Bitcoin’s 4-year cycle: a drag on the price?

plus: Western Union's stablecoin, crypto ETFs, optimistic markets and more

“The real danger is not that computers will begin to think like men, but that men will begin to think like computers.” – Sydney J. Harris ||

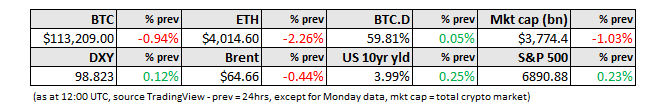

Hey all, and happy Fed day!

I have to confess that I do enjoy Halloween-y music, on both the fun and the ghoulish ends of the spectrum. So this week, in the usual song recommendation slot below, you’ll find the ones I’m listening to most these days, all for the seasonal spirit, of course.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides vetted blockchain data to answer your hardest macro questions, like:

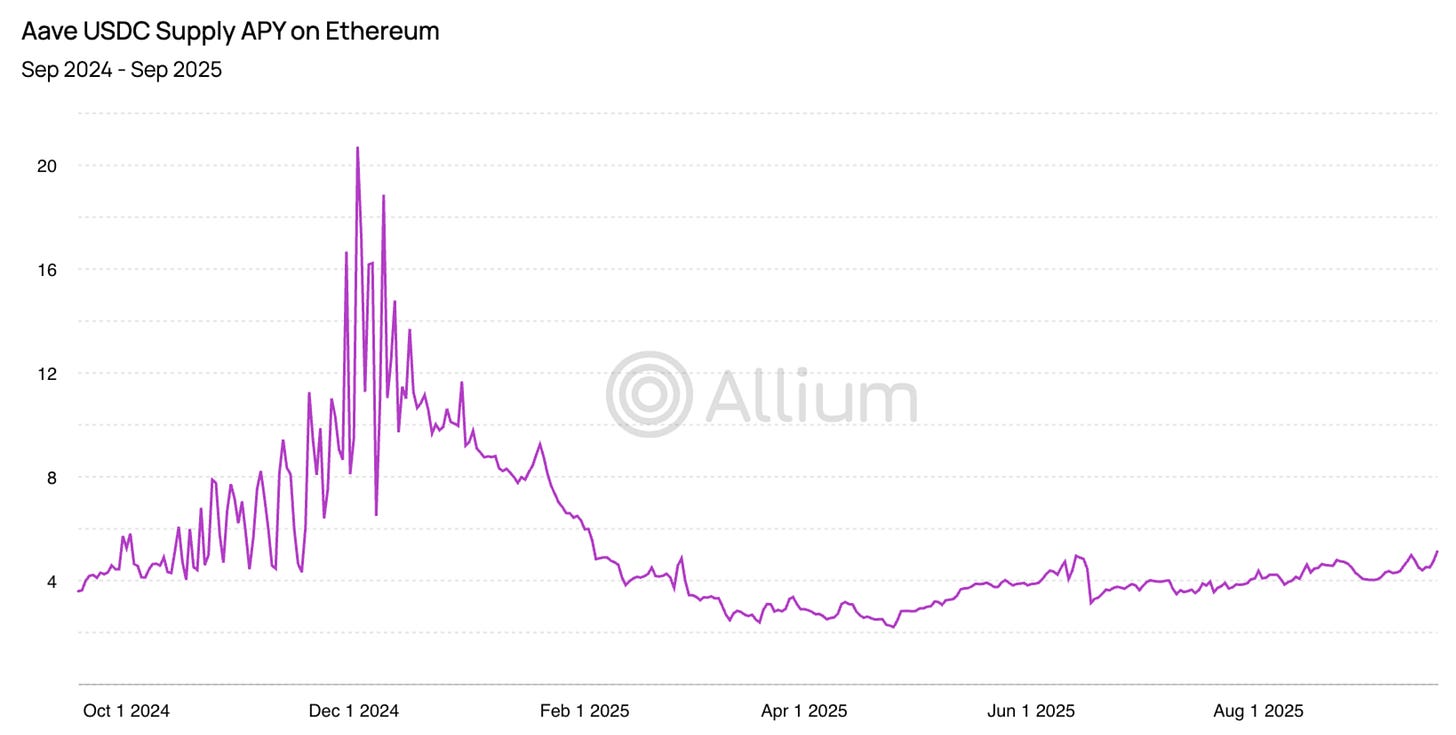

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Bitcoin’s 4-year cycle: a drag on the price?

Western Union’s stablecoin: scalability wins

Macro-Crypto Bits: market confidence, consumer confidence, AI capex, new ETFs, Pakistan

WHAT I’M WATCHING:

Bitcoin’s 4-year cycle: a drag on the price?

Here’s a theory for why BTC’s price has been lacklustre recently, in the face of climbing stock markets and gold, throwing into doubt its risk asset AND its safe haven narrative: we could be near the peak of the BTC’s historical 4-year cycle. Below I’ll explain why some would think that, why I don’t, and why it matters.

This year has seen an uptrend in the sale of older coins, as we can see in the below chart that tracks the average age of moved BTC: