Friday, July 26, 2024

a new “in brief” section, Nigeria’s crypto clampdown, crypto ETFs in Japan

“It ain't the heat, it's the humility.” – Yogi Berra ||

Hello everyone, and happy Friday!! Best of luck to all those participating in the Olympics, which kick off today.

Today’s newsletter is relatively short, since it’s a muggy Friday in summer. 😎

Plus, I’m trying something new starting today: a brief list of “news” I didn’t go into depth on, but that I think is relevant to the crypto/macro overlap. Regular readers will know that it’s hard for me to be brief (the devil is always in the details!), but I’ll see if I can get the hang of it. The list won’t be comprehensive, but it will be curated.

I’ll be writing again for my friends at the Connecting the Dots newsletter which goes out on Sunday, so you’re in time to scoot on over and subscribe! It sends out useful macro/crypto insight on a weekly basis, very digestible.

IN THIS NEWSLETTER:

Nigeria’s crypto clampdown

The continued spread of crypto ETFs

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get unique content, interesting links and my eternal gratitude - and there’s a free trial!

IN BRIEF:

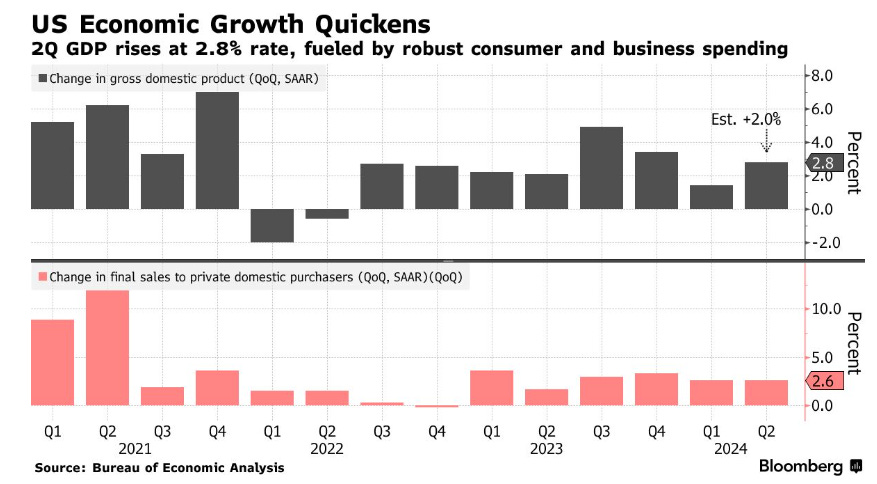

US Q2 GDP came in at 2.8%, notably higher than the expected 2.0% and higher still than Q1’s 1.4%. Where is that slowdown?

(chart via Bloomberg)

Jersey City's pension fund will invest in BTC spot ETFs. When a traditional and supposedly conservative institution takes a position in crypto assets, I always want to know why: in this case, according to a statement, it seems like it’s as a tech play, with the mayor saying in a post on X: “blockchain is amongst the most important new technology innovations since the internet.”

On stage at Bitcoin 2024, BlackRock’s head of digital assets Robert Mitchnick said that most BTC spot ETF demand is still from direct investors, with RIAs and investment platforms still gearing up. That’s encouraging, and could explain the still-strong inflows.

(chart via coinglass)

Bitcoin miner Marathon (MARA) announced that it has purchased $100 million worth of BTC in the open market, will continue to make market purchases, and will hold on to all of its mined BTC. This could be a sign that the post-halving miner selling is nearing its end. It also turns MARA stock into a leveraged bet on the BTC price, in that the bottom line and balance sheet should benefit from both BTC-based income from mining and from balance sheet revaluations especially with the new accounting rules. (This is not investment advice! I’m just commenting on the interesting strategy.)

Senator Elizabeth Warren said at a Senate Committee on Banking, Housing, and Urban Affairs hearing yesterday that foreign-owned bitcoin miners operating in the US are a national security threat. Apparently they are used for spying, and they are a threat to the energy grid. Oh, and of course a disaster for the environment.

Indian city Raipur is putting real estate records on a blockchain. When reading about enterprise applications, it’s always worth asking yourself why a blockchain is needed. In this case, it’s to combat forgery. We can hope there are checks for authenticity before records are input into a block – but it is true that paper-based and even some digital systems are much easier to game than an immutable ledger. Privacy will be ensured through the use of zero-knowledge proofs, with building permissions updated via smart contracts. Officials have said they are exploring extending the use case to birth, death and marriage certificates.

The Deputy Governor of the Philippines central bank has said that the country’s wholesale CBDC, currently undergoing trials, is expected to go live by 2029. The aim is to smooth off-hours interbank settlement (the highest priority apparently, not sure why), securities settlement and cross-border payments.