An antidote to repression and chaos

plus: what's ahead this week, cycles, new alliances, Brazil retaliation and more

“As to the evil which results from a censorship, it is impossible to measure it, for it is impossible to tell where it ends.” – Jeremy Bentham ||

Hi all! I hope you got some cleansing downtime this weekend. Let’s roll up sleeves for what’s ahead.

A programming note: this newsletter will be taking a break next week – I haven’t been on a holiday, as in an actual trip with husband, for three years. No complaints, we’re homebodies, have two dogs, and anyway, we live in a gorgeous city that itself is a holiday destination. But we’re getting on a plane together on Sunday, to Malta, for five days. Neither of us have been before, so recommendations are welcome.

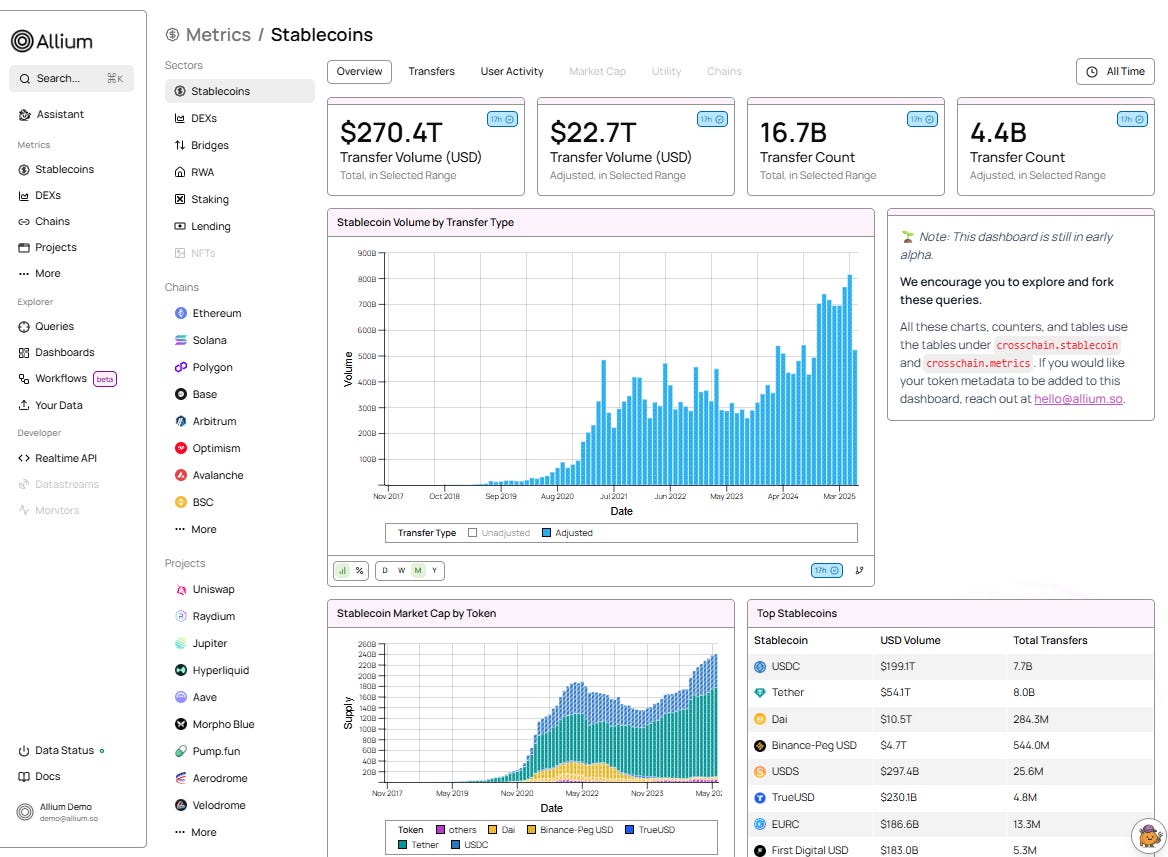

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Coming up: FOMC, retail sales, Hong Kong, Beijing and more

An antidote to repression and chaos

Macro-Crypto Bits: consumer sentiment, BTC cycles, watch the scientists

Also: far-right, Romania, Brazil, debt and more

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Coming up this week:

The big deal this week is no doubt the US rates decision, with markets pricing in a 25bp reduction in the federal funds rate.

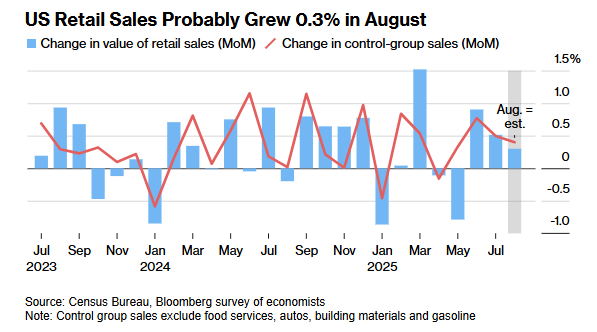

On Tuesday, we get US retail sales for August, expected to slow significantly on a month-on-month basis.

(chart via Bloomberg)

We also get industrial production, forecast to show no growth, and import/export prices, which in theory have weakened but I’ll believe it when I see it.

Tuesday is also the kick-off of the two-day FOMC meeting, but we don’t get the final decision until the committee publishes a statement at 2:00pmET on Wednesday. A 25bp cut is the baseline expectation – it will be the first since Donald Trump became President, and he has already voiced his dissatisfaction, insisting a “big” cut is needed.

Wednesday also brings Hong Kong’s annual policy address from Chief Executive John Lee.

Military personnel and scholars meet in Beijing for the 12th Xiangshan Forum on regional security and cooperation.

And President Trump kicks off a two-day state visit to the UK.

Also, Wednesday is the deadline for enforcement of the TikTok ban.

Thursday brings the US weekly unemployment claims data – hopefully the surge last week will be offset.

On Friday, the Bank of Japan meets to discuss monetary policy – no move on rates is expected, but talk is building of a rate hike before the end of the year.

An antidote to repression and chaos

“It’s not used for anything.”