Friday, Feb 17, 2023

What the latest big SEC action means for all crypto assets, signs of economic weakness, market tension, art experimentation and more...

“It's no wonder that truth is stranger than fiction. Fiction has to make sense.” – Mark Twain ||

Hello everyone, and happy Friday! Today’s email is a bit shorter than usual (you’re welcome), and later (sorry), because I’m fighting a rotten cold and can barely think. I’ve been powering along this week fuelled by gallons of hot apple juice and ginger tea. Please drop in any home remedies that work for you in the comments. 😊

You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystems. Nothing I say is investment advice! Nevertheless, if you find this useful, do please consider liking, and sharing with friends and colleagues.

If you landed here from somewhere other than your inbox, or if this was shared with you, I hope you’ll think about subscribing to support my work (or try a free trial!). I’d really appreciate it. 😊

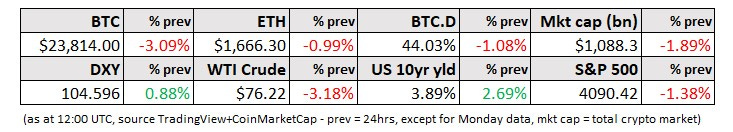

MARKETS

Could consumer data be misleading?

With some key economic numbers dominating the week’s coverage, today I want to surface some other signals from the week that tend to be more overlooked and are painting a different picture.

To recap the high-profile numbers:

US CPI came in more or less as expected (6.4% year-on-year in January, higher than the expected 6.2% but slightly lower than December’s 6.5%), but the resilience shown in some sectors such as services spooked a market hoping for a rapid deceleration.

US retail sales grew the most in nearly two years (+3.0% month-on-month for January, notably higher than average forecasts of +1.8%, and much higher than December’s 1.1% drop), underscoring the surprising strength of the consumer.

These are telling us that the road to 2% inflation will be really, really rough – I’m in the camp that the US just won’t get there without some serious meddling with how the figure is measured.

Unless…

Looking at some other less glittery data points, we can see some signs of a global economy that is weakening. This could call into question the “soft landing” narrative that is essential to the further US rate hikes that several Fed officials have been calling for this week (with some suggesting a return to half-point increases).