A scene change: Central banks and stablecoins

plus: tariffs, jobs, rates, gold, mood and a lot more

“Underlying most arguments against the free market is a lack of belief in freedom itself.” – Milton Friedman ||

Hi everyone, I hope you’re all doing well!

I know many of you are in “back to school” mode, which is both exciting and wistful. And I’m kinda looking forward to joining you with sharpened pencils on Monday - but over in my little corner, the summer vibe is not yet over as this week is short and festive.

Programming note: I know I’ve already missed one day this week, but I’m missing another one tomorrow, and won’t be publishing the free weekly on Saturday – back to normal schedule next week!

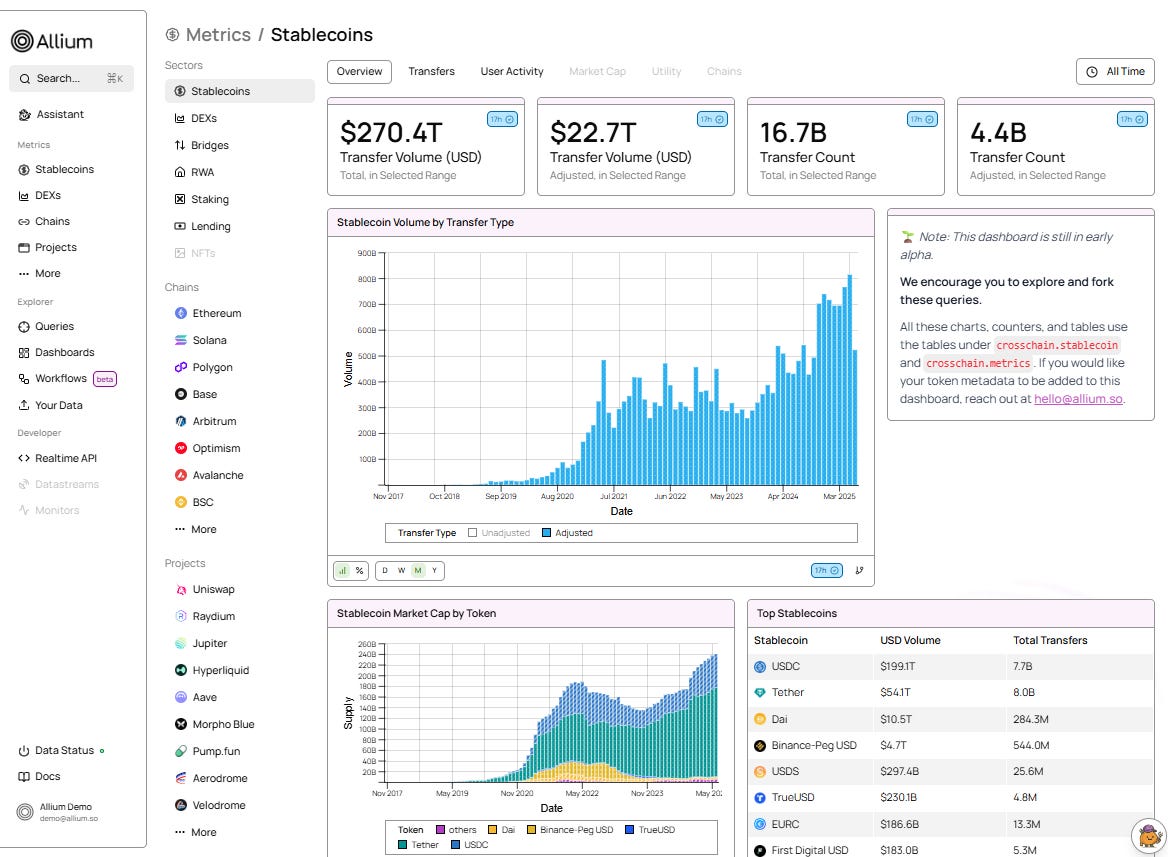

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Tariffs: Overuse of a blunt instrument leads to bruising

A scene change: Central banks and stablecoins

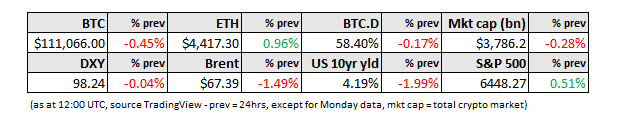

Macro-Crypto Bits: gold, jobs, yields, mood

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Tariffs: Overuse of a blunt instrument leads to bruising

The US use of tariffs to bend the will of other nations in their domestic decisions is escalating to nonsensical levels.

Trump’s imposition of additional tariffs on Brazil for its “persecution” of his personal friend – former president Jair Bolsonaro, for a coup attempt after narrowly losing the 2022 election (and against whom there is plenty of evidence) – seems to have set an ugly precedent.

Now, the State Department is looking into imposing tariffs on countries that comply with a UN marine fuel emissions-cutting initiative, according to a report yesterday from Reuters. The Dutch government, for example, has apparently already received a verbal warning.

And then there’s the threat against Norway for the decision of its sovereign wealth fund to sell shares in Texas-based Caterpillar, after public pressure to divest in businesses seen as aiding Israel’s war effort. Whether you agree or not with their decision, surely it should be theirs to make? This time the threat of punitive tariffs did not come from Trump but from Senator Lindsay Graham – he is of course not authorized to impose tariffs but is a Trump ally and, feeling empowered by the precedent, is no doubt bending the President’s ear on this.