FOMC: Bracing, but for what?

plus, what's ahead for this week

“You can tell whether a man is clever by his answers. You can tell whether a man is wise by his questions.” – Naguib Mahfouz ||

Hi everyone, I hope you’re all doing well! Over here, I desperately need some sign that spring is around the corner. The home stretch of winter is always the hardest, and even normally luminous Madrid has been cold and grey for what feels like weeks.

Below, I talk about what we should look out for at tomorrow’s FOMC statement and press conference – no move in rate cuts, but there could be a couple of shocks from other areas.

It’s a long one today! But since I have to miss tomorrow’s publication, I figure it averages out?

Yesterday, I stepped in as a substitute host on Scott Melker’s Macro Monday show – a spirited debate as always, you can see that here.

Production note: This is a choppy week, I apologize – I have to miss publication again tomorrow, as I’ll be away from my desk until early afternoon. Should be back to normal next week!

IN THIS NEWSLETTER:

Coming up: what to keep an eye on this week

FOMC: Bracing, but for what?

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as audio, relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Coming up: what to keep an eye on this week

(a new section in which I’ll aim to give you a heads-up on possible market-moving events, as well as those that could shape the geopolitical and crypto stage)

A significant crypto event yesterday was the listing of SOL futures on the CME, the first time the institutional platform has moved beyond BTC and ETH. This can be seen as a prelude to approval for SOL ETFs, for futures as well as for spot – according to The Block, there are currently 13 proposals in the queue for approval. The CME is not the only SOL derivatives venue, SOL futures are also available on Coinbase’s regulated derivatives exchange – but, the CME is a venue used by most traditional investors, potentially opening up a new market and deepening the asset’s liquidity.

The launch did not seem to cheer up the market, though – yesterday, SOL traded rangebound, and so far is weaker today.

(chart via TradingView)

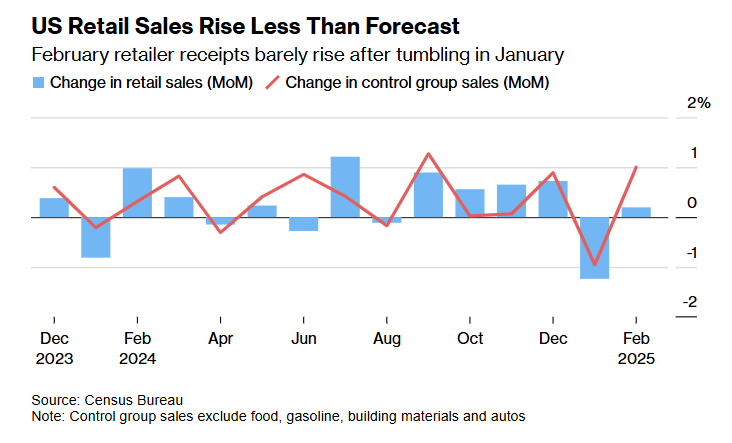

Yesterday’s US retail sales figures for February disappointed with a 0.2% month-on-month increase, rather than the expected 0.6% climb. That said, it was an improvement on January’s startling 1.6% drop, although it adds to the narrative of increasingly cautious consumption.

(chart via Bloomberg)

Today, Trump and Putin are reportedly getting on a call to discuss a Ukraine ceasefire. Given the characters involved, who knows what will transpire, but there does seem to be a broad willingness to talk which suggests that the end of the war is not far away. One can hope.

Also today, the German Parliament votes on the radical spending plan proposed by incoming Chancellor Friedrich Merz – this would set up a €500 billion infrastructure fund, and allow defence spending to not be included in the debt limit, potentially unleashing a further €400 billion. If passed (which is likely), this marks a radical departure for a notoriously spendthrift country.

Later, we get the latest US industrial production for February – the previous two reads came in well above expectations, at 0.9% and 0.5% month-on-month respectively; the consensus forecast for February is for a deceleration to 0.2%.

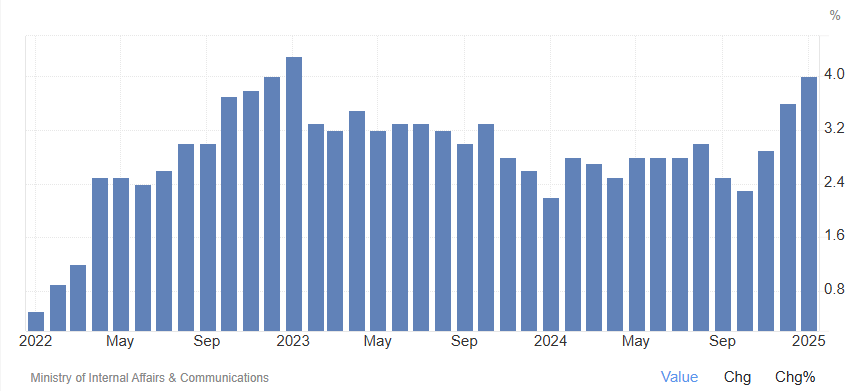

And the Bank of Japan reveals its decision regarding interest rates – this is widely expected to be no move, but the statement will be scrutinized for hints of a hike in coming months given the country’s recent steep climb in inflation (now higher than in the US!). Any suggestion of a move on rates could rattle markets as Japanese money invested in US assets could accelerate the flow home.

(Japanese year-on-year CPI, chart via TradingEconomics)

The big macro event this week is the two-day FOMC rate-setting meeting which concludes on Wednesday with Chair Powell’s statement and press conference. More on this below, but to summarize, no-one expects a move in the federal funds rate but we are all eager to know what the likely changes to language and tone mean for central bank actions in the months to come, and what the updated economic projections say about Committee concerns.

Thursday brings US jobless claims, a weekly report that can be noisy but which suggests some trend lines via the continuing claims (those that are still unemployed a week after first filing) and the four-week average of initial claims.

And on Friday, the SEC kicks off a series of roundtables titled “Spring Sprint Toward Crypto Clarity”, with one focused on classification: “How We Got Here and How We Get Out – Defining Security Status.”

Bracing, but for what?

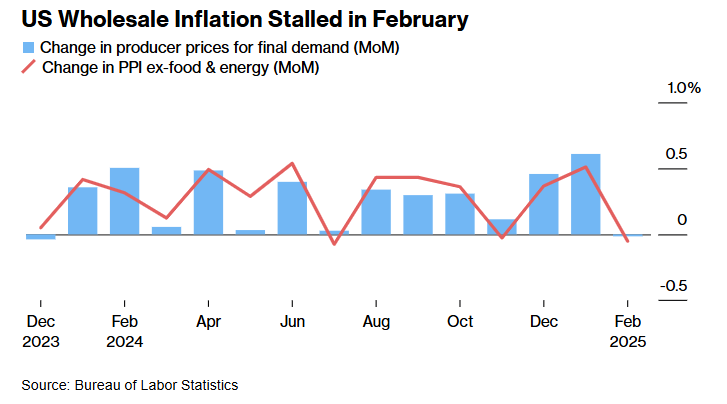

Last week, the good news in the February Consumer Price Index (CPI) read – at 0.2% month-on-month, lower than expected and than January’s figure – was echoed in the February Producer Price Index (PPI) data released on Friday.

The gauge of wholesale inflation stripping out food and energy (the core index) declined by 0.1% month-on-month, the first drop since last July. This was much less than the expected 0.3% increase and January’s 0.5% climb, and was enough to bring the year-on-year increase down to 3.2%, vs 3.3% and 3.7% in January.

(chart via Bloomberg)

Good news! But, as with Wednesday’s CPI data drop, the market didn’t seem to notice. The S&P 500 continued its downward march, and the US 10-year yield barely blinked.

This was probably due to the composition of the deceleration, which – like the CPI – was largely driven by categories that do not form part of the Fed’s preferred inflation measure of core Personal Consumption Expenditure (PCE), stripping out energy and food.

And, the core goods PPI index increased by 0.4% month-on-month, the most in more than two years.

What’s more, the index measuring wholesale and retail trade margins fell by a whopping 1%, which does not bode well for earnings.

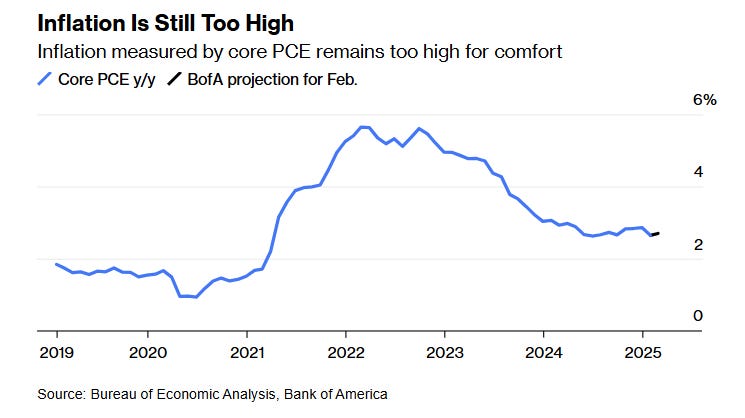

The core PCE index, due next Friday, is now expected to climb by around 0.34% in February, month-on-month, which would raise the year-on-year measure to 2.75%, from 2.65% in January. Not what the Fed wants to see.

(chart via Bloomberg)

Speaking of which, tomorrow we’ll hear more words from the US central bank on how they’re encouraged by inflation’s deceleration but there is still more work to do. And we will no doubt get confirmation that the current rate pause will be extended – no surprise there.

However, there will be two key aspects of the statement that warrant close attention, either of which could send the market scurrying.