Bitcoin near a bottom?

Plus: Japan, Ukraine, consumer confidence, economic growth

“Life starts all over again when it gets crisp in the fall.” – F. Scott Fitzgerald, The Great Gatsby ||

Hello everyone, I hope you’re all doing well! I am SO glad to be back at my desk. There is an overwhelming amount to catch up on, though, and much of what I wanted to get to today is being pushed to later in the (short!!) week.

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

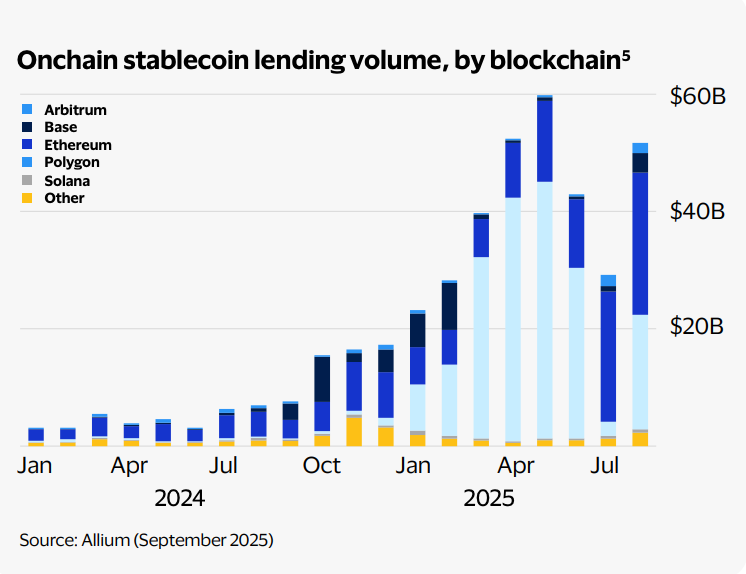

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Bitcoin near a bottom?

Geopolitics: Ukraine and Japan

Macro-Crypto Bits: US consumer confidence, economic activity

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes.

WHAT I’M WATCHING:

COMING UP:

For the US, the Thanksgiving holiday makes this a short week. Nice for a change.

US commerce secretary, Howard Lutnick, and trade representative Jamieson Greer are in Brussels today, meeting with finance and trade ministers, EU commissioners and industry CEOs in a bid to finalize details of the US-EU trade agreement.

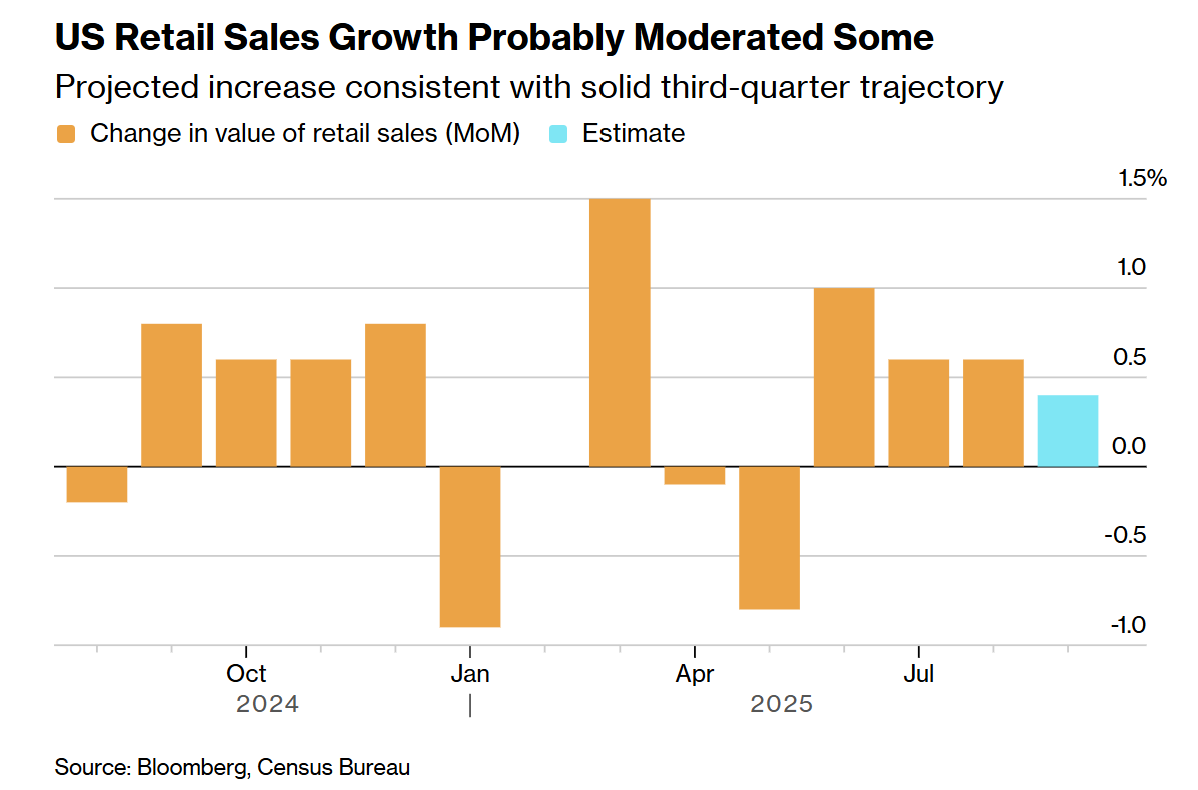

On Tuesday, we get US retail sales for September, with consensus estimates suggesting a slight slowdown to 0.4% growth month-on-month, from August’s 0.6%. This is old data by now, though, so it shouldn’t affect markets much, whatever the result.

(chart via Bloomberg)

We also get the September Producers Price Index, and the Conference Board consumer confidence report.

On Wednesday, UK Chancellor of the Exchequer Rachel Reeves delivers the autumn budget. Since it’ll be taken as bad news if she delivers tax increases and bad news if she doesn’t, we could see some market turmoil that just might spill over.

And on Friday, we get Japan’s November inflation read for Tokyo, taken as a leading indicator of national inflation – this could shed light on the likely timing of a rate hike.