Deregulation resistance, and the slide into autocracy

what's changed in geopolitics over the past few days, and what's ahead this week

“The silly question is the first intimation of some totally new development.” – Alfred North Whitehead ||

Hello everyone! I hope you all had a good weekend. It has FINALLY stopped raining where I am, and I didn’t fully realize just how much I missed Madrid’s blue skies.

Today I offer a list of what to watch on the economic and political fronts this week.

I also highlight developments from the past couple of days that impact the macro and crypto topics I most talk about: geopolitics, the global economy, tokenization, crypto market structure, and more. I was also going to share the results of a relevant survey but the previous two sections have taken up my allotted wordcount (Substack flashes green banners at me if I go on for too long!) – so, I’ll put that on the list for later this week.

IN THIS NEWSLETTER:

Coming up: what to keep an eye on this week

Macro-Crypto Bits: tariffs, Germany, Ukraine, EU, China and more

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Coming up: what to keep an eye on this week

(a new section in which I’ll aim to give you a heads-up on possible market-moving events, as well as those that could shape the geopolitical and crypto stage)

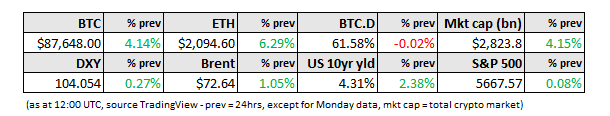

Today, we get the preliminary read on S&P Global’s US Purchasing Managers Index (PMI) for March – expectations are for a modest decrease in manufacturing and increase in services activity.

Tomorrow, the US Conference Board releases the results of its latest consumer survey.

Wednesday delivers the latest US durable goods report, expected to confirm growing concern over the uncertainty with a slowdown in business spending.

Also on Wednesday, UK Chancellor of the Exchequer Rachel Reeves will present her fiscal update to Parliament, and the outlook is ugly. Borrowing will most likely overshoot her projections by around £20 billion, and the Labour government (I’ll say that again, the Labour government) is aiming to cut the number of civil servants by around 10,000.

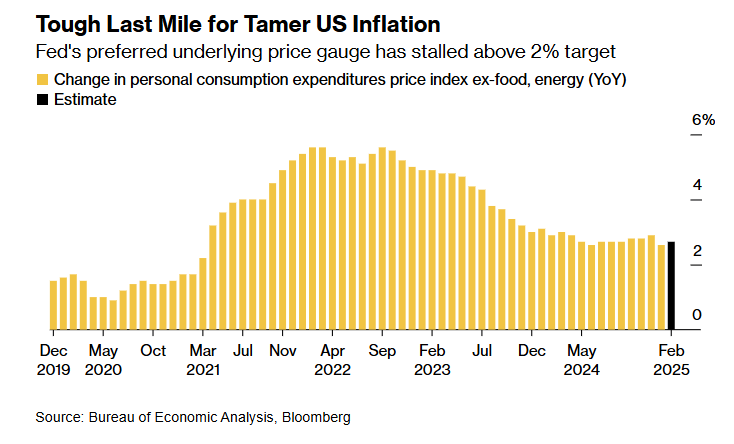

On Thursday, we get the final read of US Q4 GDP, expected to confirm growth of 2.3%, lower than Q3’s 3.1%. The core PCE increase for Q4 should be confirmed at 2.7%, up from 2.2% in Q3.

Also, SEC Chair nominee Paul Atkins faces his Senate Banking Committee confirmation hearing.

And European leaders will meet yet again to try to reach agreement on how to help Ukraine. I’m losing track of how many of these summits they’ve had, all with the same result: no clear path forward.

On Friday, we get the main economic report of the week: US PCE data for February. This is forecast to show continued stickiness with a 2.7% year-on-year increase, slightly higher than last month’s 2.6%. The month-on-month increase is expected to accelerate 0.35%, higher than last month’s 0.28% and double the rate consistent with the Fed’s 2% target.

(chart via Bloomberg)

Also on Friday, we get US personal income growth for February, expected to decelerate on a month-on-month basis from 0.9% to 0.4%. Personal spending, however, is expected to have grown by 0.6% over the month, vs a drop of 0.2% in January.

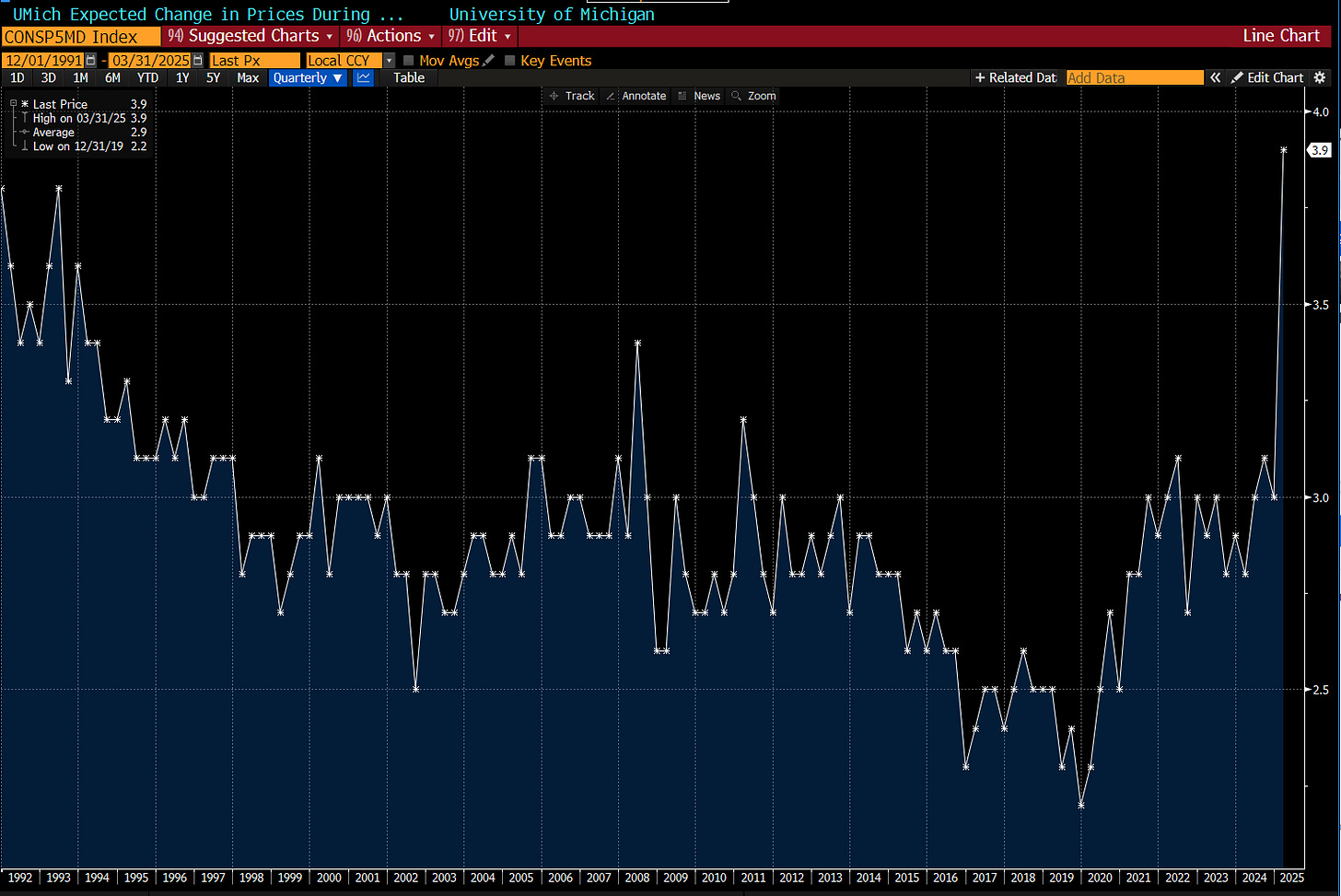

And we get the final University of Michigan consumer survey report for March, which will either confirm or adjust the startling increase in inflation expectations reported a couple of weeks ago – long-term inflation expectations jumped from 3.4% to 3.9%, the highest level recorded by the survey since at least the early 1990s.

(chart via @lisaabramowicz1)

Macro-Crypto Bits

This section offers brief comment on some of the news items I’ve seen today that are relevant for the macro and crypto narratives I talk about. I’ll try to keep this short, but there is SO MUCH going on.

US: In what may be another flip-flop or may be a clarification, President Trump is now hinting that the reciprocal tariffs due to fall on April 2 will be more targeted than originally feared. Also, the Administration will not be implementing sector-specific tariffs on the same day, as originally suggested. Markets are liking this. (Bloomberg, paywall)