Friday, Feb 16, 2024

this cycle is different, BTC as a store of value, why the trust issue matters, banks and custody

“There is a theory which states that if ever anyone discovers exactly what the Universe is for and why it is here, it will instantly disappear and be replaced by something even more bizarre and inexplicable.

There is another theory which states that this has already happened.” – Douglas Adams ||

Hello everyone, and happy Friday! I hope you get to touch grass this weekend – it’s been an intense few days.

You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but I don’t give trading ideas, and NOTHING I say is investment advice. For full disclosure, I have held the same long positions in BTC and ETH for years, and have no intention to either buy more or sell in the near future.

If you’re not a subscriber, I do hope you’ll consider becoming one! You’ll get a ~daily newsletter that goes deeper into some of the things I’m looking at, mainly how crypto fits in to the broader economic landscape, why it matters, and where this is all heading. With audio! Most days, anyway.

If you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

Women in Blockchain is working on understanding the crypto compensation landscape (and not just for women!) – would you help them out by filling in a brief survey? We know the ranges are wide, but more information could be useful.

IN THIS NEWSLETTER

This cycle is still early

Not a store of value, you say?

Legacy banks custodying crypto is getting closer

Why the global trust issue is so important

WHAT I’M WATCHING

This cycle is still early

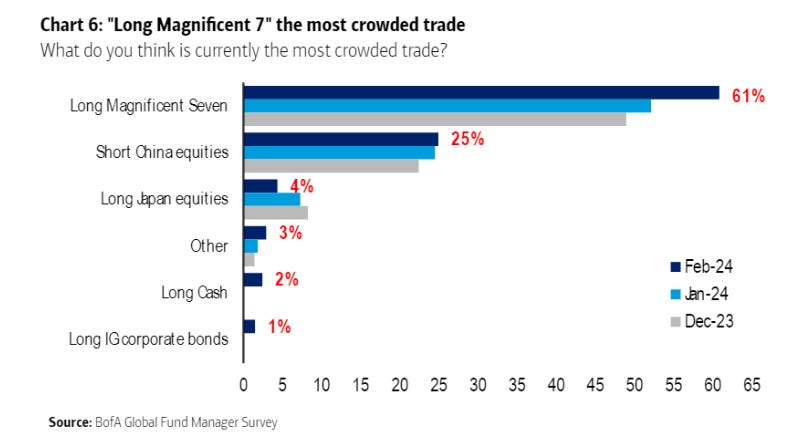

Back in May 2021, with BTC around $50,000, the monthly Bank of America fund manager survey had “long bitcoin” as its “most crowded” trade.

(chart via Bitcoin.com)

Now, again at ~$50,000, it’s not even on the list.

(chart via Bloomberg)

This feels like it is just getting warmed up.

Not a store of value, you say?

According to @_benkaufman on X, BTC has hit all-time highs in the following currencies:

Japanese yen

South African rand

Argentinian peso

Turkish lira

Nigerian naira

Pakistani rupee

Egyptian pound

Kenya shilling

Bangladeshi taka

Congolese franc

Lebanese pound

Sri Lankan rupee

Ukrainian hryvnia

And it is really, really close to hitting all-time highs in Norwegian and Swedish kroner.

So, when someone tells you that BTC cannot possibly be a store of value, ask them about their currency base and their timeline.

Legacy banks custodying crypto is getting closer

Last week, I wrote about the bipartisan push to strike down the SEC’s Staff Accounting Bulletin (SAB) 121, which prevents listed banks from custodying crypto assets for their clients. Now, the Bank Policy Institute, the American Bankers Association, the Financial Services Forum and the Security Industry and Financial Markets Association have added their voices to the mix.