Digital euro deadlines

Plus: stablecoin interest, US jobs, economic activity and more

“The greatest lesson in life is to know that even fools are right sometimes.” – Winston S. Churchill ||

Hello everyone! I hope you’re all doing well. My household is settling back into a gentle quiet now that the Christmas crowd has dispersed, and yet I am still finding bits of giftwrap ribbon everywhere.

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

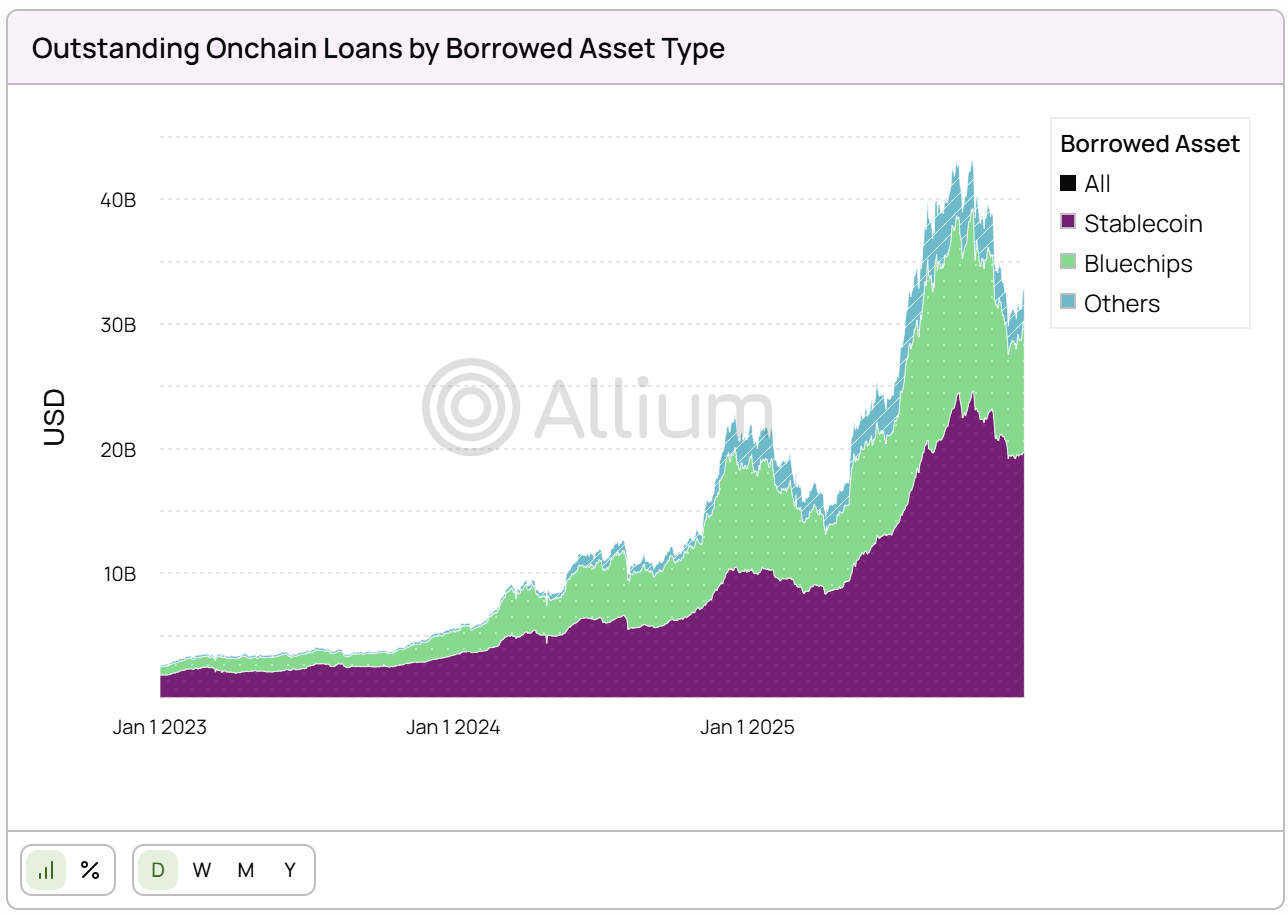

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Digital euro deadlines

Stablecoin interest: the deeper issue

Macro: US jobs

Macro: US services activity

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

Digital euro deadlines

The year has started off with the digital euro campaigners out in force.

On Tuesday, Banque de France Governor François Villeroy de Galhau stressed the need to “secure the pivotal role of sovereign central bank money in the digital world” in order to avoid losing the “hard-won achievement” of European sovereignty conferred by the adoption of the euro. He’s obviously talking about collective rather than individual sovereignty, and assumes a broad understanding that greater power vested in institutions will make Europe more resilient.

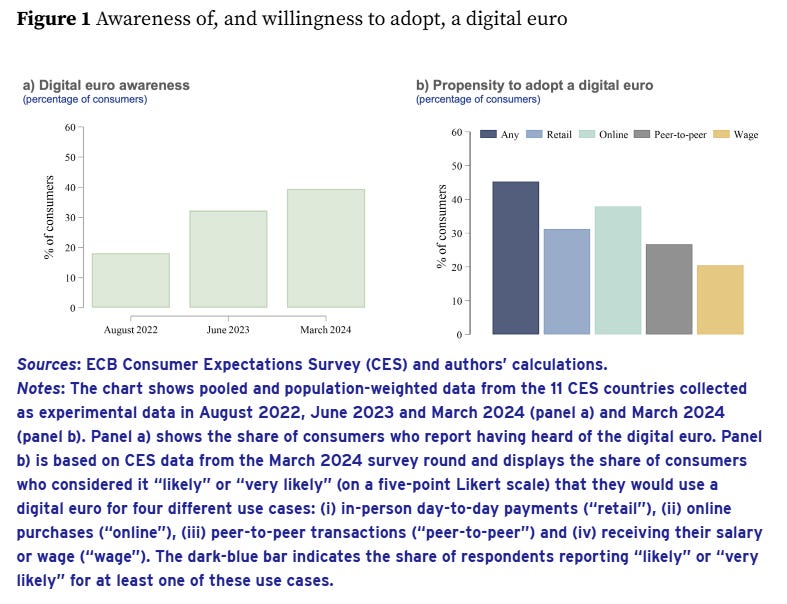

Earlier this week, the Centre for Economic Policy Research (CEPR) – an independent, pan-European think tank – shared a summary of a recent paper showing that around 45% of consumers within the 11 largest EU countries would be open to using a digital euro for transactions and salaries. According to the authors, this would not have a material impact on bank deposits, with only a small reallocation from deposits. And different holding limits (these have not yet been decided) would not significantly impact either the use of the digital euro, nor its weight in household portfolios.

(chart via CEPR)

And yesterday, the Financial Times ran an op-ed from Isabelle Mateos y Lago, chief economist of BNP Paribas, in which she (correctly, in my opinion) emphasizes the advantages of a wholesale CBDC as a lower-risk alternative to stablecoins, a gateway to more efficient markets, and a facilitator of both onchain and offchain trade. The piece skates around the issue of the retail-facing digital euro, which perhaps inadvertently gives it a side door into institutional consciousness.

The flurry of public messaging is not new – last year we saw countless speeches, X posts and well-placed articles on how the digital euro is just the convenience tool we’ve all been waiting for, and if we don’t accept it the euro is in trouble.

But the next few months will no doubt bring an added urgency as a key vote approaches.