Finally, some regulatory convergence?

plus: Asian gold demand, US economic activity

“If you have built castles in the air, your work need not be lost; that is where they should be. Now put the foundations under them.” – Henry David Thoreau ||

Hi everyone, and happy Fed day! A strange thing to say, I know, but these are the times we live in.

A relatively short (and late!) newsletter today as I have to deal with a root canal – condolences are welcome. Even worse than having a root canal, though, is not being able to when you need one, so this isn’t fun but I’m feeling grateful my tooth will stop bothering me.

A programming note: this newsletter will be taking a break next week, which will probably be terrible timing, I know.

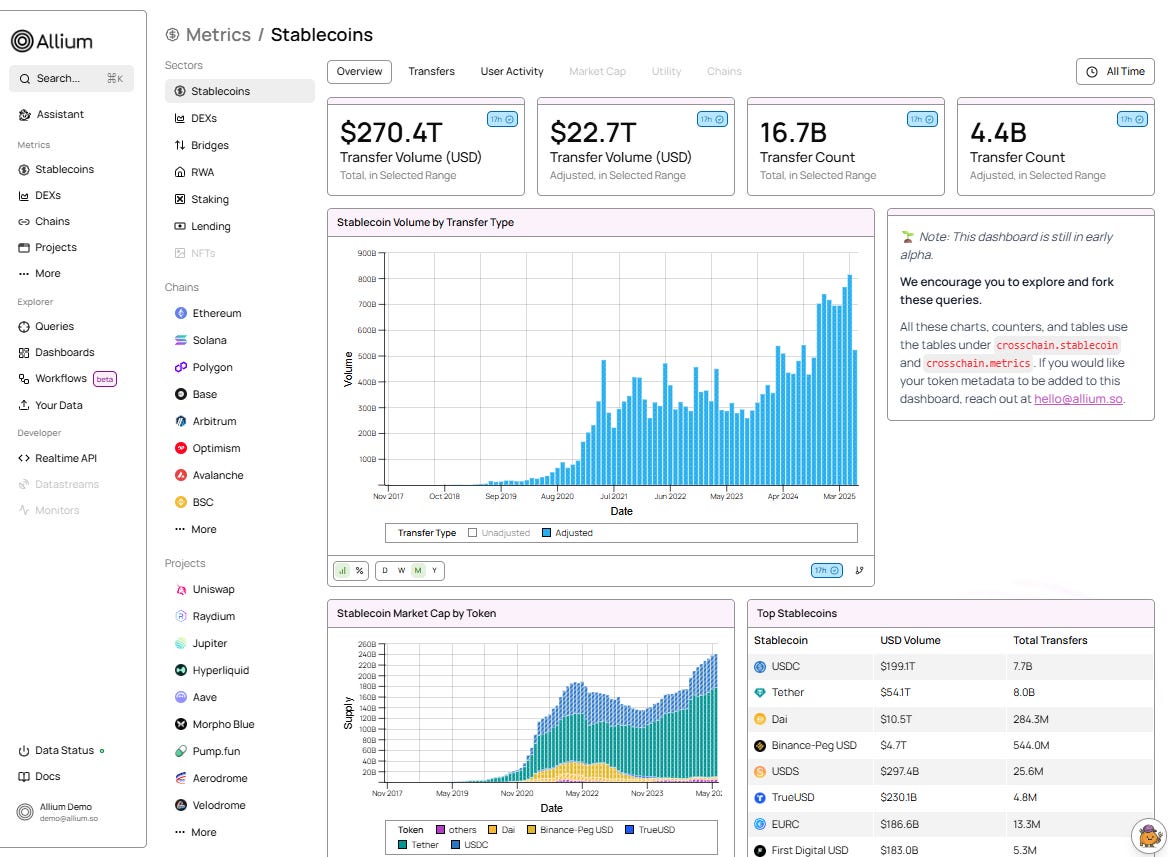

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Finally, some regulatory convergence?

Asian gold demand

Macro-Crypto Bits: US retail sales and manufacturing

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Finally, some regulatory convergence?

Yesterday, UK Chancellor of the Exchequer Rachel Reeves met with leaders of some of the UK’s main crypto businesses. That would normally evoke a shrug, as over the past few years we’ve seen some dialogue between the UK government and the crypto industry, and we even heard former Prime Minister Rishi Sunak promise to make Britain a crypto centre – nothing concrete ever came of it.

But this meeting was different. US Treasury Secretary Scott Bessent was in attendance.

Also in attendance were representatives from Coinbase, Circle and Ripple. These have strong UK presence, but they are global businesses.

The takeaway is that this meeting was about more than “what should a UK regulatory framework for digital assets look like?”. Rather, the vibes are “how can we coordinate policy with other key crypto centres?”.

This matters more than it might seem, as a patchwork of rules is never as efficient as global standards. The problem has always been: who would set those standards? Given varying degrees of understanding, competing priorities (support innovation vs prevent crime, for instance) and different financial structures (which speaks to the influence of defensive central banks), unity on a crypto approach has been a pipe dream.

But, if we are tiptoeing into a marketplace with coordination, it’s not just economies of scale that can be unleashed. One of the key premises of blockchains is a borderless market. Another is connectivity. But for these to be realized, at least at the institutional level, you need regulation that supports cross-border cooperation.

So, let’s hope that Bessent was able to get Reeves to see the opportunity the UK government has been leaving on the table. Let’s hope that conversations with global crypto businesses help her understand that the industry is evolving rapidly outside her jurisdiction, and that the UK is being left behind.