Friday, Nov 11, 2022

“The peculiar essence of our financial system is an unprecedented trust between man and man; and when that trust is much weakened by hidden causes, a small accident may greatly hurt it, and a great accident for a moment may almost destroy it.” – Walter Bagehot ||

In spite of this being five days that felt like a month, I can’t believe it’s Friday already. I’m probably not the only one eager to see the back of this particular week, and I hope you all have some self-care planned for the weekend. You’re reading the premium Crypto is Macro Now email, and I’m glad you’re here. If you find this useful, please share with friends and colleagues.

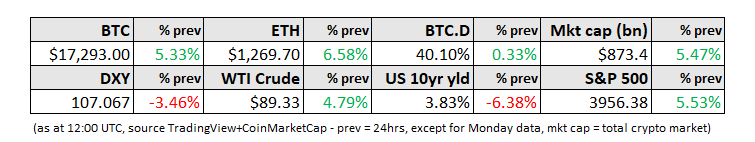

MARKETS

Markets brought some relief to the widespread crypto dismay yesterday as the US CPI for October came in at 7.7% vs 7.9% expected and 8.2% in September. The core inflation index, excluding food and energy, increased by 6.3%, lower than consensus estimates of 6.5% and pulling back from a 40-year high of 6.6%. The S&P 500 reacted enthusiastically with a 3.3% jump on the open, going on to deliver the best first-day post-CPI performance of 5.5% since records began.

The size of the reaction can be partly explained by the coiled-spring effect of a positive surprise in the numbers after a series of negative surprises, and by signs that this turning in the CPI acceleration may be more than a blip. The Federal Reserve of Atlanta tracks “sticky CPI”, an index of items that change price slowly, which was unchanged for the first time since the middle of last year.

(chart via the Federal Reserve of Atlanta)

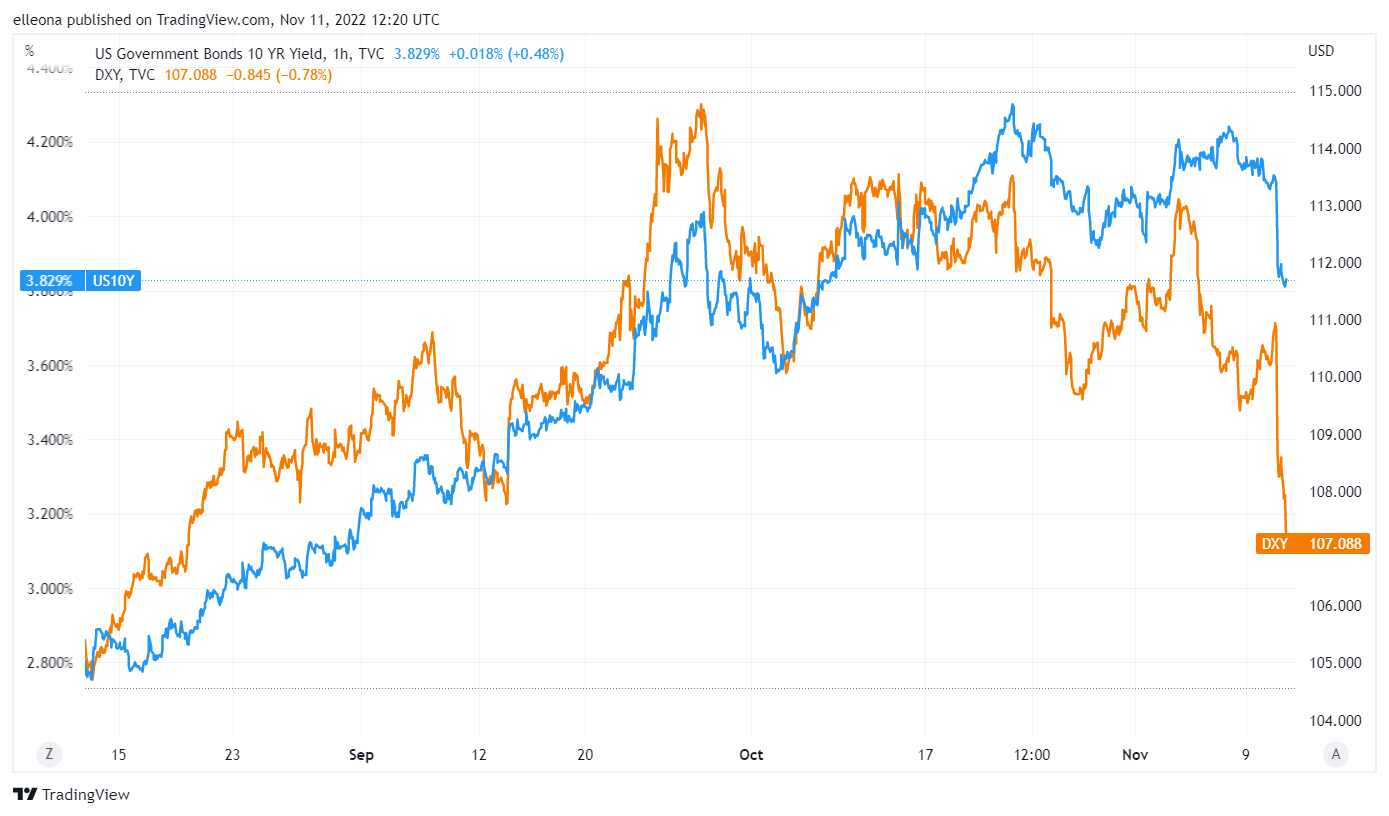

Treasuries enjoyed their best day since the pandemic, with the US 10-year yield dropping from 4.11% down to 3.83% in the space of two hours. The DXY dollar index tumbled the most in a decade to reach a three-month low as rate hike expectations adjusted downward.

(chart via TradingView)

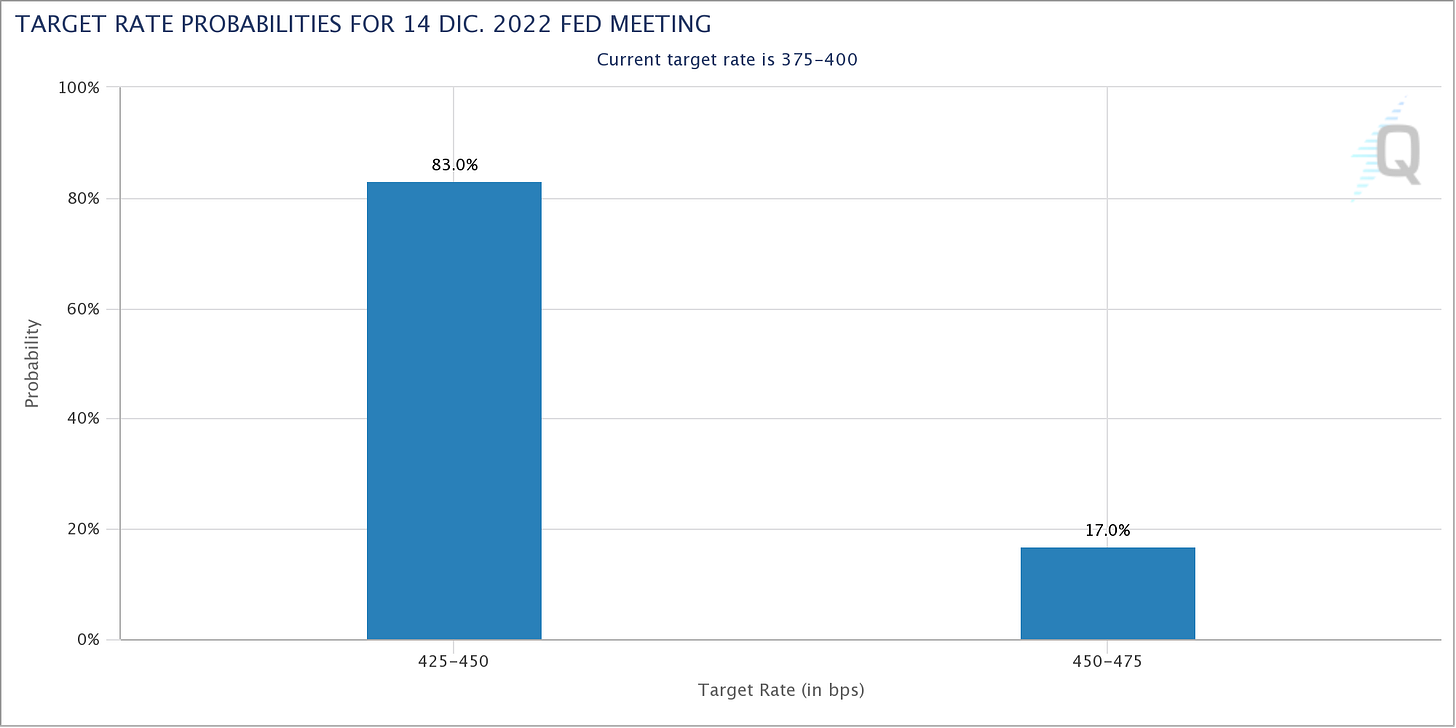

The CME FedWatch indicator now assigns an 85% probability to a 50bp hike in December and an almost 50% probability of a 25bp increase in February, approximately double that of just a week ago.

(chart via the CME FedWatch)

Fed officials expressed cautious optimism, with Dallas Fed President Lorie Logan saying it “may soon be appropriate to slow the pace of rate increases” – but Powell did stress in his last public speech that the central bank would need to see a consistent pattern of weakening price growth to consider pausing.

Even crypto prices, still bruised from the FTX revelations, recovered slightly, with BTC moving from a low of $15,650 to around $17,200, around which it has hovered since. ETH recovered to around $1,270 and has stayed anchored to that level.

Nerves in the crypto market are still high, however, as the FTX drama continues to unfold. BTC implied volatility, which had been stable at unusually low levels for the past few weeks, shot up earlier this week, although it has retraced slightly.

(chart via glassnode)

Details continue to emerge on what happened at FTX, effectively confirming the use of customer funds to support the trading company Alameda. The legal consequences of this have yet to become clear, as regulators move to mitigate the impact and initiate investigations. Over the past 24 hours:

FTX Japan has been ordered to suspend operations.

Cyprus is planning to suspend the license that allows FTX to operate in the EU.

Bahamian regulators have frozen the assets of FTX Digital Markets and related parties.

Australian entities FTX Australia and FTX Exchange have called in the administrators.

Sam Bankman-Fried is reportedly being investigated by the SEC (his firms FTX, FTX.US and Alameda Research are already under investigation).

FTX.US has warned of a trading halt in the coming days.

The entire team of FTX’s philanthropic arm Futures Fund has resigned, as has the head of institutional sales.

Bankman-Fried said that Alameda would be shut down.

The US Department of Justice has contacted crypto exchange Binance for information about its recent interactions with FTX.

The White House Press Secretary confirmed that the Biden administration is monitoring the situation.

Various US lawmakers, including the Chairs of the Senate Banking Committee and the House Financial Services Committee, have issued statements drawing a direct line between FTX and the lack of clear crypto regulation.

The next few weeks will see a tragic rhythm of announcements from firms impacted by the loss of funds, both direct from FTX actions and indirect from the damage to investor confidence. Over the past day:

Blockfi has suspended withdrawals

Mechanism Capital has funds stuck on FTX

So does the derivatives unit of Genesis Trading (my former employer)

And crypto lender Hodlnaut

NEWS

Trust in reserves? Stablecoin issuer Tether published its quarterly attestation of its reserves for September 30. This is particularly relevant to the current mood in that:

the attestations are only quarterly (which says nothing about the state of the reserves for 89 days out of every 90),

take almost a month and a half to compile and make public (as we have seen, the market can radically change in a short time-frame) and

trust is currently low – users (and probably regulators) could reasonably start to demand more transparency.

Solana sell pressure. On Tuesday, it looked as if a whopping 63 million SOL were in the queue to be unstaked at the end of epoch 370, scheduled for yesterday. The “normal” amount is an order of magnitude less, and concern over the selling pressure this represented pushed the price of SOL down 50% between Saturday and Wednesday. It turns out that 28.5 million of those in the queue belonged to the Solana Foundation which, in light of the market concern, decided to delay its unstaking. It’s not clear why the Foundation was unstaking quite so much – a tweet said something about a cloud service provider change, which raised more questions than it answered.

Also…

The Information published detail on FTX’s investments in (not just from) VC firms.

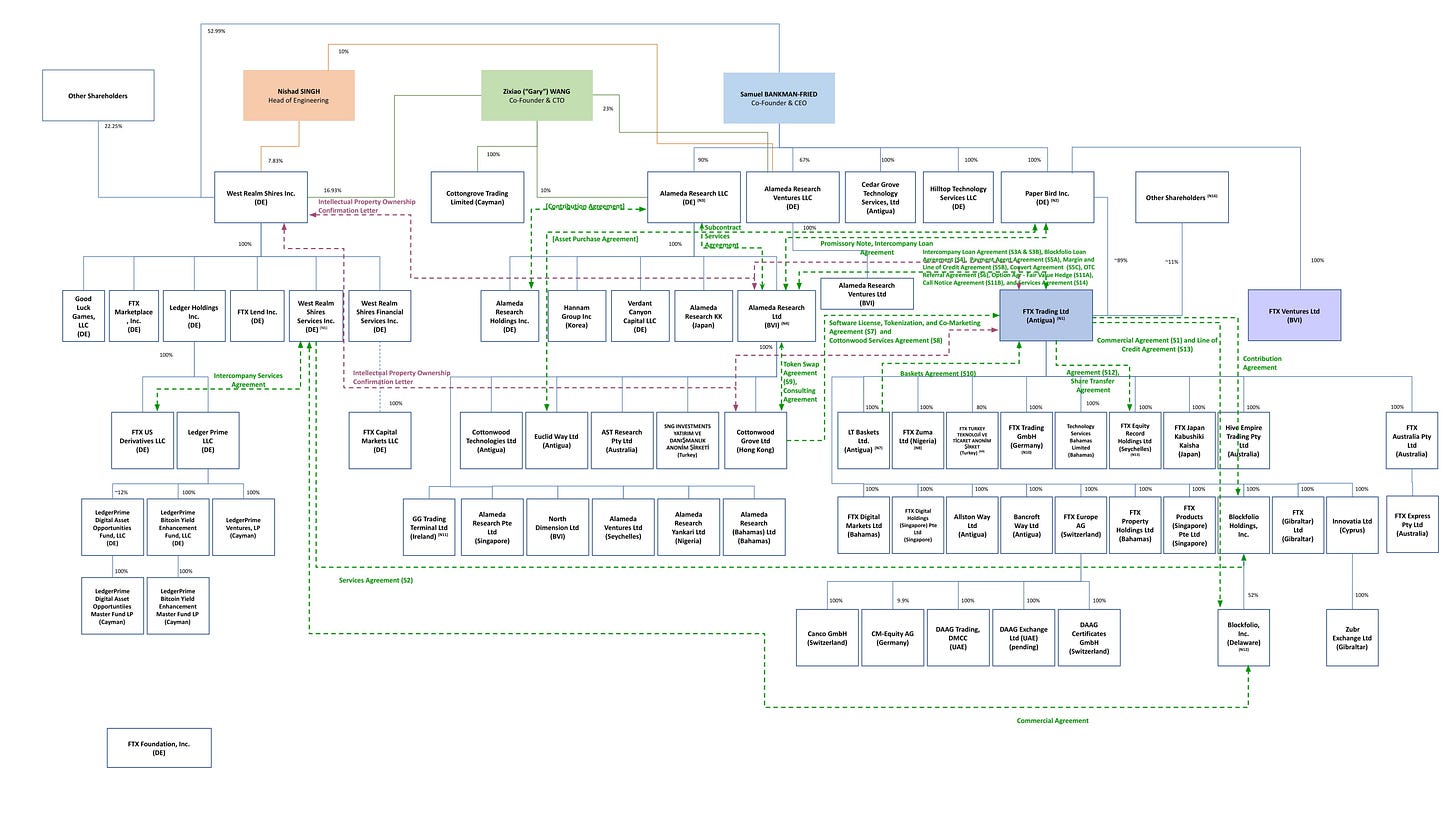

The team at FT Alphaville came up with a detailed and illuminating map of the FTX empire

(chart via FT Alphaville)

If you haven’t yet had your fill of FTX summaries and takes, this one from NYDIG’s Greg Cipolaro is excellent.

An interesting thread from @alex_bcg on market making mechanics which sheds light on the FTX-Alameda relationship.

And here’s Sam’s apology tweet thread.