China’s digital yuan changes shape

plus: the Big Deal of the week, quiet markets, US jobs (again), inflation and more

“I like nonsense; it wakes up the brain cells.” – Dr. Seuss ||

Hello everyone, and Happy Friday! The first week of 2026 in the bag. Let’s face it, the year has gotten off to an exhausting start (and that’s even after a short week for me!).

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

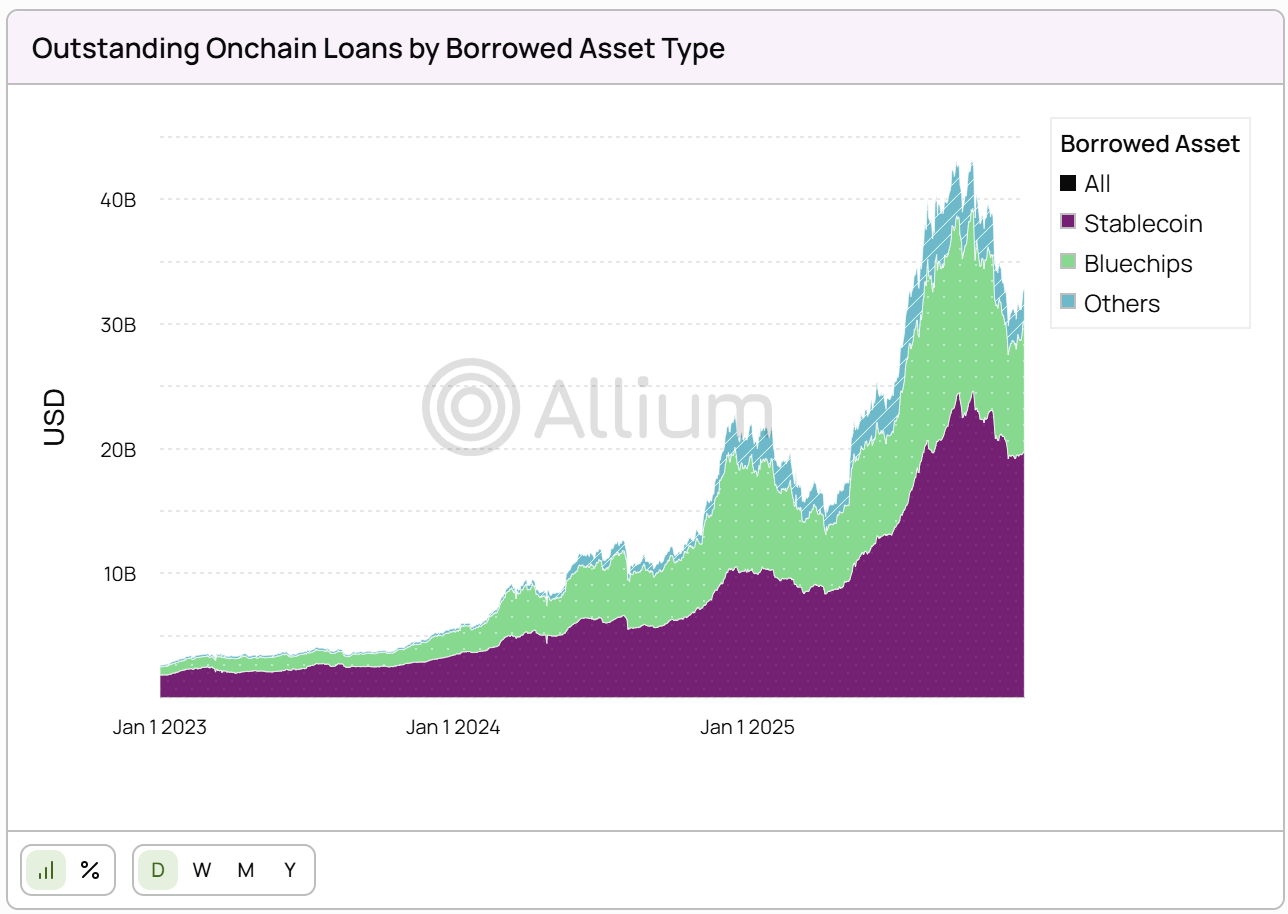

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

The big deal this week: geopolitics

Markets: quiet for now

China’s digital yuan changes shape

Tariff policy alternatives

Macro: trade and GDP

Macro: US job cuts

Macro: US wage inflation

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

The big deal this week: geopolitics

(Trying out a new feature in which I have a think about what I see as the most significant development of the week for the crypto-macro narrative. What one thing has shaped the playing field for what’s ahead? Things are moving fast, it’s helpful to sometimes step back from the noise.)

The big deal for the first trading week of 2026 has to be the moving geopolitical pieces. The snatching of Maduro woke the world up to the new rules in which adversaries and allies are treated alike and protocol is an unnecessary distraction. It remains to be seen how much of a change in the lives of Venezuelans the US move implies – so far, democracy has not been restored and reports of continued repression on the ground suggest that hopes of a new dawn for the country will be disappointed.

Greenland is now more in play than ever, as we finally realize that President Trump is serious about taking it. It’s astonishing how mainstream media is largely ignoring the riots in Iran, which by all accounts are the most determined and widespread in recent memory. Taiwan is getting some attention but not a lot of love, and most of us seem to assume it will official be Chinese before long. Yesterday, Trump told the New York Times that there could be more US military action in Nigeria.

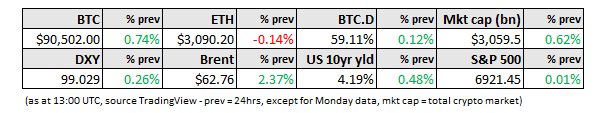

This matters for markets as dollar demand tends to spike in times of global unrest – not great for liquidity nor for commodities, although most are up on the week.

It matters for crypto as the uncertainty and likely crackdowns highlight the role of independent, resilient networks for transactions and communication, as well as the potential value of digital hard assets. Yet BTC is drifting, volumes are thin, derivatives markets are quiet. All very strange.