Do we really want 24/7?

plus: market rotation, risk-off sentiment and more

“What people believe prevails over the truth.” – Sophocles ||

Hi everyone! I hope you’re all taking care of yourselves, staying hydrated, getting some fresh air…

Later today, I’m on Maggie Lake’s Talking Markets show – we go live at 4pmET, and you can watch it here. I believe we’re also going live on Substack, will confirm.

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

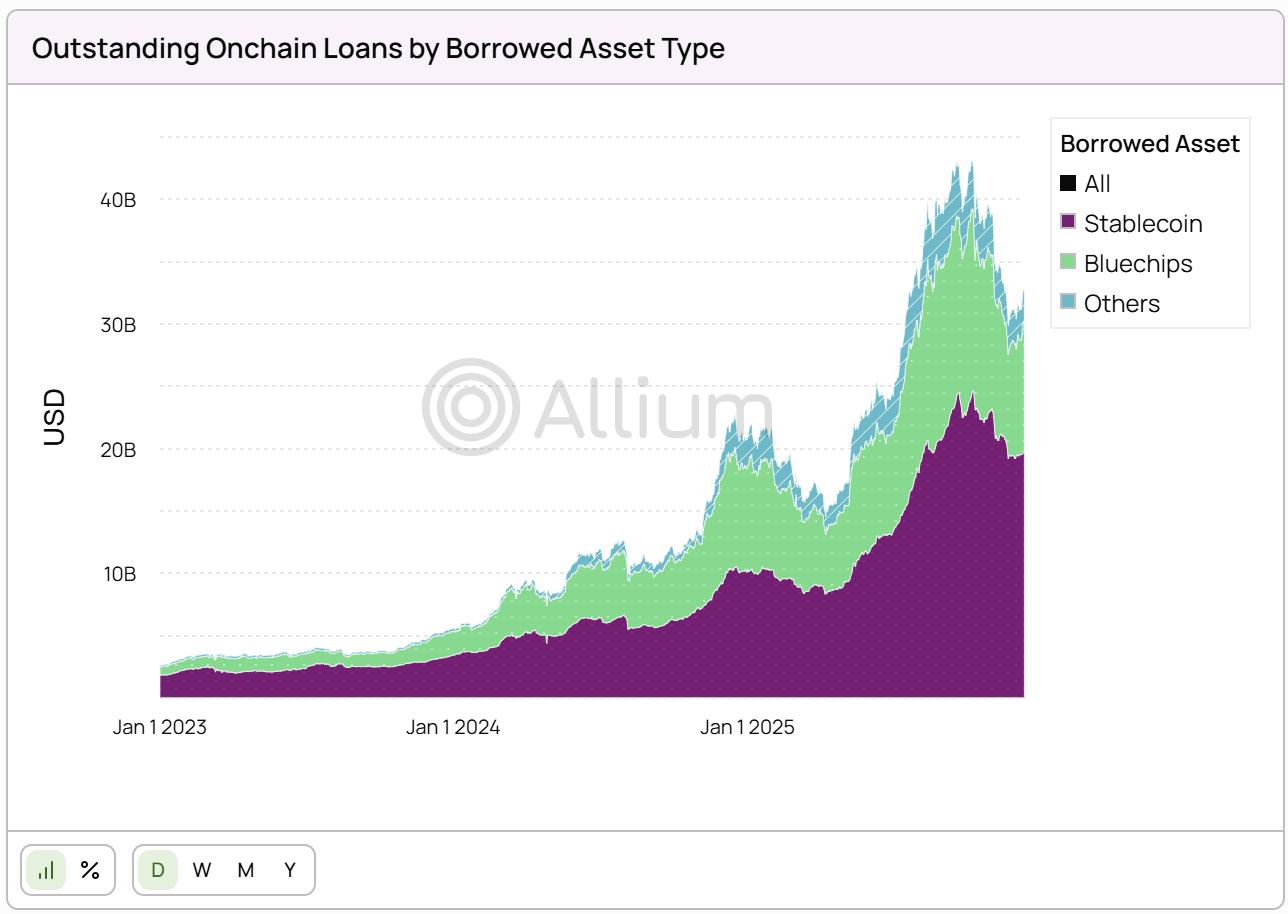

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Do we really want 24/7?

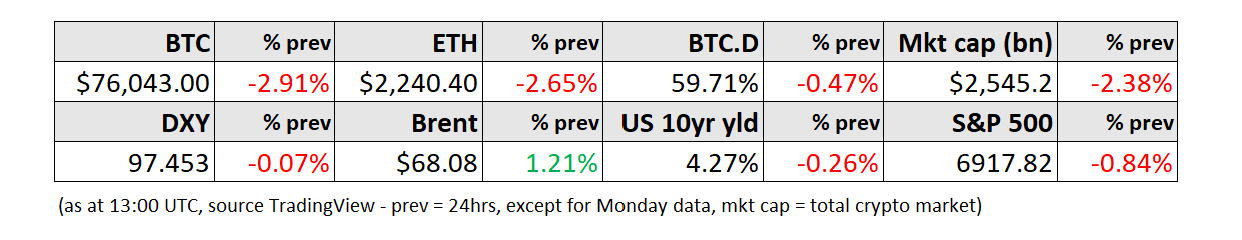

Markets: rotation and risk-off

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

Do we really want 24/7?

We’re told – loudly these days, by big names – that one of the key advantages of tokenized markets is that they can trade 24/7. After all, crypto markets are always on, so it makes sense the same should apply to any asset trading on blockchains. And limitations are antiquated! Time for modernization! Abundance for all!

(post by @brian_armstrong)

Very few are questioning this claim. And we should. Always-on trading comes at a significant technical cost. And the non-technical angle raises questions as well.

First, a key misplaced assumption:

Trading hours have nothing to do with the technology. The decision is operational. Markets could trade more hours today if there was sufficient justification, and several have made the move to do so.

An example: In October 2024, the NYSE announced that weekday trading on its Arca exchange – an electronic platform that lists ETFs, ETNs and similar products – would expand to 22-hour trading on weekdays. It got SEC approval for the change in February 2025, a year ago. But the expansion has not yet been implemented. Why?

Glad you asked. It turns out the multiple moving parts of US markets require some coordination.