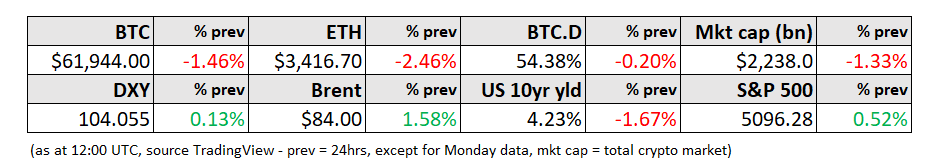

Friday, Mar 1, 2024

BTC resilience, inflation data, moves against the SEC

“You've got to be very careful if you don't know where you are going, because you might not get there.” – Yogi Berra ||

Hi all, and welcome to March! And, of course, Happy Friday!

No voice recording today, sorry, I’m coming down with something and don’t have much voice. I should be fully recovered by Monday.

IN THIS NEWSLETTER:

BTC resilience despite heavy ETF outflows

About that inflation data

More moves against the SEC

If you’re not a subscriber to the premium daily, I hope you’ll consider becoming one! You’ll get ~daily insight into the growing overlap between the crypto and macro landscapes, as well as some useful links, and (usually!) access to an audio read of the content.

WHAT I’M WATCHING:

BTC resilience

It feels really weird to be talking about Bitcoin resilience with the price not far from the previous all-time high.

But it looks like that’s what we’re seeing.

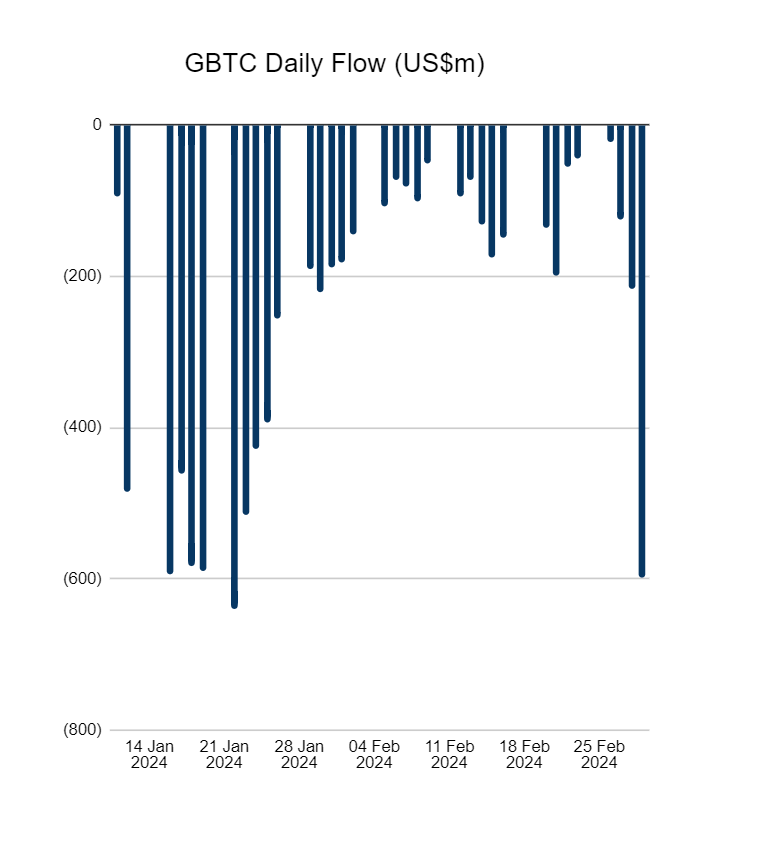

Yesterday, the bitcoin market withstood strong outflows from Grayscale’s BTC spot ETF (GBTC), with the net redemption of around 9,750 BTC (~$600 million), the second steepest exit since trading as an ETF began.

(chart via @FarsideUK)

And yet the BTC price barely budged.

(chart via TradingView)

This can only be partly attributable to the offset from net inflows into the new BTC spot ETFs, which reached a considerable $700 million yesterday, the second strongest day so far, with BlackRock easily leading the pack as usual.