If you have an apple and I have an apple and we exchange these apples then you and I will still each have one apple. But if you have an idea and I have an idea and we exchange these ideas, then each of us will have two ideas.” – George Bernard Shaw ||

Hi everyone! I hope you’re all gearing up for a strong January, whatever your field. Start as you mean to go on, right?

I’ve got a pause on that, personally, as I’m still battling an uncomfortable cold – gloves are off, though, I’m moving on from gallons of ginger tea, bags of throat lozenges and seemingly endless eucalyptus steams, and am now on some envelopes of god-awful stuff from the pharmacy. Enough already.

As usual, I kick off the week with a review of where we are in markets and macro indicators. I also look at the firestorm of moves that will hopefully correct egregious US regulatory overreach.

Given my cottonwool head, and since today’s email is chart heavy, I won’t be doing an audio version.

IN THIS NEWSLETTER:

A jittery US dollar

Inflation expectations

Regulatory overreach: Cleaning house

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as audio, relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

A jittery US dollar

With end-of-year rebalancing behind us, tailwinds are back in the driving seat and BTC is already up over 8% so far this year.

(BTC/USD chart via TradingView)

Initially, this looked like it was triggered by a sharp drop in the US dollar. Yesterday morning, the Washington Post reported that Trump was considering dialling back his tariff plans to focus on specific critical imports. Lower tariffs in theory would weaken expected dollar demand, which should boost dollar-denominated commodities while easing global liquidity conditions.

(DXY dollar index chart via TradingView)

But the timing doesn’t sync – BTC started climbing as the DXY dollar index bounced after Trump denied the Post’s report.

(chart via TradingView)

The bounce didn’t hold, though, in part because a correction in the DXY was long overdue (up over 2.6% in December alone), and in part because Trump’s denial was taken as an extension of his use of tariff threats as a negotiating tool. Put differently, he has to maintain the threat of extensive tariffs if they are to have the desired effect on concessions from trade partners. We can’t have the Washington Post hand a win to the negotiating opponents, now can we?

This morning, however, the DXY is heading back up and is once again above 108 as economic data continues to come in strong.

The final read for December’s US Composite Purchasing Managers Index was revised down, but still came in at the highest since May 2022. The new orders index rose the fastest since March 2022.

(chart via @LizAnnSonders)

This Friday, we get another round of key US employment data, with consensus expectations pointing to payroll growth of roughly 160,000. This would bring the average down to 180,000, lower than other years but in line with pre-pandemic averages. I’ve commented before that we’re not yet seeing a worrying slowdown, we’re seeing a normalization from the crazy post-pandemic job market.

(chart via Bloomberg)

Bond traders are worrying about inflation, however. US yields continue to climb, with the 10-year earlier today reaching its highest point since May amid concerns about this week’s $119 billion treasury issuance.

(chart via TradingView)

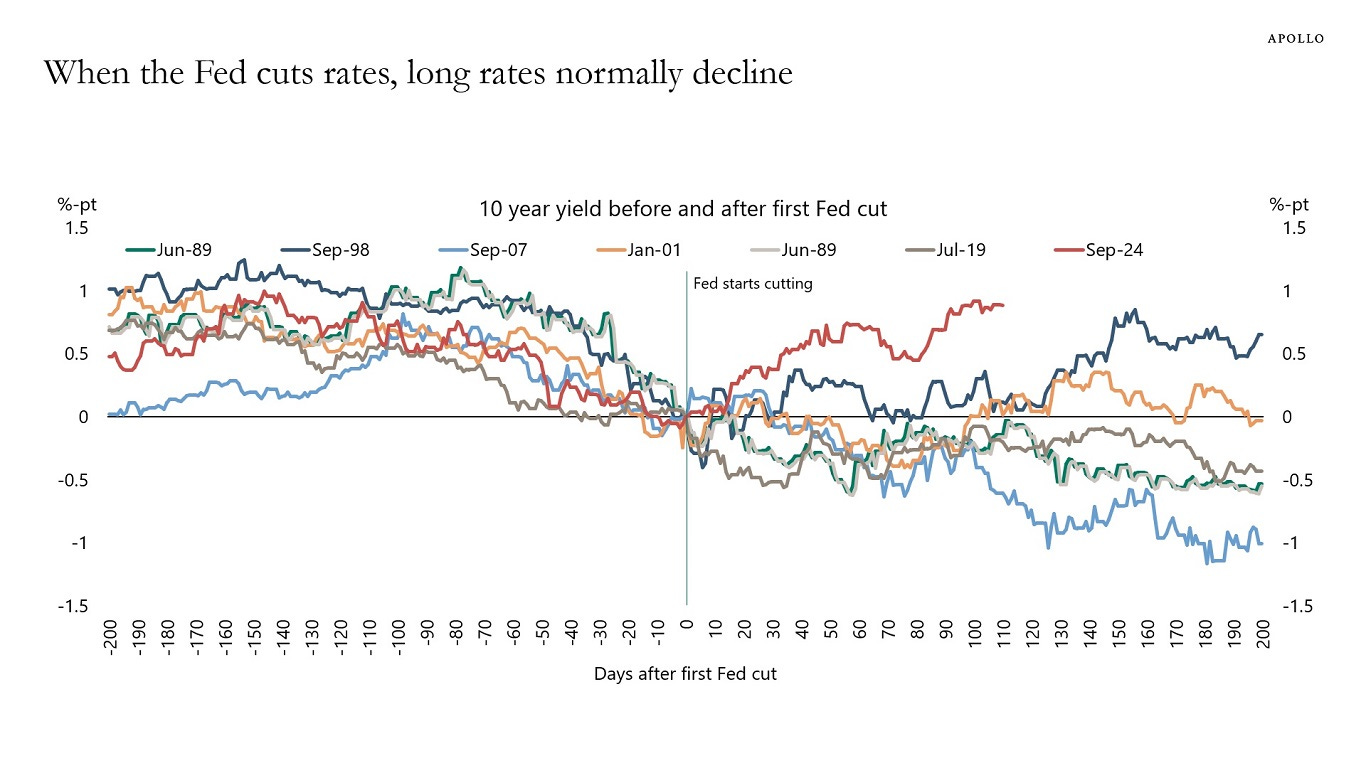

At over 4.6%, the US 10-year yield is a full 100 basis points higher than when the Fed started cutting rates in September, essentially offsetting the 100 basis point reduction in the fed funds rate. This is the steepest yield climb after the beginning of an easing cycle in modern history. Trouble is brewing.

(chart via Apollo Academy)

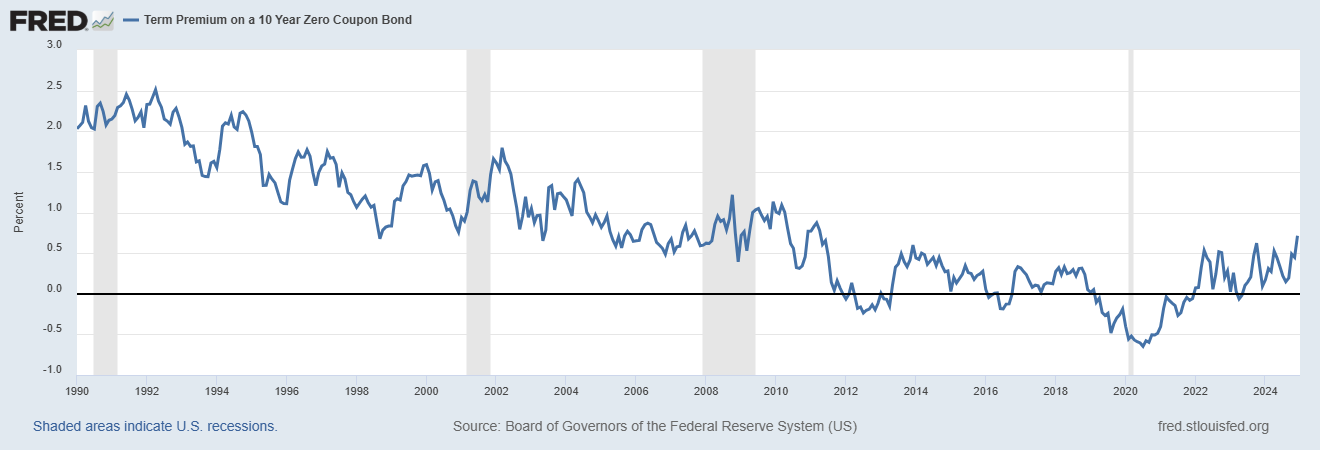

What’s more, the 10-year term premium – a composite measure of built-in risk and inflation expectations – is currently at its highest point since early 2011.

(chart via the St. Louis Fed)

Inflation expectations

US treasury yields are climbing while the DXY is heading down? What gives?