ETH momentum, Japan elections

plus: EU-China, consumer confidence, crypto legislation and more

“Our knowledge can only be finite, while our ignorance must necessarily be infinite.” – Karl Popper ||

Hello everyone! I hope you all had a refreshing weekend. And if any of you have to navigate airports this week, my thoughts and prayers are with you, best of luck.

A late send today, apologies - it’s a long one with a ton of charts. Will aim for brevity the rest of the week.

Tune in later to our Bits & Bips livestream! Alex Kruger, Ram Ahluwalia and myself will be joined by Cosmo Jiang. We kick off at 4:30pm ET, and you’ll be able to see that here.

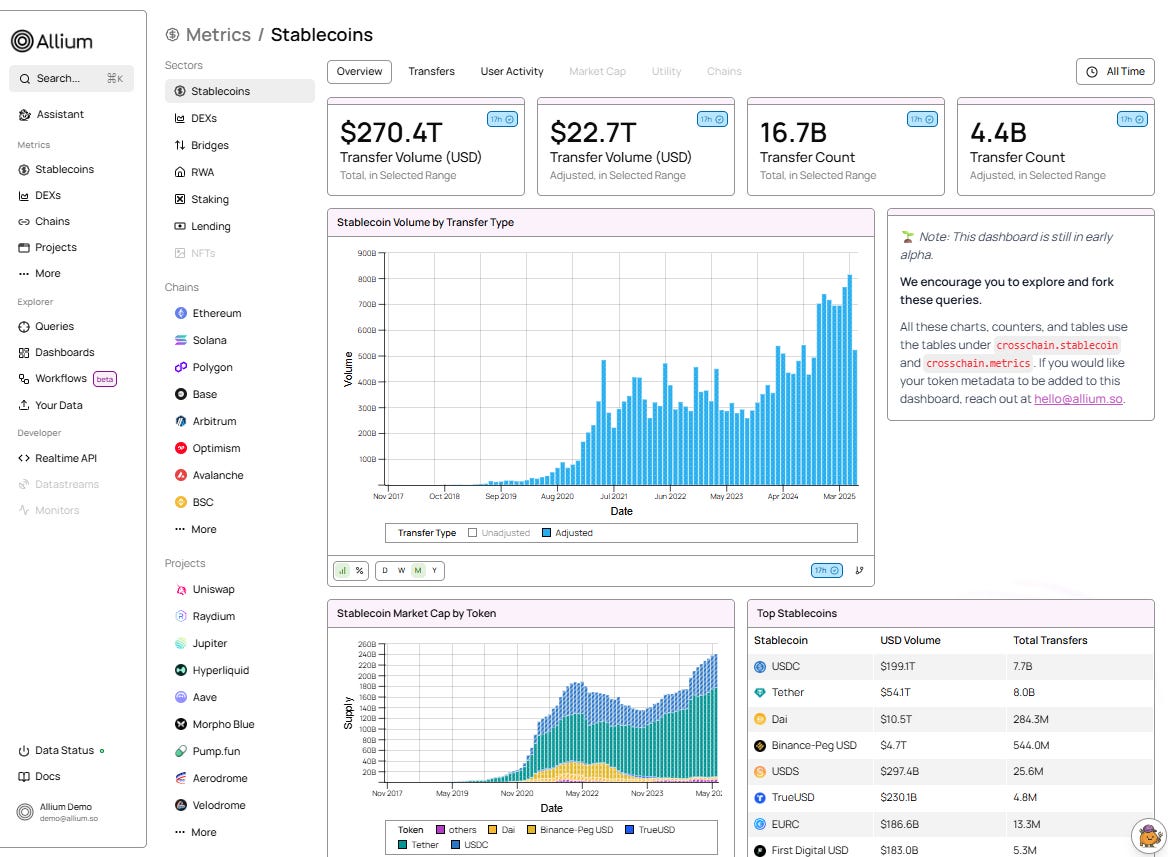

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Coming up: EU-China, Powell, US housing, ECB and more

ETH momentum

Japan elections

Macro-Crypto Bits: consumer confidence, crypto legislation

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Coming up: EU-China, Powell, US housing, ECB and more

European leaders are meeting early this week to formulate a plan for tariff retaliation in the ongoing tussle with the US – they seem resigned to no trade deal.

US Q2 earnings reports continue throughout, with Alphabet, Tesla, SAP, IBM, Coca Cola and Intel among those on deck.

In terms of US economic data, the week is relatively light.

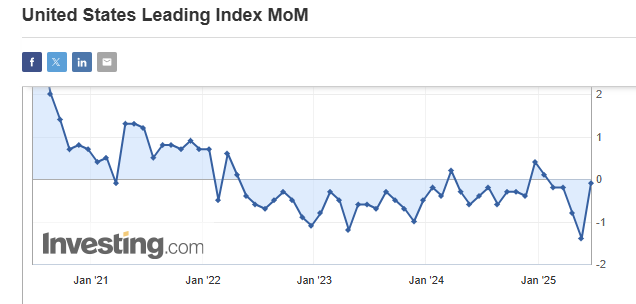

Later today, we get the latest read of the US Conference Board’s leading index, which has been, with a smattering of exceptions, negative for the past three years and yet somehow the economy seems to be chugging along.

(chart via Investing.com)

On Tuesday, Federal Reserve Chair Jerome Powell gives the opening speech at a banking conference in Washington DC – these will be prepared remarks and so will almost certainly not touch on the political pressure, but that doesn’t mean we won’t be scrutinizing his words for clues as to how he’s holding up. You should be able to watch that live here.

At the same event, Vice Chair for Supervision Michelle W. Bowman will give a speech called “Innovation”, which could be interesting. These will be the last remarks from Fed officials before the FOMC statement next Wednesday.

Also on Tuesday, UK Chancellor of the Exchequer Rachel Reeves will appear before the House of Lords Economic Affairs Committee for her annual scrutiny session – that should be quite tense. She might get questions about reported plans to sell the UK’s ~61,000 BTC hoard to boost the country’s finances.

On Wednesday, we get US previously-owned home sales, expected to show little change.

Thursday brings US jobless claims, building permits and new home sales, which economists believe will show a slight recovery.

Also on Thursday, we get the preliminary S&P Global PMI data for US manufacturing and services activity for the month of July.

The European Central Bank rate-setting committee is expected to hold rates unchanged at 2% despite a strengthening euro, before heading off for the summer break.

And in high-level geopolitics, Thursday kicks off the EU-China summit in Beijing, with Ursula von der Leyen and António Costa, the EU’s two most senior leaders, meeting with President Xi Jinping and Premier Li Qiang. There is a lot riding on this given how badly trade negotiations are going between the EU and the US, but expectations are low.

On Friday, we get US durable goods for June.

ETH momentum

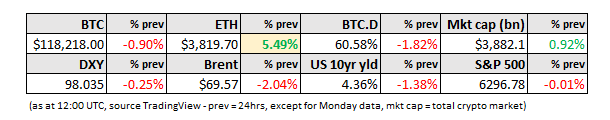

Momentum behind ETH does not seem to have fizzled out just yet despite its almost 60% increase over the past month. Yesterday, it broke through $3,800, and for the first time in years, $4,000 looks within reach.

(ETHUSD chart via TradingView)

BTC is also holding good ground just below $120,000, but its performance pales in comparison – over the past week, BTC is flat while ETH is up 27%. Over three months, BTC has climbed 35% while ETH is up 140%.

(BTC/ETH price ratio chart via TradingView)

Some are calling this an ETH short squeeze, where those who had borrowed ETH to sell, expecting it to go down, are scrambling to close out their loans. There may be some of that, but the climb feels too orderly and persistent for what is usually a short-term, volatile phenomenon.

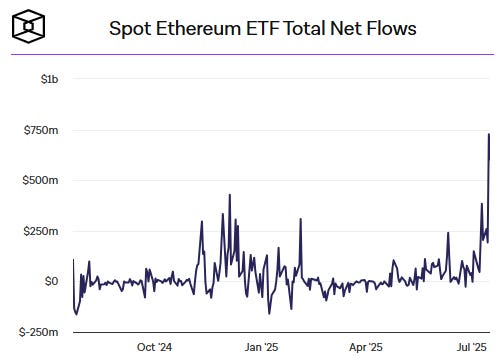

We can see a shift in the asset’s demand profile in the ETH spot ETF flows, which have reached record levels.

(chart via The Block Data)

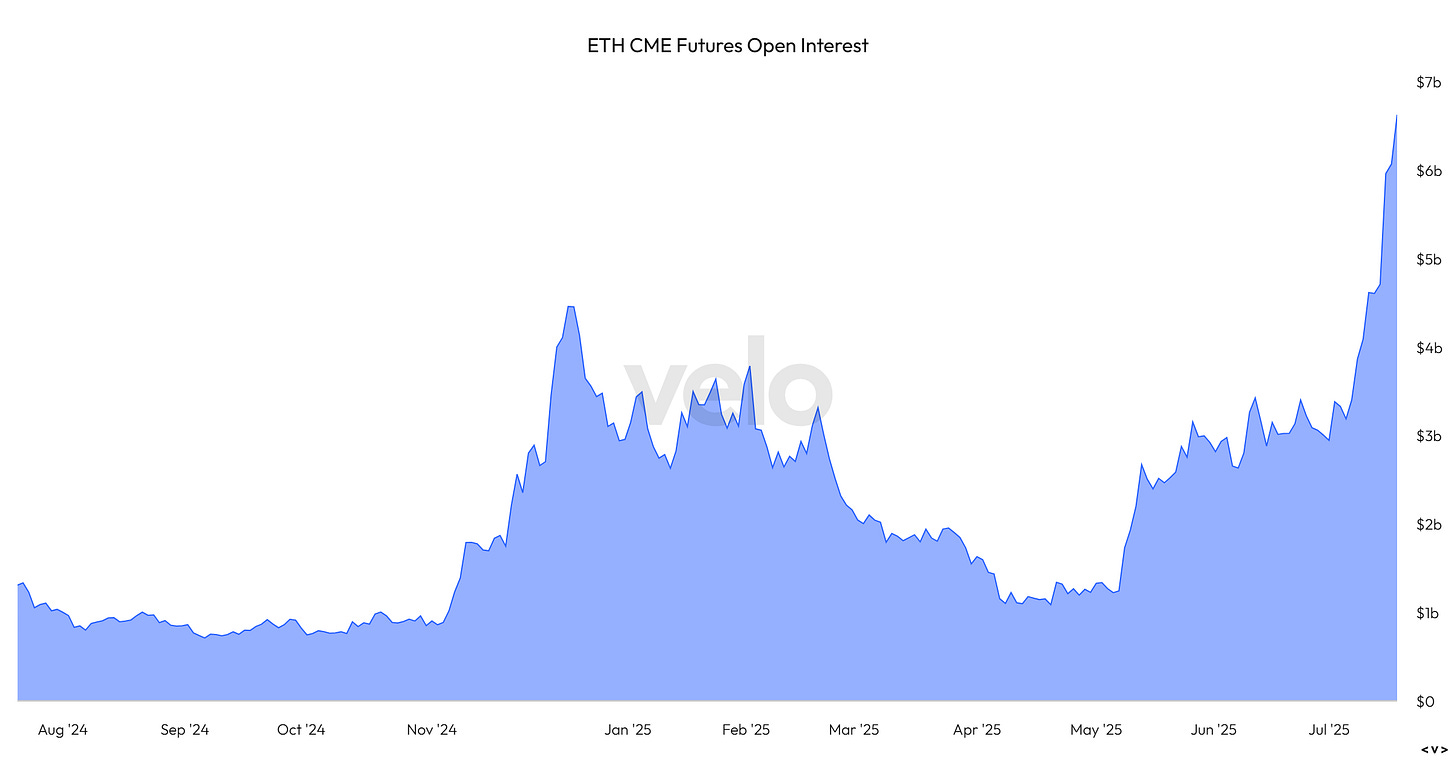

Some of this could be due to traders getting back into the “basis trade”, where they buy spot ETH (direct or via the ETFs) and sell the futures, locking in the difference. And there has been a considerable jump in open interest on CME ETH futures.

(chart via velo.xyz)