Digital euro politics

plus: too soon to celebrate CPI, what’s coming up this week, and more

“If the freedom of speech is taken away then dumb and silent we may be led, like sheep to the slaughter.” – George Washington ||

Hi all! I hope you all had a great weekend, and for my American readers, that you’re enjoying the extra holiday!

I’m afraid I have some choppy publication coming up 🙁. Not for holidays (I wish!), but for the eye surgery I mentioned a few weeks ago. The first is on Thursday, so I’ll have to skip publication Friday and Saturday, and maybe also on Thursday, depending on the time I’m assigned. In theory, same next week. Not ideal, but on the bright side, I’m hoping that “seeing more clearly” means both literally and figuratively.

🥌

My op-ed in American Banker last week highlights how stablecoin market mechanics remind us of the difference between price and value. “What last week’s crypto crash can teach us about stablecoins’ value”

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

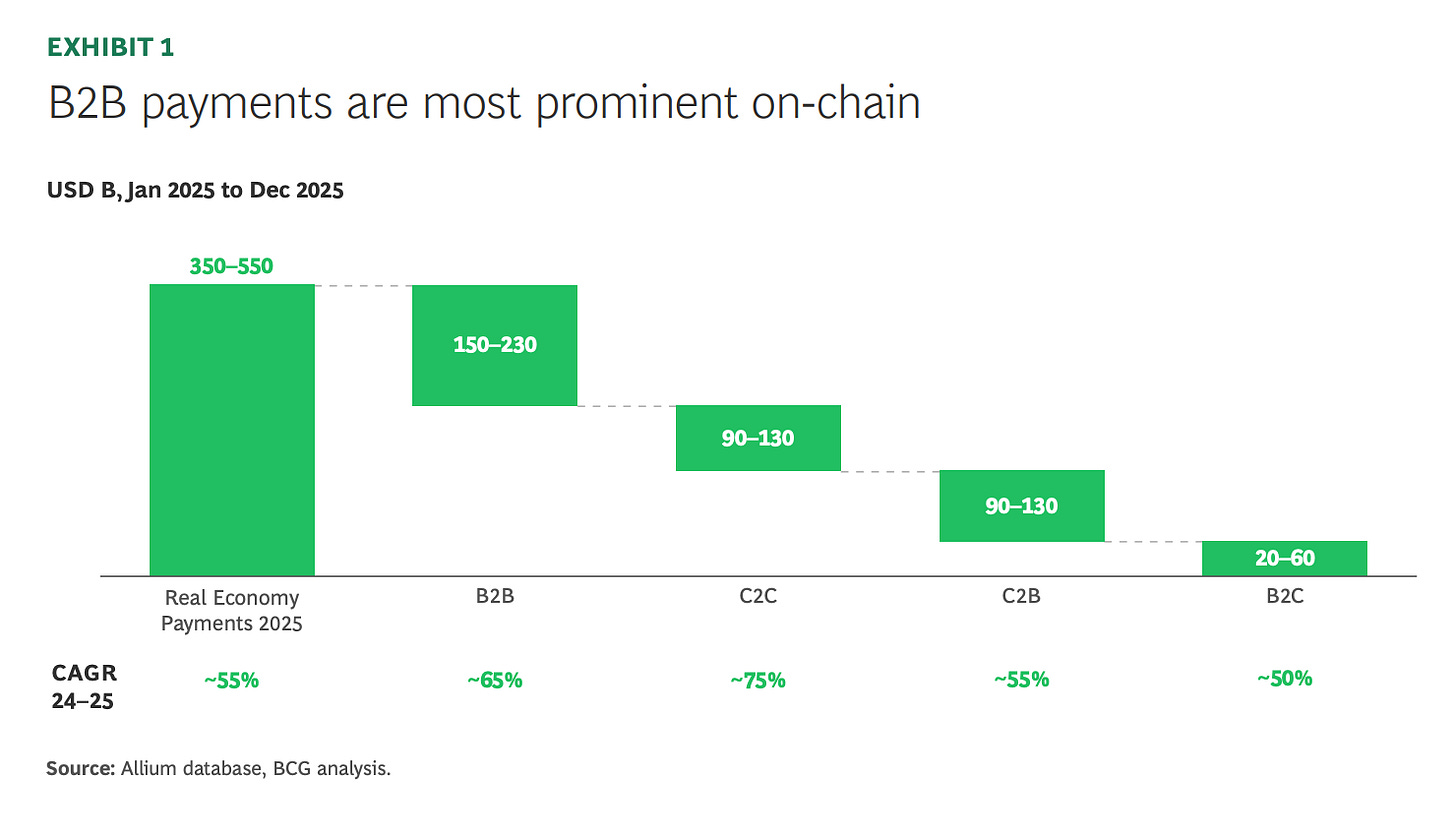

The latest whitepaper published with BCG, Stablecoin Payments: The Truth Behind the Numbers, examines how stablecoins are being used in the real economy today. The analysis estimates $350–550B in on-chain payments in 2025, led by $150–230B in B2B activity, with consumer flows contributing another $200–320B.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Coming up this week: US GDP & PCE, Fed minutes, maybe Supreme Court

Digital euro politics

US CPI: too soon to celebrate

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

Coming up this week:

A relatively quiet week in terms of data up until Friday, when we get US PCE inflation for January, and US Q4 GDP.

Today is a holiday in the US for President’s Day, and Canada for Family Day. Chinese markets are also closed for the New Year celebrations; they reopen next Tuesday. Hong Kong has a half day today, and reopens on Friday. South Korean markets are closed today, they reopen on Thursday.

🎊 Tuesday ushers in the Year of the Horse. 🎊

On Wednesday, we get the minutes from the latest FOMC meeting, which should give an idea of how many voting members are arguing for cuts and how many for holds.

We also get US durable goods indices for December – consensus forecasts point to a month-on-month contraction of 1.8% after November’s strong 5.3%. US industrial production for January is expected to deliver a slight softening in month-on-month growth of 0.3%, vs 0.4% in December. And the US Treasury releases data on net capital flows for December.

Friday brings some key US economic data in the form of December’s Personal Consumption Expenditures (PCE) report. The average forecast seems to be for an acceleration in the core index (ex-food and energy) from 2.8% to 3.0%, with the headline index accelerating from 2.8% to 2.9%.

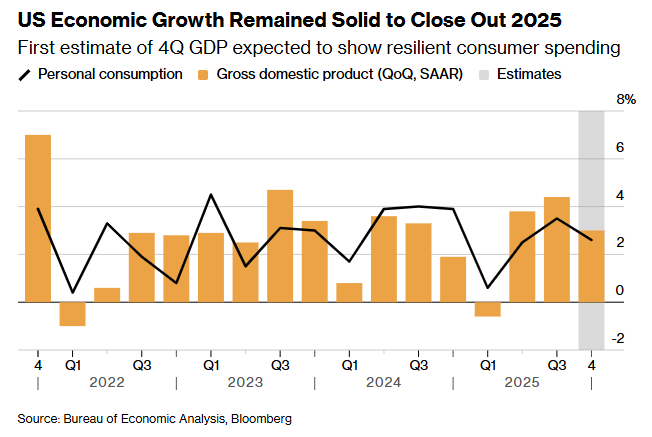

We also get the first GDP estimate for Q4, which covered the longest-ever government shutdown. This is expected to slow from 4.4% in Q3 to a still-solid 3%.

(chart via Bloomberg)

And we get the February report on consumer sentiment from the University of Michigan.

Plus, on Friday, the Supreme Court is scheduled to release its next batch of decisions. These may include the tariff case, or they may not. I have no idea what the market is pricing in here – I don’t think the market knows, either.

Digital euro politics

You might have seen some anguished posts on social media last week about how the European Parliament has approved the digital euro bill. This is not true.

What happened is the following:

Every year, the European Central Bank (ECB) presents an annual report. And every year, the European Parliament (EP) prepares a non-binding resolution – a set of opinions, not a legislative proposal – on its content. Members (MEPs) can suggest amendments if they want to gauge the Parliament’s temperature on certain issues: in this case, two amendments affecting the digital euro were proposed.

Amendment 40 positions the digital euro as a new form of public money that should, to ensure universal access, be usable both online and offline – the key rapporteur (responsible for getting EP legislation across the finish line) had suggested the digital euro at first be limited to offline use, to give private initiatives a chance to grow.

Amendment 41 emphasizes the digital euro’s relevance for Europe’s monetary sovereignty, and its potential to reduce fragmentation in retail payments.

On top of the resolution vote, each amendment is voted on separately.

Amendment 40 was approved with 420 votes in favour, 158 against, and 64 abstentions.

Amendment 41 was approved with 438 votes in favour, 158 against, and 44 abstentions.

In sum, the majority of MEPs support the idea of a European CBDC.

Does this mean the digital euro is a shoo-in? Maybe, probably, but not necessarily. As far as I know, the Parliament has yet to debate the proposed legislation. And the bank lobbies could be startled by last week’s vote, enough to ramp up their protests.

But bank lobbies in Europe do not have anything like the firepower they have in the US: they are less funded, more fragmented, and generally less combative. That said, they have voiced their protest to the digital euro plan, and are no doubt at least partially to thank for legislative delays.

What I find surprising is the lack of public comment from the US on the topic. We know how President Trump feels about trade partners taking steps to move away from the US dollar, and the ECB has been clear that the digital euro is necessary to limit the use of both the dollar and US platforms such as Visa and Mastercard. Maybe he’s distracted with other pressing issues; possibly he’s saving his firepower for negotiations involving Greenland; or maybe he just doesn’t care. In which case, the BRICS nations will feel emboldened enough to press forward with India’s suggestion of a platform to connect members’ CBDCs.

My objection to the digital euro is not about surveillance – this feels tinfoil-hatty to me, as the authorities already monitor and control all our digital payments, and can already switch off our access any time they want. The ECB isn’t going to add much there, and fear-mongering accusations pointed at the central bank are largely uninformed clickbait.

No, my strong objection is what it does to the role of the central bank. This is mission creep writ large, from which there will be no going back – no entity ever willingly gives up power and influence. Central banks have an important mandate: ensuring the stability of the financial system. This should not include offering retail-facing services that compete with the banks they are tasked with overseeing.

Even more egregious, in my book, is the assumption that public institutions should wade into payments, an area traditionally dominated by private entities. The ECB has said that it feels obliged to step in given the absence of private solutions, with no consideration for why there are no pan-European payment platforms. Put differently, the ECB could instead encourage the EU to amend the numerous barriers to European financial services, such as a fragmented banking system, overly strict compliance rules, and oppressive innovation-dampening bureaucracy. That would benefit the whole economy. But no, the central bank sees an opportunity to grab more power, and it will take it.

And don’t get me started on the inevitable nudges. I used to say that we’ll get a digital euro in the EU, but that no-one will use it. I was naïve: the ECB can’t fail on this, it would be a strong blow to its foundation of institutional trust. In other words, if we don’t use it, incentives will be introduced to make sure we do.

These could be monetary, such as removing the ban on interest or introducing another type of reward, which could further detract from the banking sector; or they could be behavioural, such as coordination with the EU to pass laws mandating CBDC payment for travel, for instance. Official nudges whittle away at our consumer choice, and before long, we get used to it.

The digital euro is being presented as a monetary solution to strengthen the economic resilience of Europe. But this is not about economics, it’s political, a centralization of power in an unelected authority with a platform that can be used to influence and even control behaviour.

And talk is escalating of extending the political manoeuvring in France – the surprise resignation last week of the Banque de France governor means that President Macron, rather than his likely far-right successor, chooses the next central bank chief – to that of the ECB itself, as Christine Lagarde’s term expires next year. This hardly feels democratic.

In sum, we have to hope the opposition to the digital euro steps up the good work. But their cause, although just, does not have strong enough support to stop what now looks like momentum. And even if President Trump were to come out swinging, there’s a strong chance that anti-US sentiment could galvanize more support for something he is against.

Another sliver of hope to hold on to is that banks do some more flexing here, that euro stablecoin initiatives step up the pressure, that the EU goes ahead with the much-talked-about capital markets union, and that a few politicians aware of the winds of change blowing in from the younger generation start to question what governments and central banks are for.