Friday, Feb 23, 2024

Nigeria's crypto move, retail flows? not yet, and why moon landings matter

“Sometimes glass glitters more than diamonds because it has more to prove.” – Terry Pratchett ||

Hello everyone, and happy Friday! I hope you have some great things lined up for the weekend, I am certain you’ve earned it! Apologies for the copy/paste error in yesterday’s intro.

You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but I don’t give trading ideas, and NOTHING I say is investment advice. For full disclosure, I have held the same long positions in BTC and ETH for years, and have no intention to either buy more or sell in the near future.

If you’re not a subscriber, I do hope you’ll consider becoming one! You’ll get a ~daily newsletter that goes deeper into some of the things I’m looking at, mainly how crypto fits in to the broader economic landscape, why it matters, and where this is all heading. With audio!

If you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

IN THIS NEWSLETTER

Nigeria is playing a risky hand

About those retail flows: I’m not convinced

Yesterday’s moon landing is a big deal

WHAT I’M WATCHING

Nigeria is playing a risky hand

Here’s an interesting story that outlines a crypto market development we could see a lot more of around the world this year, and that introduces an intriguing regulatory twist.

The government of Nigeria has blocked access to cryptocurrency exchanges operating in the country in an attempt to stem the devaluation of the naira. There’s a lot to unpack in this one.

First, how does a government block access to websites? Usually, it’s through telecom operators, which can be asked to blacklist specific IP addresses. In the case of Nigeria, the Nigerian Communications Commission (NCC) ordered telecom companies to restrict consumer access to the websites of Binance, Coinbase, Kraken and many other crypto exchanges, including local operations.

Second, do these restrictions work? Sort of, but not really – they’re more an added friction which could deter many, but those who want to buy crypto assets will find a way. VPNs can get around IP restrictions. Websites can change IP addresses. And, according to Binance, only “some” of its Nigerian users have experienced issues accessing the site, with access to its app as yet unimpeded. CoinDesk reported yesterday that Coinbase has confirmed its website is still accessible in the country. And Nigerian users on X today report they can still access popular crypto sites. IP blocking is a game of whack-a-mole, hard to enforce and hard to maintain.

What’s more, peer-to-peer (P2P) platforms are particularly popular in Nigeria – according to blockchain forensics firm Chainalysis, Nigeria ranks first in global P2P exchange trade volume. While the IPs of well-known P2P platforms can be blocked, there are many smaller ones that have not registered and that could in theory dodge an IP freeze. On X earlier today, Ray Youssef – CEO of P2P platform Noones – showed users how to activate private browsing, which seems to grant previously denied access. And Telegram reportedly hosts some impromptu message boards that result in trades.

Third, and even more important, is why would the government do this? Here is where it gets particularly interesting.

Apparently, crypto exchanges are to blame for the devaluation of the naira.

The official reason given for the move against IPs is, according to the local Premium Times, the “continuous manipulation of the forex market”, and the decision was taken “following reports that currency speculators and money launderers were using [crypto platforms] to execute criminal activities”.

Also, presidential advisor Bayo Onanuga in a tweet on Wednesday accused Binance of “blatantly setting exchange rate for Nigeria, hijacking CBN [Central Bank of Nigeria] role”. Binance, meanwhile, published a notice highlighting its efforts to comply with the authorities, which did not go down well with many users.

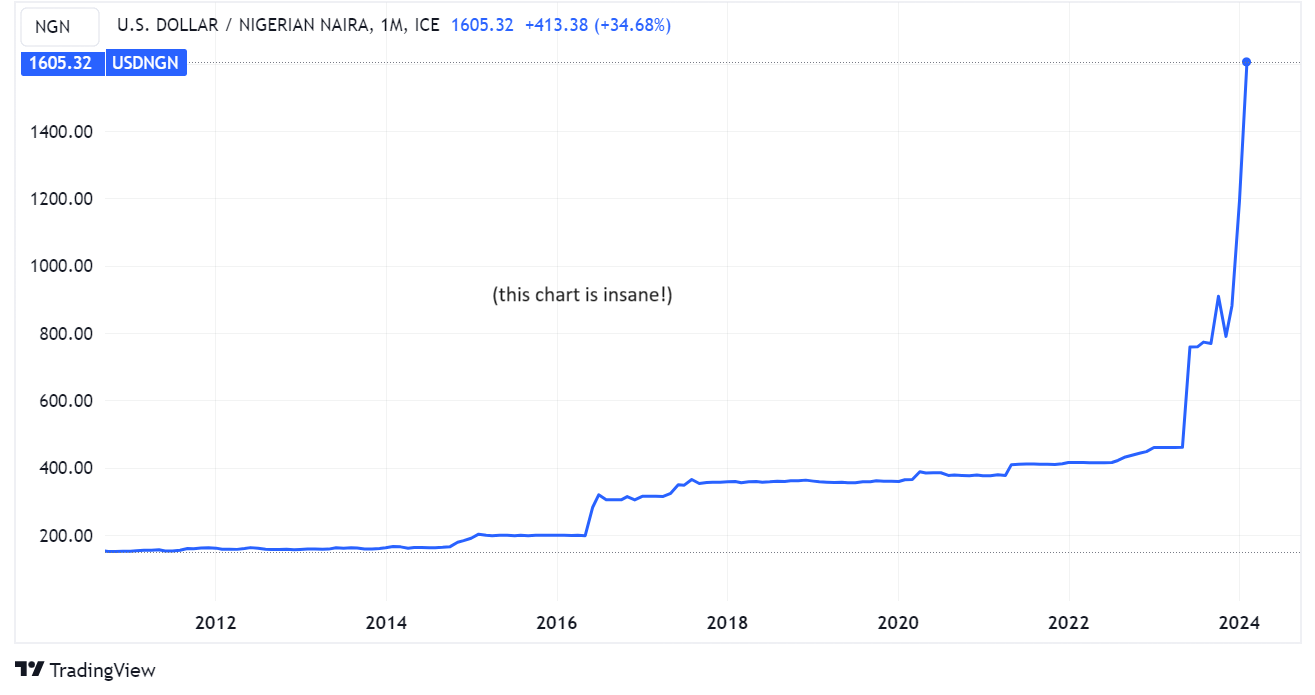

If the official statements from government representatives sound like desperation, well, there’s ample reason for that: the naira has been one of the worst performers in the world against the dollar over the past year, and analysts don’t see much relief in sight.

(chart via TradingView)

Obviously, the 76% increase in Nigeria’s broad money supply over the past year is probably more responsible for the crash of the currency than are cryptocurrency purchases. But the government has over the past few weeks tried a host of increasingly desperate measures, which do not seem to be working. It looks like it’s time for a new scapegoat.