EU wholesale CBDCs and diplomatic spats

Plus: more institutional stablecoins, nervous markets, systemic risks and more

“Vast ills have followed a belief in certainty.” – Peter L. Bernstein ||

Hello everyone! I hope you’re all doing well, gearing up for the marathon that is Q4.

My latest op-ed in American Banker looks at how we are likely to end up navigating an ocean of stablecoins: As stablecoins proliferate, so will efficiency in the marketplace (paywall).

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides vetted blockchain data to answer your hardest macro questions, like:

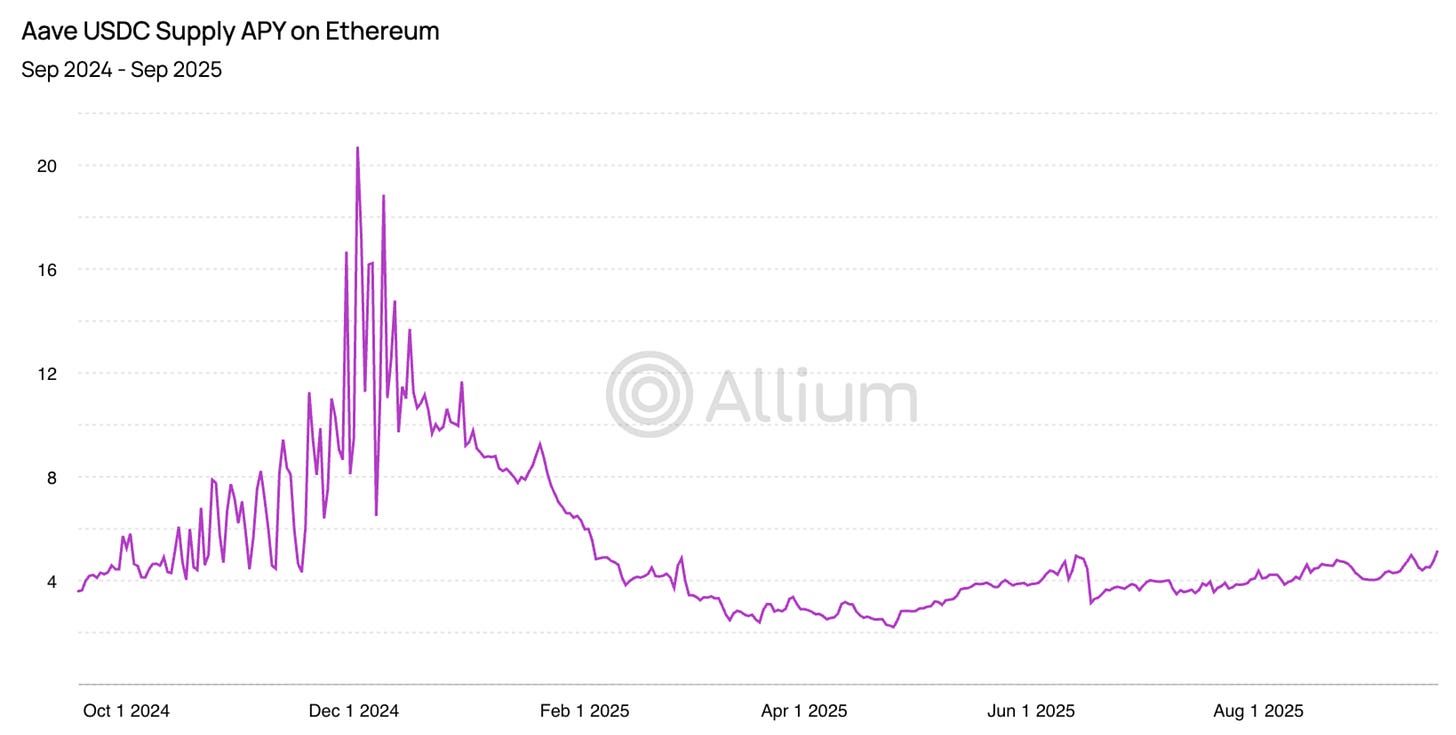

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

The EU’s wholesale stablecoin takes shape

Diplomatic spats move markets

Scepticism and the institutional stablecoin rush

Macro-Crypto Bits: nervous markets, systemic risks

Also: a dangerous EU precedent, crypto politicians, Luxembourg

WHAT I’M WATCHING:

The EU’s wholesale CBDC takes shape

Messaging from the European Central Bank (ECB) around CBDCs is shifting. After a barrage of posts from officials over the past few weeks about how the retail-facing digital euro would make our daily lives so much easier, last week we got a breath of fresh air from an unexpected source.

On Thursday, the governor of the French central bank, François Villeroy de Galhau, gave a speech at the Fintech Forum in Paris. He repeated the ECB’s warnings about dollar stablecoins introducing a “disorderly proliferation of private settlement solutions and a growing dependence on non-European and unregulated players”. And, true to form, he suggested that the solution was more regulation: MiCA’s rules should be tightened to dissuade multi-jurisdiction issuance of stablecoins (for instance, USDC is issued in under US and EU rules). Sigh. By making euro stablecoin issuance even more limited in potential for the large players, it won’t be the first time EU regulation achieves the opposite of what it intended.

But then the governor pivoted to a summary of the ECB’s work on a wholesale CBDC. We haven’t heard much about this, as the messaging has been full-on promotion for the retail-facing digital euro. Villeroy de Galhau acknowledged as much, that the wholesale project was “less well known and less high-profile” than the digital euro, but emphasized that “it is even more important” (yes!) and that it has “become a high priority: we must accelerate our efforts”. This is a big deal – there is a strong case to be made for wholesale digital central bank money (wCBDC), none at all for the retail version.

The work ahead has two phases:

1) Next year, we should see the launch of the Pontes pilot which will test the settlement of tokenized assets using central bank money, either via a connection between distributed ledgers and the TARGET settlement network, or on a new Eurosystem distributed ledger.

The former option was a key feature of the recent ECB trials (I wrote more about them here), and involves inserting a step that syncs the distributed ledger on which tokenized assets move with traditional payments rails. The advantage is that it’s a relatively low lift for banks, which makes adoption more likely; the disadvantage is that it severely limits the harnessing of blockchain efficiencies, and could become entrenched enough to dissuade the further step to full blockchain integration.

2) The Appia project is working on a shared ledger where tokenised central bank money, commercial bank money and assets can interact. This one is especially interesting, given its potential to “help overcome many technical obstacles to the integration of European capital markets”.

By this, Villeroy de Galhau is referring to the stubbornly fragmented nature of European finance – I wrote about this last week, how the EU has a common currency but still doesn’t have either banking or capital markets union, which hinders raises and returns. Without a unified capital market, Europe can’t develop a deep and liquid pool of “safe” capital that can back the stablecoins central bankers such as Villeroy de Galhau think it should issue. And, national variations in the application of the MiCA crypto framework add friction.

But, the emergence of an EU digital market could change that. Moves are afoot to move all MiCA-related enforcement under the umbrella of the markets regulator ESMA, rather than leave it in the hands of national authorities – a necessary step for the development of a bloc-wide digital market.

See also:

If you like this newsletter, would you mind sharing it with colleagues and friends, and nudging them to subscribe? Thanks!

Diplomatic spats move markets

US Secretary of the Treasury Scott Bessent gave an extraordinary interview to the Financial Times yesterday, in which he accuses China of doing what the US is doing and how that’s just wrong (obviously, he put it differently).

Some highlights (if that’s the right term):

Bessent insists that China’s implementation of export controls reflects “problems in its own economy” – never mind the US has been doing this for years.

“Maybe there is some Leninist business model where hurting your customers is a good idea.” (I mean, I just…)

“They are in the middle of a recession/depression, and they are trying to export their way out of it.” – on the first part, debatable, but even if true, why wouldn’t China try to export more?

“[Trade negotiator Li Chenggang] was pretty unhinged and very aggressive in stating that the US would face ‘hellfire’ if things didn’t go his way.” – being aggressive is a sign of weakness now?

He also pointed out that there was probably a fight between government agencies going on in Beijing, with the Commerce Department wanting to take a more provocative stance – which is pretty much what has been going on in Washington DC since January.

The US is now preparing “countermeasures”, including an export tax on any company selling US-made software to China. In what looks like a troll worthy of Trump or Vance, last week China’s Ministry of Commerce issued a slew of documents – including information on its export controls – that could be only be accessed only through WPS Office, China’s answer to Word and the rest of the Microsoft suite.

Going back to Bessent’s interview: this is not just a sulky spat. Trust between the two nations is being eroded, and we have to wonder at what point that impacts the economic outcome. Bessent said in the interview that the US had reached out on Friday for a conversation about the controls; China wouldn’t take the call, but started begging for meetings once the White House made the conflict public. I’m not convinced we can take that at face value, but even if the insinuation is true, the whole thing feels like it’s getting personal and petty.

This matters for markets, which are heading into earnings season with a bit less confidence than they had last week. (For more on the nervousness, see below.)

Scepticism and the institutional stablecoin rush

Just over the past few days:

Citigroup has joined nine European banks – including UniCredit, ING, CaixaBank, Raiffeisen Bank, DekaBank and others – in a consortium to develop a euro stablecoin. The work will be carried out by a new company based in the Netherlands, with launch targeted for the second half of 2026. I wonder what President Trump will think of a US bank helping to set up a competitor to USD stablecoins.

A different group of global banks – including Bank of America, Citigroup, BNP Paribas, Deutsche Bank, Banco Santander, MUFG, UBS, Goldman Sachs and TD Bank – has joined forces to explore “digital money”, focusing on G7 currencies. Again, given his threats of 100% tariffs on any country that tries to move away from the US dollar, it remains to be seen how Trump reacts to US banks looking to issue non-USD stablecoins. For both of the above consortia, I’ll believe it when I see it.

BNY Mellon is exploring deposit tokens, according to an interview with the firm’s head of treasury services. Usually, “exploring” doesn’t lead to much – but this move makes operational sense for the treasury management of BNY clients.

After Wyoming, North Dakota looks set to become the second US state to issue a stablecoin. “Roughrider Coin” will be issued by the state-owned Bank of North Dakota, with the back-end handled by Fiserv’s digital asset platform. Rollout will begin next year as a limited pilot, to alleviate concerns about a diversion of funds from deposits. Unlike Wyoming’s stablecoin FRNT, the Roughrider Coin will not cater to retail accounts, preferring to focus initially on bank-to-bank transactions such as overnight lending, construction advances, agricultural loans, and more, offering instant transfers outside of business hours. The business case here is not obvious, especially given the considerable cost to banks in both platform upgrades and potential deposit loss. Is there really that much demand for 24/7 banking in North Dakota?

I’ve seen some chatter over the past week about Alipay issuing a euro-backed stablecoin, which would be a big deal if true – but the news feels “off”. I may be wrong and will apologise if so, but 1) the move doesn’t make strategic sense (why would Alipay want a euro stablecoin?), and 2) I haven’t seen any information backing this up. The interim MiCA register of the European markets regulator ESMA does have an entry for Alipay, which seems to have gotten authorization in Luxembourg back in July. But the links that accompany the registration – one to a website for something called bettrcoin, and another to a white paper for the BREUR stablecoin – don’t work. And the top entry in Google for bettrcoin points to an app for buying domain names. So, more breathless froth about institutional support?

Macro-Crypto Bits

Short-form thoughts on key macro/crypto twists:

Markets: still nervous

It’s notable that the S&P 500 has not recovered levels from before President Trump’s heated post on Friday – the complacent assumption that the trade war was essentially over seems to have been dented, which is healthy. Futures are pointing to a weak US open today.

(chart via TradingView)

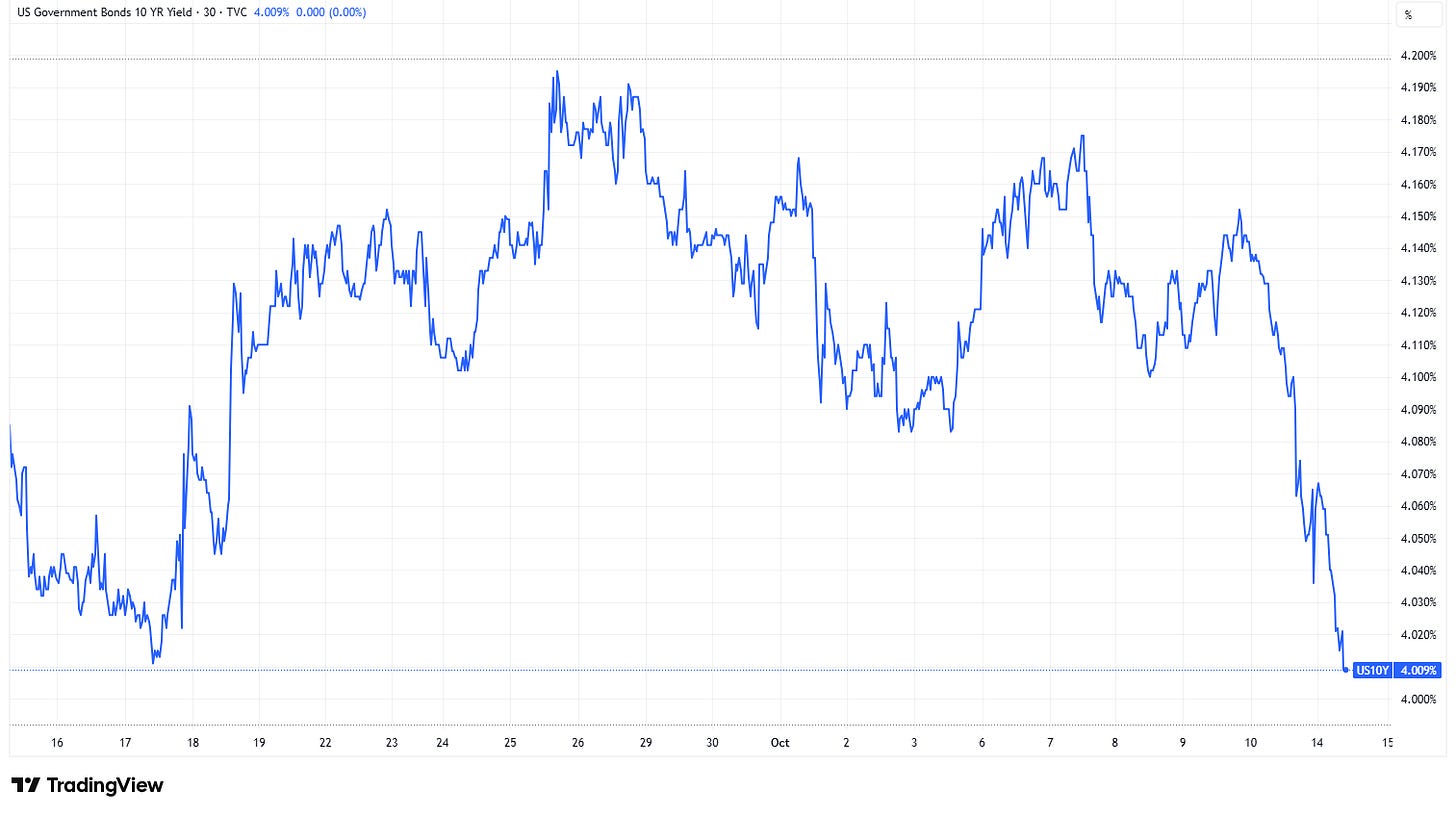

What’s more, the yield on US 10-year treasuries continues to head down, suggesting a rotation into relative safety pushing bond prices up.

(chart via TradingView)

The gold price is reinforcing this narrative, continuing to power upward.

(chart via TradingView)

And so is the US dollar, which is not following yields down.

(chart via TradingView)

Crypto markets are also nervous today, despite the recent leverage flush, with BTC acting more like a risk asset than digital gold.

(chart via TradingView)

In sum, it looks like global markets are getting a bit more nervous, with Bessent’s interview with the FT (see above) cancelling any relief from President Trump’s placatory comments over the weekend. It used to be that Bessent was the one to calm choppy waters…

Macro: systemic risks

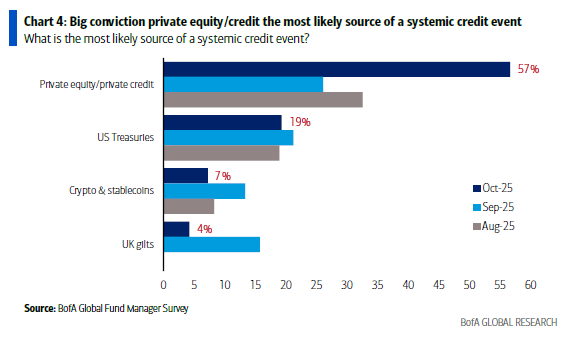

Speaking of which, here’s something quite amazing – according to the latest Bank of America fund manager survey, more global fund managers see US treasuries as a systemic risk than crypto and stablecoins, by a significant factor. How things have changed.

(chart via @lisaabramowicz1)

The growing concern over private credit funds is justified. Yesterday, ratings agency S&P issued a warning of the risks in the opacity and complexity of the structures, Moody’s issued a warning not long ago of the rising participation from retail investors, and even a little bit of digging into the exposure of banks and insurance companies is terrifying.

ALSO:

Yesterday, the Dutch government seized control of Chinese-owned chip maker Nexperia on the grounds of “economic security”. This is an extremely alarming precedent that is not only going to damage the already tense EU-China relationship; it could also trigger a scramble to divest from other global partners, at a time Europe needs the financing help. An insane move.

Luxembourg’s sovereign wealth fund has allocated 1% of its portfolio to BTC. This is not as significant as the headlines have been suggesting – the fund is small, and 1% amounts to roughly $7 million. Plus, the allocation was through spot ETFs, which is not nearly as interesting as if a sovereign wealth fund were self-custodying the asset, treating it like a “safe” reserve. It’s not the first sovereign wealth fund to invest in BTC, but it does seem to be the first in Europe, which is something I guess?

Leader of the UK’s right wing Reform Party, Nigel Farage, is taking a leaf from President Trump’s playbook and appealing to crypto money. Speaking yesterday at Blockworks’ Digital Asset Summit in London, he urged the largely institutional crowd to consider him their “champion” and promised supportive legislation as well as a strategic reserve. Donations welcome, of course. To be fair, Farage has been pro-crypto for ages, this isn’t just an opportunistic pivot. But the echo rings loud.

LISTEN/READ:

(As always, if you’d like me to write up notes on any of the featured podcast episodes, just let me know! Happy to oblige, bandwidth permitting.)

In this episode of Unchained, Laura Shin talks to Dragonfly partner Rob Hadick and Helius CEO Mert Mumtaz about stablecoins: why we will get a flood of issuance, why Circle will struggle, Tether’s plans, layer-1 strategies, and more.

🎶WHAT I’M LISTENING TO: Some soaring chorals – Ndikhokhele Bawo, by the University of Pretoria Camerata🎶

If you find Crypto is Macro Now useful, would you mind hitting the like button? ❤ I’m told it feeds the almighty algorithm.

BE CAREFUL OUT THERE!

DISCLAIMER: I never give trading ideas, and NOTHING I say is investment advice! I hold some BTC, ETH and a tiny amount of some smaller tokens, but they’re all long-term holdings – I don’t trade. Also, I often use AI for research instead of Google (always double-checking facts), but never for writing.