American exceptionalism + geopolitics

why they matter for crypto, US markets, democracy, French tokens and more

“Clothes make the man. Naked people have little or no influence on society.” – Mark Twain ||

Hi everyone, and Happy Friday! I hope you have a great weekend planned. On Sunday we finally adjust our clocks for Daylight Savings (an archaic concept that needs to be binned), so US readers just might start getting this newsletter earlier as of Monday. I hope, anyway.

Today, Macro-Crypto Bits had SO much to comment on regarding the geopolitical realignment: military assistance, the Arctic, Turkey, Asian trade and a whole lot more.

Plus, I share some notes from a compelling podcast on American Exceptionalism.

IN THIS NEWSLETTER:

Macro-Crypto Bits: geopolitical realignment, the Arctic, waning support for democracy, gold, US PCE and a whole lot more

The death of American Exceptionalism

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as audio, relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Macro-Crypto Bits

This section offers brief comment on some of the news items I’ve seen today that are relevant for the macro and crypto narratives I talk about. I’ll try to keep this short, but there is SO MUCH going on.

The TL;DR of why the accelerating geopolitical realignment we’re seeing matters for crypto:

1) the building case for dollar alternatives in international trade heightens the insurance value of holding non-sovereign currencies;

2) change is usually accompanied by turmoil which in turn is accompanied by repression, which makes decentralized savings important for individual resilience.

US

Another Fed official has expressed doubts that the inflation impact from tariffs will be “transitory”. Speaking yesterday at an event, Richmond Fed President Tom Barkin pointed out that economic sentiment was falling, but strong employment and stubborn inflation made the current rates stance “a good place to be”. It’s increasingly sounding like support for any rate cuts at all this year is weakening.

Q4 GDP for the US was revised up to 2.4% yesterday, from 2.3% initially reported. More good news came in the core Personal Consumption Expenditure (PCE) index which was revised down from 2.7% to 2.6%. Continuing with the happy numbers, after-tax profits climbed 5.9% in the quarter, the most in more than two years. And a measure of aggregate profit margins widened to 15.9%, higher than the pre-pandemic average. This is especially good news in that it suggests businesses may in aggregate be able to weather the input cost increase from tariffs without a hefty hike in prices.

(chart via Bloomberg)

Markets

Markets were not cheered, however, as sentiment looks now toward the valuation impact of margins squeezed by tariffs, and a receding likelihood of an agreement on Ukraine – yesterday, details emerged on the US proposal for control of Ukraine mineral extraction and industrial production, with few expecting the Ukraine to agree, even if Russia were to relax its conditions for a Black Sea ceasefire.

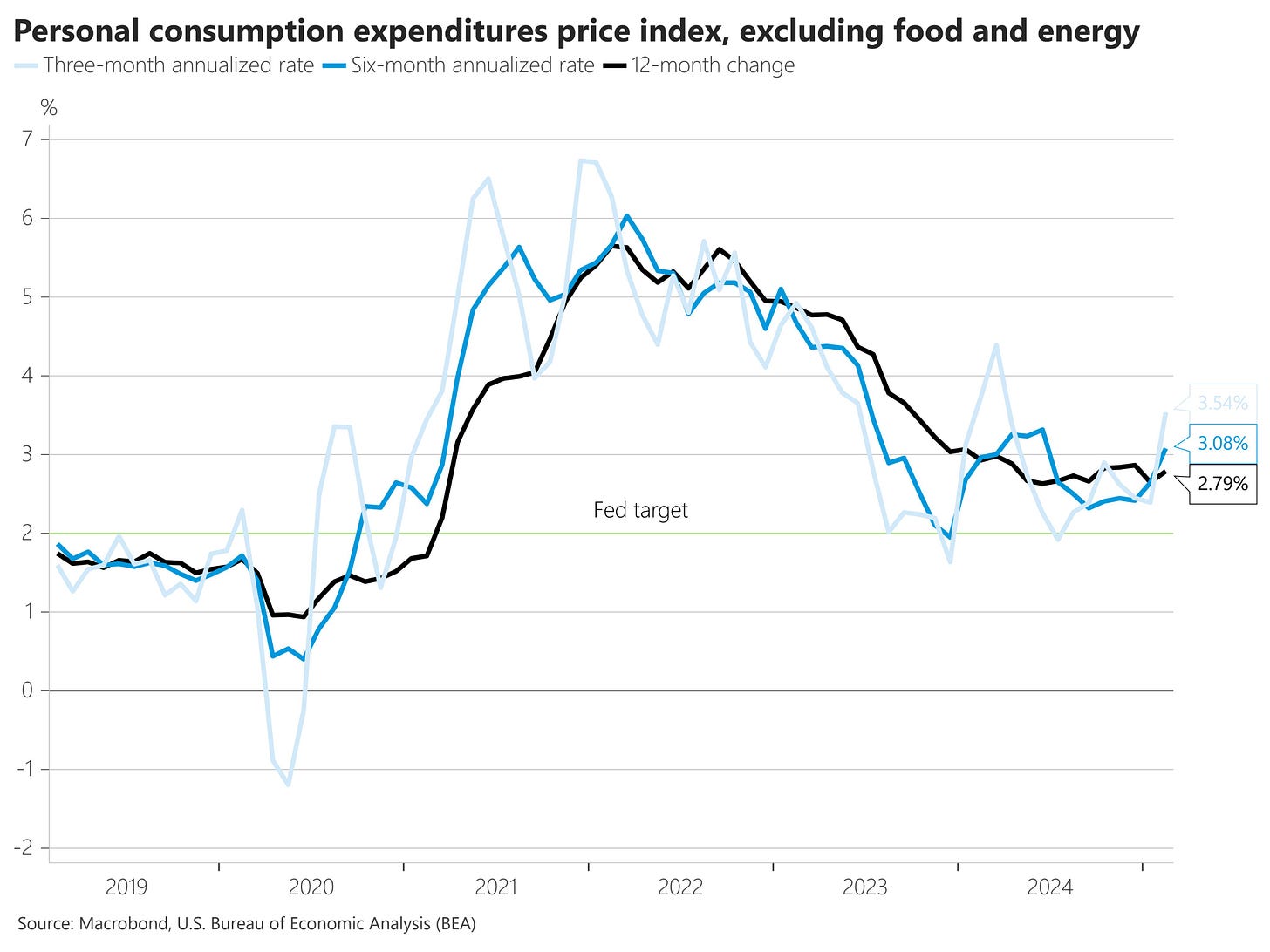

What’s more, February’s core PCE index, the Federal Reserve’s preferred inflation gauge, increased by 2.8%, higher than the forecast of 2.7%. This brings the 3-month annualized basis up to 3.5%, heading in the wrong direction and a far cry from the Fed’s target of 2.0%.

(chart via @NickTimiraos)

Crypto assets, heavily correlated these days to risk sentiment, are sharply down this morning, suggesting that today could be rough in stock markets as well.

(chart via TradingView)

Meanwhile, gold is now comfortably above $3,000, and earlier today hit a new all-time high of $3,086.

(chart via TradingView)

Further to run? Check out the below chart which shows gold as a percentage of total reserves. More specifically, take a look at China way over on the right.

(chart via @RonStoeferle)

Philippines

Here’s further evidence of the US rush to move its military focus from Europe to Asia: while President Trump and his team push for a rapid solution to the Ukraine war and talk about reducing their commitment to NATO, the US is boosting military support for the Philippines. Defence Secretary Pete Hegseth is in Asia this week, and reportedly pledged to send new advanced missile systems and unmanned vehicles to the Southeast Asian nation. The US and Philippines also plan to conduct joint special operation forces training on islands near Taiwan.

This will no doubt alarm China, which has engaged in escalating skirmishes with Philippine naval vessels over the years. These have been attributed to territorial disputes over fishing and energy rights but are most likely part of a broader hemisphere domination strategy.

It’s no secret that the Trump Administration sees China as a much greater threat than Russia. It is interesting to see this now start to play out on the board, and it is a sobering reminder that EU outrage over the US treatment of Ukraine will fall on deaf ears.

Greenland

US VP JD Vance is in Greenland today, visiting the Pituffik Space Base, the US’ northernmost military base and a key station for satellite and missile monitoring. The signal here is much more than continuing Trump’s “Greenland will be ours” flex – it highlights the growing strategic importance of the Arctic.