Big crypto market structure changes and why they matter

plus: FOMC cohesion, US jobs, GDP and more

“There are three kinds of lies: lies, damned lies, and statistics.” – Benjamin Disraeli ||

Hello wonderful readers! I do hope you’re having a good summer so far. ❤ Oh, and happy Fed Day!

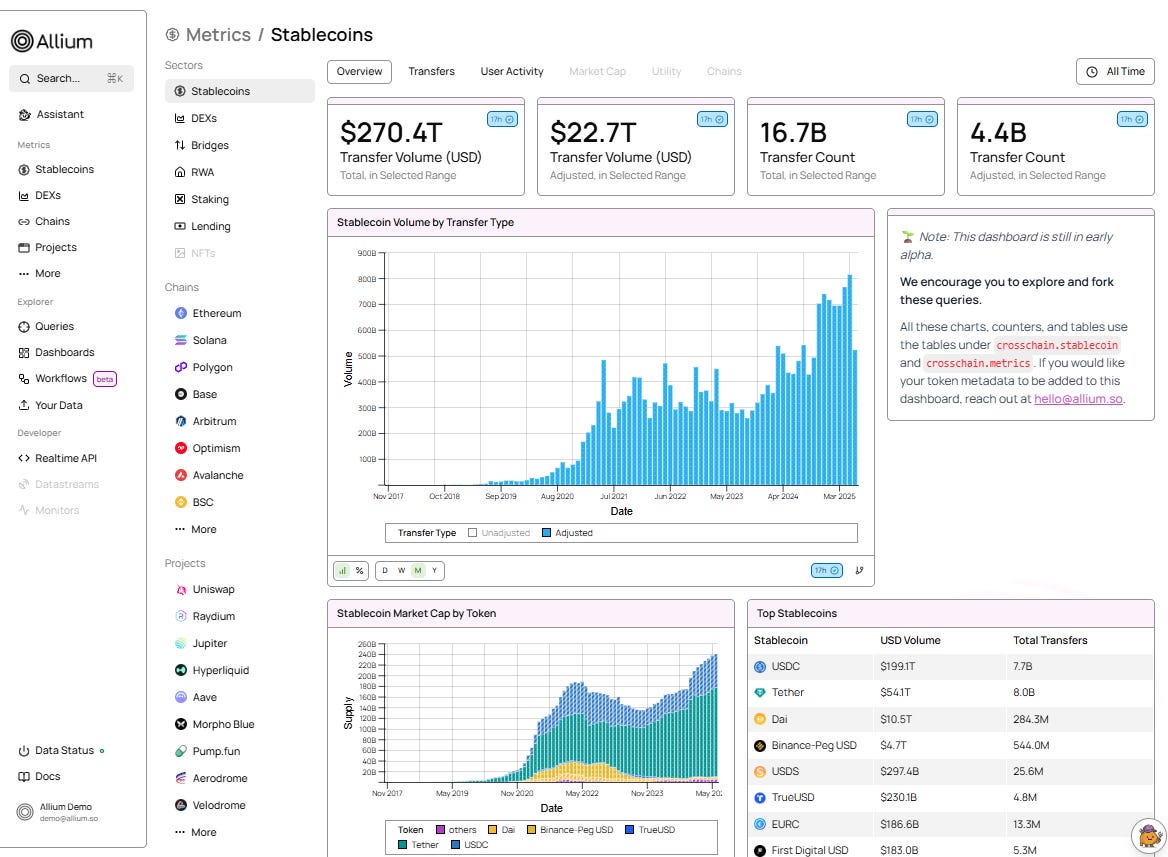

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Big crypto market structure changes and why they matter

Macro-Crypto Bits: FOMC cohesion, US jobs, GDP

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Big crypto market structure changes and why they matter

Yesterday saw approval of a couple of technical changes to spot crypto ETFs: in-kind redemptions, and IBIT option limits. Small details, you may think, but these are actually a big deal:

In-kind redemptions

The SEC voted yesterday to approve in-kind creations and redemptions for spot crypto ETFs, something the crypto industry has been pushing for ever since the ETF listings started to be seriously debated.

To see why this decision matters, some definitions and a brief market plumbing explanation are in order:

In the ETF world, “authorized participants” (APs) are large financial institutions that act as intermediaries between an ETF issuer (such as BlackRock, Bitwise, etc.) and the secondary market. They are responsible for getting the ETF shares to market, handling redemptions and ensuring fair pricing.

Current rules dictate “cash creation and redemption” for the spot BTC and ETH funds, which means APs can’t touch the underlying assets directly. If they need new fund shares (to satisfy investor demand, or for inventory), they send cash to the issuer who buys the underlying asset, creates the shares and sends them to the AP. The reverse happens when the AP wants to reduce its ETF holdings (either because it bought shares from selling investors, or for internal reasons): the AP sends the shares to the issuer who cancels them, sells the underlying asset in the market and returns the proceeds to the AP.

With “in-kind creation and redemption”, an AP can handle the underlying assets directly. If it needs more ETF shares, it buys the underlying assets in the market and forwards them to the issuer, who creates the shares and sends them to the AP. In-kind redemptions work similarly but in the other direction: the AP sends ETF shares to the issuer and receives the requisite amount of BTC or ETH in exchange.

You’re probably wondering why it matters who buys the underlying crypto asset, as long as the ETF is properly backed? It matters for market efficiency, costs and sell pressure.