Amundi’s tokenization: the hidden story

Plus: the BIS and real estate tokenization, macro signals, and some backstabbing

“When a thing ceases to be a subject of controversy, it ceases to be a subject of interest.” – William Hazlitt ||

Hi everyone! I hope you’re all taking care of yourselves – you know, drink fluids, keep healthy snacks handy, get some fresh air. We’re in the final stretch of the year, it’s important to enjoy what we can.

🍂 If you speak Spanish and are interested in a less frequent, shorter update on developments in the crypto-macro intersection, I hope you’ll subscribe to sister publication Cripto es Macro. 🍂

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

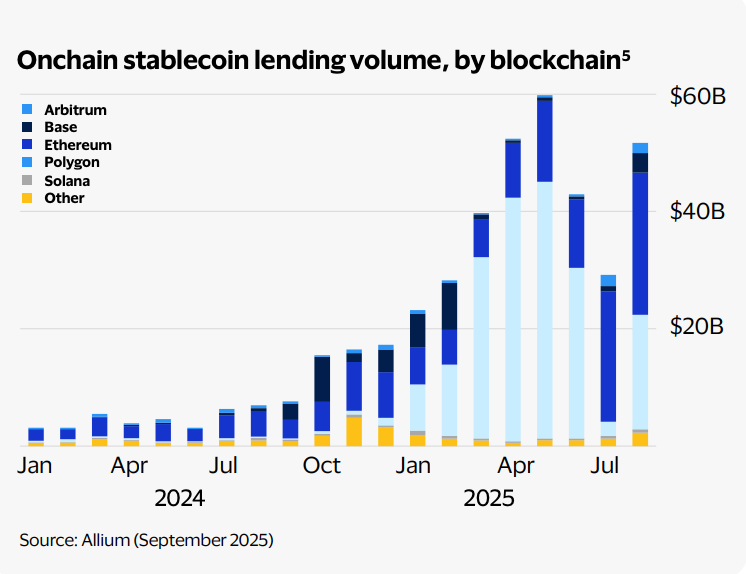

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Amundi’s tokenization: the hidden story

The BIS and real estate tokenization

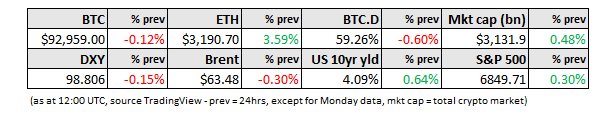

Markets: knives out?

Macro: US jobs and services activity

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

Amundi’s tokenization: the hidden story

Last night I bravely took a look at my growing backlog of things that I want to get to, and saw that I hadn’t commented on Amundi’s tokenized fund. This is worth a mention, but not because of the fund itself.