FIFA, tokens and questions

plus: the AI bubble, blurring boundaries, EU regulation, record inflows and more

“Despotism has so often been established in the name of liberty that experience should warn us to judge parties by their practices rather than their preachings.” – Raymond Aron ||

Hello everyone! I hope you’re all doing well.

I have fighter jets screaming past my window as I type, rehearsing for this weekend’s military parade. And I have a senior dog desperately trying to find somewhere to hide. For now, he’s trembling in the corner of the shower of our small bathroom, and my heart breaks just thinking what must be going through his head.

Here’s a link to my latest op-ed in American Banker: Stablecoins will blur the boundaries between banks and nonbanks (paywall).

Programming note: Apologies, I have to skip publication tomorrow due to a teaching conflict.

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides vetted blockchain data to answer your hardest macro questions, like:

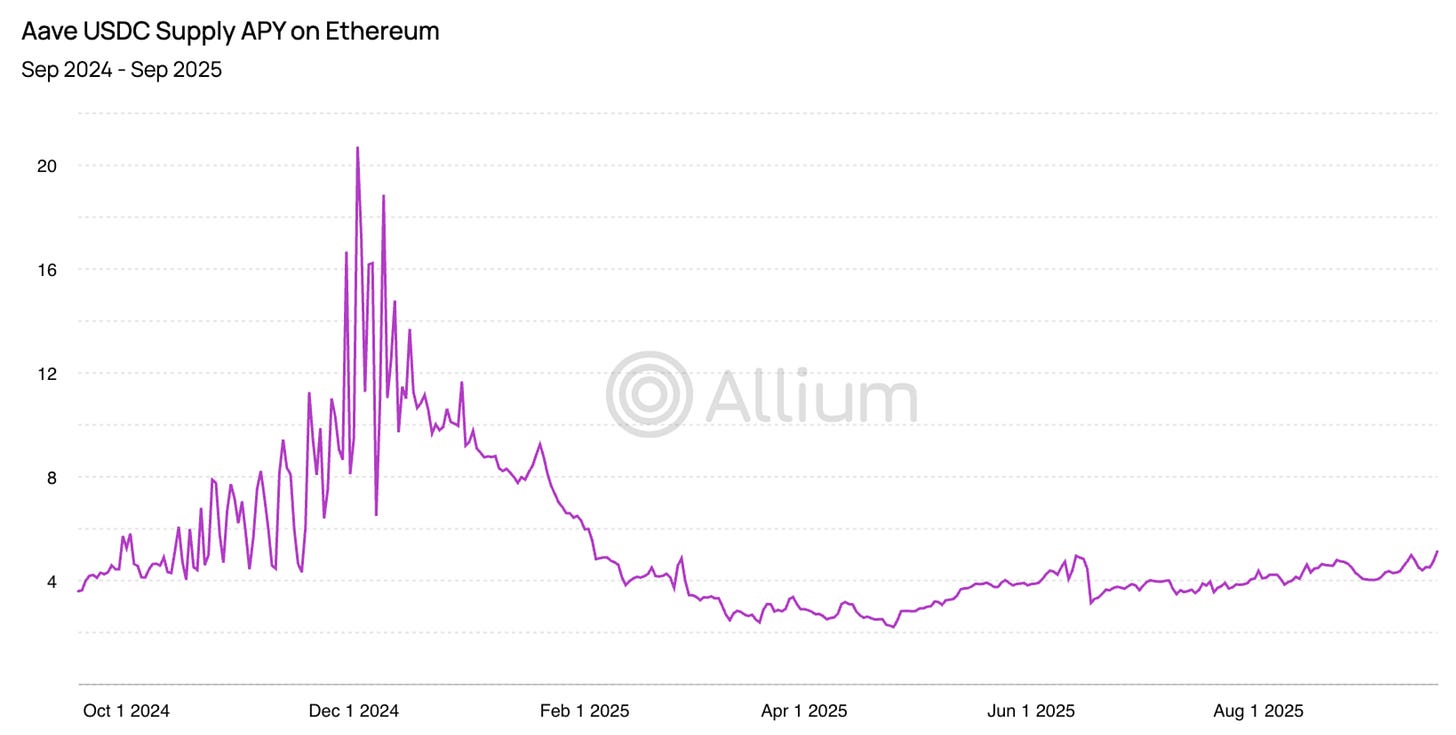

“How has the lending interest rate of USDC for Aave on Ethereum changed ahead of Fed rate cuts?”

Our data covers 100+ chains and is internally checked for accuracy every 5 minutes. We handle the pipelines and edge cases so you can uncover insights faster with a single, verified data source. Teams like Visa, Stripe, and Grayscale trust Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

The AI bubble

FIFA, tokens and questions

Macro-Crypto Bits: BTC consolidation, ETH catch-up, record inflows and crypto regulation

Also: the blurring of boundaries, empty pilots, transfer agents and more

WHAT I’M WATCHING:

The AI bubble

I’m sensing a change of tone in media reporting on the AI boom. True, this may be my filter bubble at work, but the warning voices are seeping beyond Substack and into more mainstream reporting.

Over the past couple of weeks, I’ve seen a few articles like this one in the Wall Street Journal, which calls out the colossal amount of investment in AI data centers with few convincing explanations of the likely return.

“The artificial-intelligence boom has ushered in one of the costliest building sprees in world history. … A big problem: No one is sure how they will get their investment back—or when.”

Just over a week ago, Reuters ran an op-ed by Edward Chancellor (author of The Price of Time, excellent book) titled “AI investment bubble inflated by trio of dilemmas”, which largely all boiled down to an absence of competitive options.

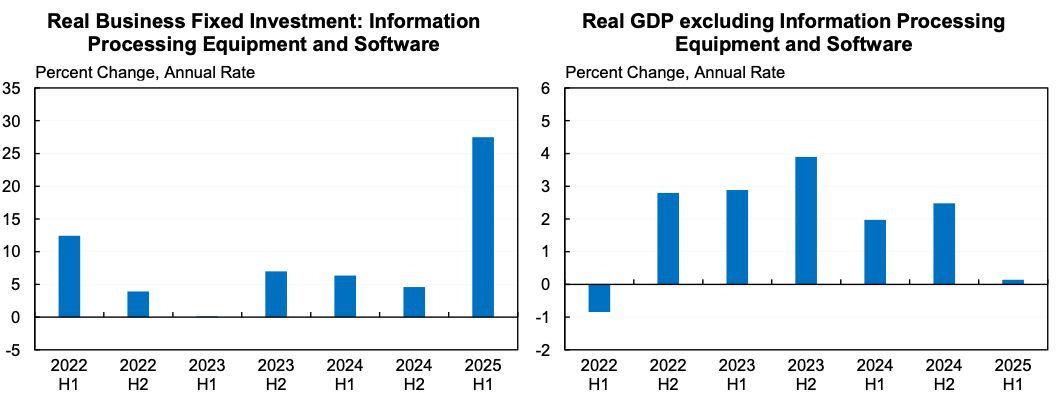

Last week, the Washington Post published an article titled: “One force is propping up the economy. Fears are growing it won’t last.” The gist is that AI investment accounts for roughly two thirds of H1’s 1.6% GDP growth, and where’s the profit going to come from?

On Friday, the volume notched up a bit. The Financial Times published an article titled “The AI capex endgame is approaching”, citing global competition and creeping regulation.

Axios ran an article with the headline “The biggest sign of an AI bubble is starting to appear”, focusing on the build-up of debt to finance the capex race.

The New York Post reported on a talk Goldman Sachs CEO David Solomon gave in Italy, quoting him as saying:

“I think that there will be a lot of capital that’s deployed that will turn out to not deliver returns, and when that happens, people won’t feel good.”

On Saturday, Bloomberg put a bow on it with an explainer: “Why Fears of a Trillion-Dollar AI Bubble Are Growing”:

“Never before has so much money been spent so rapidly on a technology that, for all its potential, remains somewhat unproven as a profit-making business model.”

Yet, the article points out, tech executives can’t not spend, even if they themselves have doubts about the return. It’s an asymmetric bet with bad consequences either way, only with different distribution: a CEO who pulls back and lets others outspend, risks his career. A CEO who spends “in line” will suffer if the tide goes out, but probably survive the fallout since everyone’s in the same boat.

In an interview last night on CNBC, renowned investor Paul Tudor Jones said that the current market “feels like 1999”. He didn’t say the conditions were the same, he said it feels similar, and since few active traders today were also deep in markets back then, and even fewer have his depth of experience, we should at least listen.

The risk for global investors is huge, even beyond potential drops in the prices of AI-related stocks. Economist Jason Furman estimates that without the contribution from overall investment in IT, US GDP growth in H1 would have been at an 0.1% annualized rate. That does not feel like something most analysts are taking into account.

(chart via @jasonfurman)

True, without so much AI investment, other sectors might be getting more, and electricity prices would probably be lower – so, a simple subtraction doesn’t paint a complete picture.

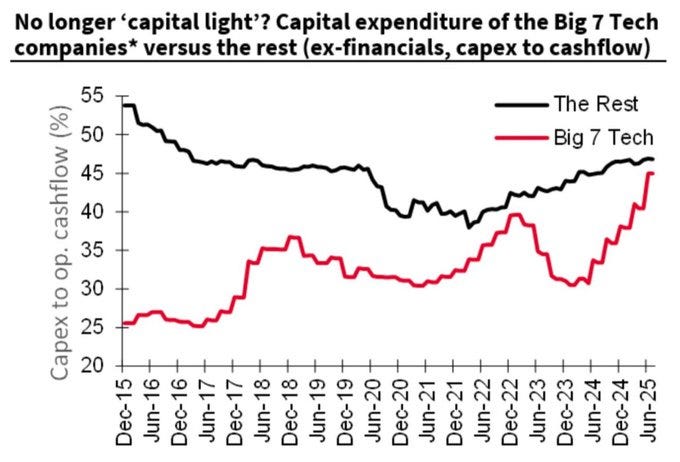

But relying on the agility and high margins of tech stocks to keep driving market index gains feels more and more like driving looking in the rear-view mirror, since these companies are no longer “capital light”.

(chart via @patrick_saner)

And, given the heavy weight of these stocks in the main indices, and the colossal amount of money in indexed investment, we have to be prepared for what the market will look like when confidence in the leaders starts to turn, but many – especially retail – can’t exit.

FIFA, tokens and questions

Here’s an innovative use case for blockchain tokens: allocation of seats for football games.