Big-name layer-1s + tokenization

plus: tariffs, data, BTC, gold and more

“The average IQ in America is - and this can be proven mathematically - average.” – P. J. O’Rourke ||

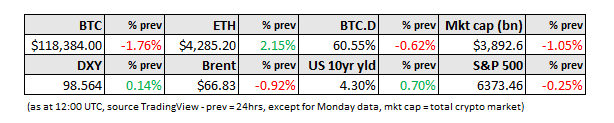

Hello everyone, and happy CPI day! I’m so looking forward to a time when we don’t have to obsess over noisy data drops because the direction has become clearer and the numbers less relevant. Or, maybe because we don’t trust the numbers anymore, that would work, too.

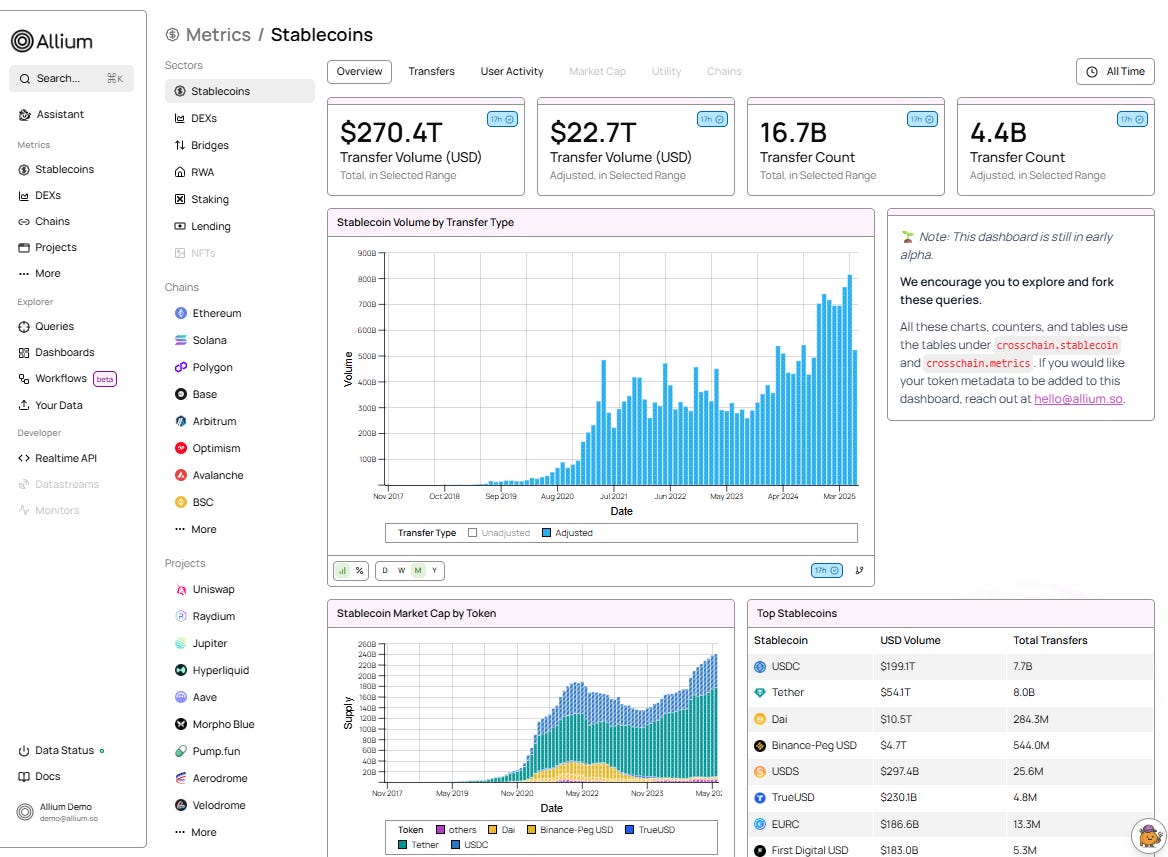

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Big-name payments-focused blockchains

CME and tokenization

Crypto adoption in high-inflation countries

Macro-Crypto Bits: data, tariffs, BTC and gold

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Big-name payments-focused blockchains

It’s starting to feel like “Layer-1 season”.

Yesterday, we saw reports based on a now-deleted job posting that payments operator Stripe was building its own layer-1 blockchain called Tempo, together with VC firm Paradigm.

And, along with Q2 results, earlier today stablecoin issuer Circle unveiled Arc, a layer-1 blockchain expected to launch on testnet later this year. Details are slim, but it looks like Arc will connect clients across Circle’s ecosystem on a platform that can handle stablecoin transfers as well as FX and other market applications.

An obvious question, as always with this type of announcement, is “why?”.

One reason could be to ensure the development of features the ecosystem wants. For both Circle and Stripe, the priorities of most clients will probably be speed, cost and compliance – these are not necessarily the priorities of the Ethereum or Arbitrum communities, for instance.

Another could be to ensure low fees by controlling the system architecture.

But new layer-2s should be able to solve for that – Robinhood’s blockchain is being built as a layer-2 on Arbitrum, taking advantage of Arbitrum’s (and ultimately, Ethereum’s) security while customizing features for a tokenization-friendly platform. Kraken’s Ink layer-2 is based on Optimism’s technology. Coinbase’s Base layer-2 is also built on the Optimism stack, and today ranks as one of the most active networks.

Building a layer-1 from scratch is more expensive, will take longer, and will still have to earn the ecosystem’s trust on issues such as decentralization and security. For users of payment systems, though, that just want value to get from A to B as efficiently as possible, and that trust the operators of the network, perhaps that doesn’t matter as much as control and flexibility.