BTC ETF options launch is here!

why it matters - also, risk sentiment indicators

“The way to get good ideas is to get lots of ideas and throw the bad ones away.” – Linus Pauling ||

Hi everyone! I hope you’re all taking care of yourselves. Following crypto and macro is a marathon, not a sprint.

I had a great chat yesterday with Onramp’s Marc Connors and Rich Kerr on their Wake Up Call podcast – you can see the video here (Onramp) or here (YouTube), or if you prefer to listen, here’s the Spotify link.

Today, as promised, I share some indicators that show risk sentiment is likely to continue to move assets for a while yet – this is the counterpoint to yesterday’s “uh oh” mood.

I also look at why today’s launch of options on the IBIT spot BTC ETF is a big deal.

No audio today, as today’s text would be almost impossible to read with flow.

IN THIS NEWSLETTER:

Risk sentiment lights a fire

BTC ETF options launch is here

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as audio, relevant links and music recommendations ‘cos why not.

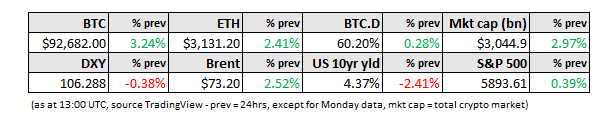

WHAT I’M WATCHING:

Risk sentiment lights a fire

Yesterday, I wrote about stretched equity valuations and the risk a strong dollar poses to global markets. Here, I point out that optimism around economic growth is boosting risk appetite, which in turn is lifting equity and crypto markets. Put differently, stretched valuations on their own do not imply an imminent downturn – arguably, sentiment matters more, and sentiment for now is good.

Some clear signs: