Friday, Mar 31, 2023

What if we DO get a Fed pivot? What's going on with BTC options? What is Warren thinking? and more...

“Yes: I am a dreamer. For a dreamer is one who can only find his way by moonlight, and his punishment is that he sees the dawn before the rest of the world.” – Oscar Wilde ||

Hello, everyone, and happy Friday! Of course, this isn’t just any Friday – the last time the end of the first quarter fell on a Friday was in 2017, and the next time won’t be until 2028. Over the past 10 years, the end of a quarter has fallen on a Friday only two times (Q1 2017 and Q4 2021), and so today feels significant in a tidy, rounded way. We head into the weekend having put the quarter to bed.

You’re reading the premium daily Crypto is Macro Now newsletter, where I focus on the growing overlap between the crypto and macro ecosystem. Thanks so much for being a subscriber! Nothing I say is investment advice! Nevertheless, I hope you find it useful – if so, please consider hitting the like button at the bottom, and sharing with friends and colleagues.

If you landed here from somewhere other than your inbox, or if this was shared with you, I hope you’ll think about subscribing to support my work (or try a free trial!). It would make my day. 😊

Programming note: 🌺 Easter is rapidly approaching and it’s a big deal where I live, so this newsletter will be taking off Friday, April 7, through to Monday, April 10, including the weekend edition. 🌺

MARKETS

What if I’m wrong…

Many market observers are convinced a Fed pivot is coming soon, with interest rate cuts that will surely boost the market. I argued yesterday that I don’t think they’re coming in the same timeframe as market expectations indicate, although these are changing rapidly. A week ago, the market was telling us that the chance of another hike in May was remote – now it seems to believe it’s the most likely outcome, with the first cut tentatively priced in for July.

(chart via CME FedWatch)

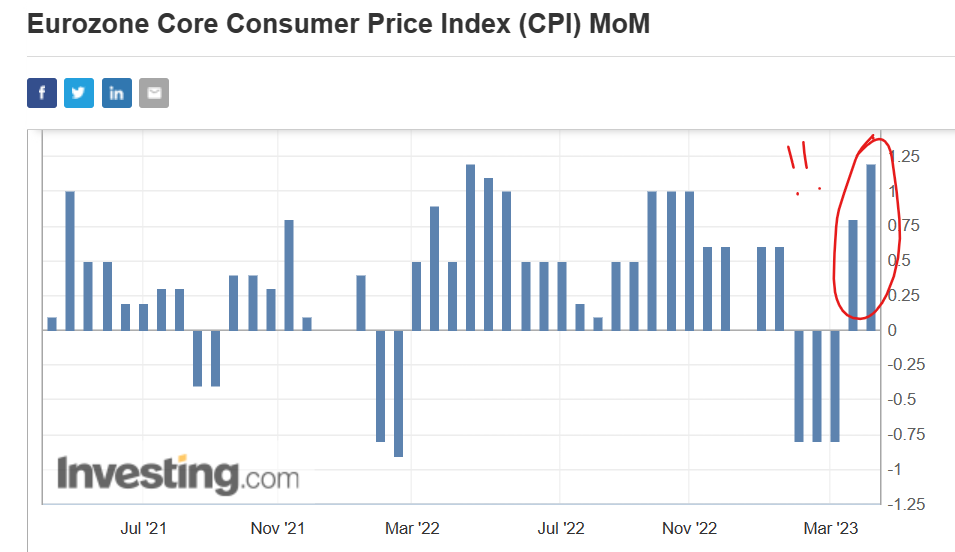

It’s likely that, too, will change as we see banking risk recede and inflation remain persistent – the preliminary Eurozone CPI inflation figures for March released this morning showed that, while the headline index fell by a record 1.6 percentage points to 6.9%, core inflation rose to 5.7%, its highest level ever. The month-on-month increase for core inflation was the highest since April of last year, double the average forecast.

(chart via Investing.com)

Since the economic factors driving both headline and core levels are similar on both sides of the ocean, this does not bode well for the US data. Later today we get the US PCE index for February, forecast to increase by 0.4%, the largest month-on-month increase since June. On the inflation front, things are not moving in the right direction.

So, I think the market is overestimating the probability of imminent rate cuts. But today I want to look at the scenario that I may be wrong (hey, it’s happened before).