Apollo Global: from onchain funds to onchain lending

plus: markets glum, US hiring also bad

“There is nothing like looking, if you want to find something. You certainly usually find something, if you look, but it is not always quite the something you were after.” ― J.R.R. Tolkien, The Hobbit ||

Hello everyone, and happy Friday!! I hope you have some good things planned for the weekend.

My latest American Banker op-ed is out (paywall): I look at white-label stablecoin issuance, from the legal aspects (cloudy) to the impact on our understanding of money (which is kinda wild when you realize we’re effectively talking about branded money).

And yesterday I sent my second newsletter in Spanish! Cripto es Macro launched earlier this week, and will feature a smaller selection of posts from the flagship publication (the one you’re reading) – if you know anyone who’d be interested, do please let them know! Gracias!

✨PUBLISHED IN PARTNERSHIP WITH: ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

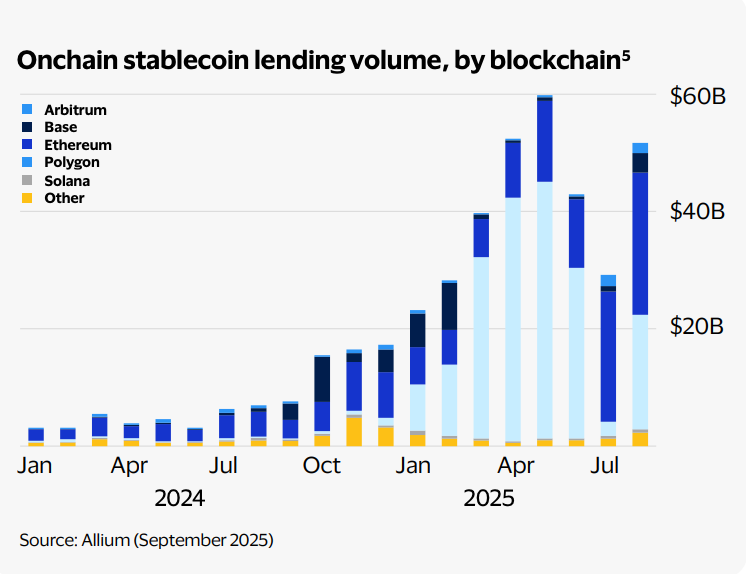

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Apollo Global: from onchain funds to onchain lending

Macro-Crypto Bits: markets glum, US layoffs not great either

WHAT I’M WATCHING:

New feature

Today I want to try something new: In the rush to keep up with the firehose of news affecting macro and crypto, I’ve missed doing deeper dives into intriguing projects in that intersection. I enjoy working on those, not just for the stories they tell but also for the insight into actual application, more relevant now than ever given how the distinct explorations, trials, pilots and launches are coming together in fascinating combinations.

So, on Fridays I will share a profile of a traditional finance company doing cool things in the crypto space, often with crypto native projects and regulatory blessing. This, I truly believe, is where we’ll see the real impact of the innovation our sector has been working on for so long – when DeFi works with tradfi and vice versa. To reach transformation at scale, they need each other.

I have a long list of companies and projects I want to get to, and it will no doubt keep growing. My aim is to provide detailed snapshots that can be updated and eventually combined to form a view of the evolving landscape.

Of course, if any of you see me get anything wrong, do let me know! Or if you know anyone at the firms I write about, do please invite them to correct me on anything I might have misunderstood.

I’m starting with Apollo Global, for no reason other than it caught my attention earlier this week.

Apollo Global: from onchain funds to onchain lending

There are few big traditional finance names that have made as deep inroads into onchain finance as Apollo Global. It’s early days yet, but their main tokenized fund has amassed over $128 million since launching in January and is taking advantage of certain onchain features, making it more than just a token replica.

But before I get into that, some background on the company itself:

Apollo Global was founded in 1990 by a group of former Drexel Burnham Lambert executives, and initially focused on distressed securities and undervalued assets but rapidly branched out into credit and real estate. In 2009, it helped found retirement services company Athene, providing the initial investment. Apollo went public in 2011 with the ticker APO, raising over $500 million, and continued to grow its investment, insurance and financing businesses organically as well as via acquisition. In 2019, it bought Yahoo – I haven’t been able to figure out why. Its biggest move to date was the 2022 merger with Athene, the insurance company it helped found in 2009 – this transformed Apollo’s “alternatives” and somewhat risky vibe to a life insurance powerhouse, while significantly boosting capital, growth and business cycle stability.

Given its expertise in “alternative” investment, the Apollo management team was no doubt aware of crypto assets from early on, but its first publicly disclosed explorations didn’t come until 2021, as far as I’ve been able to find. In that year, it announced it was working with Figure, one of the largest tokenization firms via its onchain home equity loans (HELOCs). Figure is also the operator of the Provenance blockchain; this was specifically designed for the finance industry and is today one of the ecosystem’s largest tokenization networks. According to a press release, the aim of the partnership was to work on the onchain lifecycle of investment assets, focusing on securitization, on-chain fund listing, and trading.

In December 2021, Apollo’s credit funds participated in a raise for Anchorage, one of the industry’s largest crypto custodians and today a federally chartered bank. Anchorage was selected as the custodian when Apollo started holding crypto assets on behalf of clients in 2022.

Also in 2022, Apollo’s work with Figure led to the firm buying digital HELOCs, with ownership transferred on the Provenance blockchain.

Later that year, the firm partnered with Hamilton Lane to launch investment vehicles on Provenance, using Figure’s Digital Fund Services platform.

And Christine Moy was tempted away from running JPMorgan’s crypto team to lead Apollo’s digital asset strategy.

She obviously battened down the hatches and got to work, keeping Apollo active in various collaborations and explorations while focusing on bringing blockchain into the company’s core business: alternative investment products.

In January 2025, the firm announced the launch of the Apollo Diversified Credit Securitize Fund, or ACRED, on six different chains: Ethereum, Solana, Polygon, Aptos, Avalanche and Kraken’s Ink, with expansion to Sei in September. ACRED is a “feeder fund” that channels investment to the Apollo Diversified Credit Fund, one of the firm’s largest vehicles – this lends to mid-sized US companies and has roughly $12-15 billion under management. The onchain fund is open to accredited investors with a minimum investment of $50,000, and is managed and administered by Securitize. BNY is the custodian and Wormhole provides interoperability.

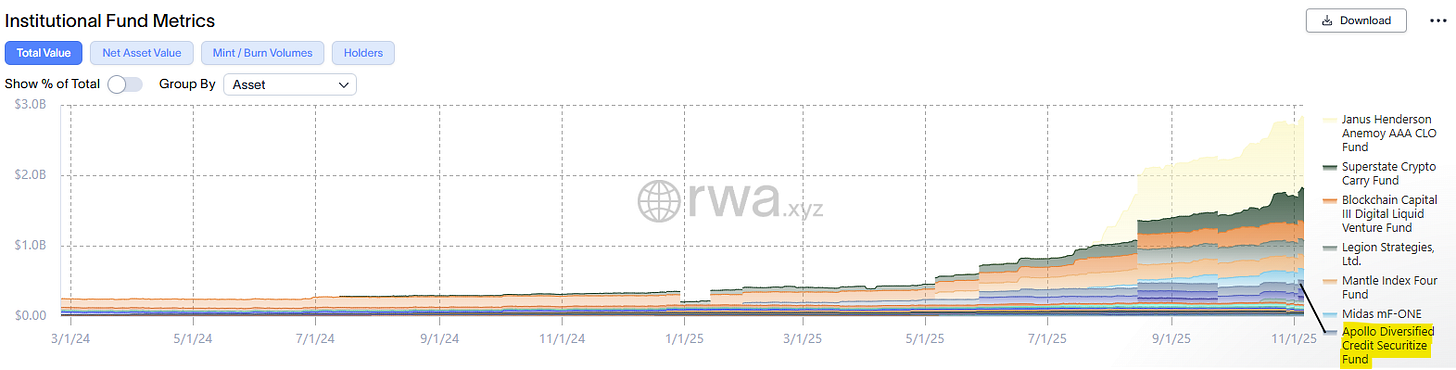

Unsurprisingly, given the names behind it, it has done well. At a market cap of over $128 million less than a year after launch, it is the second largest traditional institutional onchain fund (there are several crypto-native funds that are larger, but in this series I’m focusing on tradfi moving onchain).

(chart via rwa.xyz)

With 39 holders, according to rwa.xyz, ACRED is one of the most widely distributed of this subgroup – the largest, the James Henderson Anemoy fund, has only 10, and while the Hamilton Lane Senior Credit Opportunities fund has 57 holders, it has only $10.6 million in market cap.

Here’s a decentralized finance twist: ACRED is a Reg D security token only available to approved investors, which essentially means it can’t be transferred. But investors can connect their ACRED wallet to a smart contract operated by Securitize or an integrated partner, and immobilize all or part of their holding while minting an equivalent amount of the derivative token sACRED. This can move around the decentralized finance ecosystem, earning additional yield, acting as collateral for a loan, etc. – a cool example of how tradfi limitations can be overcome in the onchain world to earn holders a higher return.

ACRED is not the only Apollo credit-linked fund onchain: In April, Apollo made a “strategic investment” into the Plume Network, operator of a layer-2 blockchain purpose-built for tokenization. And in September, Plume and Centrifuge, a tokenization platform, announced the launch of the Anemoy Tokenized Apollo Diversified Credit Fund Segregated Portfolio (ACRDX), also a “feeder fund” for the Apollo Diversified Credit Fund. Available to non-US accredited investors with a minimum investment of $500,000, it does not seem to have attracted interest beyond the initial investment of $50 million from credit infrastructure protocol Grove.

Apollo’s next onchain push seems to be into lending. Last week, Coinbase announced that it has partnered with Apollo to work on allowing the exchange’s users to borrow against their digital assets. The partnership will also explore direct lending to corporate clients, as well as further tokenizing exposure to Apollo-managed credit strategies.

While a logical extension of Apollo’s offchain strategy and expertise, this move does shift the focus somewhat to stablecoins, which will form the backbone of the lending features. Unlike so many traditional financial institutions, I don’t see Apollo start to mumble about issuing its own stablecoin, although given its brand recognition and reach into so many segments of finance, it certainly could make a good case for one. In working with Coinbase, it seems to be signalling that working with USDC is the most efficient option – at least, for now. Should this joint exploration work out, we could see Apollo launch its own onchain platform at some point, in which case its own stablecoin would start to make sense. But there’s a lot of work to be done before then, and the partnership is a smart way for Coinbase to access Apollo’s credit depth as well as clout, and for Apollo’s onchain experience to scale with Coinbase’s huge market.

Meanwhile, Apollo’s march into onchain versions of its core competencies will continue to bridge the traditional and onchain finance worlds; I’ll be keeping an eye out for the asset management giant’s testing of new functionalities that only the onchain world can offer.

Macro-Crypto Bits

Short-form thoughts on key macro/crypto twists:

Markets: glum

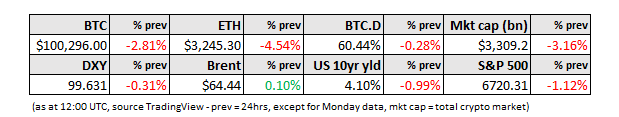

Markets have the jitters, despite an easing of liquidity concerns. Yet again, we had the S&P 500 down just over 1%, the Nasdaq down almost 2%, and today Japan’s Nikkei 225 was down 1.2%, with Asian stocks heading for their worst week since August.

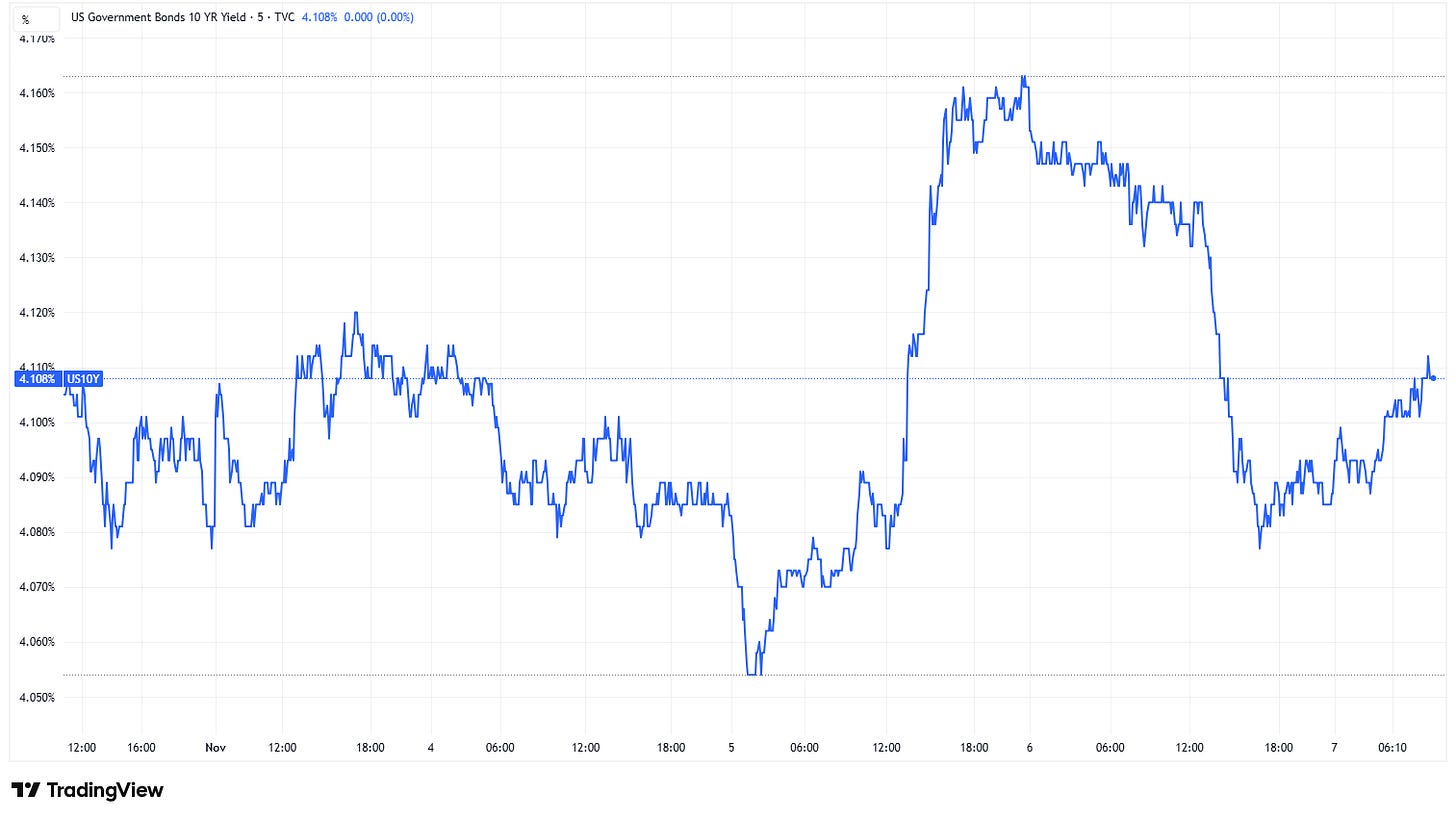

There’s rotation into the “safe haven” of US treasuries, however, with prices climbing and the 10-year benchmark yield almost uwinding its Supreme Court scare from the day before.

(10-year treasury yield, chart via TradingView)

Crypto markets are not in a good mood, with BTC yet again testing $100,000.