Friday, Nov 18, 2022

“Success is not final, failure is not fatal: it is the courage to continue that counts.” – Winston Churchill ||

Hi everyone, and happy Friday! Yet another week I’m sure we’re all glad to see the back of. I hope you can find some time to reset this weekend – it’s rough out there and many are truly suffering, but we all need to do our best to take care of ourselves and each other. We have work to do.

You’re reading the premium Crypto is Macro Now email – if you’re new here, welcome! In this daily version I take a brief look at market moves and news that highlight the trends shaping the growing overlap between the crypto and macro landscapes. Nothing I say is investment advice! I hope you find this useful – if so, do share with friends and colleagues.

And if you arrived here from somewhere other than your inbox, I hope you consider subscribing.

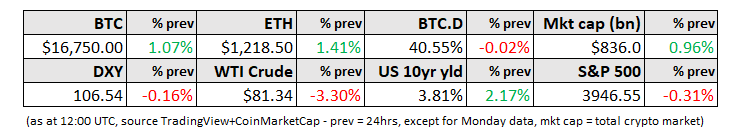

MARKETS

Why isn’t BTC dropping further?

The BTC market has held up better this week than many of us expected given the ominous rumours (some of which have so far turned out to be correct). Even Genesis’ announcement of withdrawal suspension did not seem to jolt price nerves that much. Perhaps the bad news was (is?) priced in, but that doesn’t feel convincing since liquidity is relatively thin which sets the stage for sharp moves on negative events. And after the sharp drop last week as the extent of FTX’s problems started to emerge, BTC has been relatively stable in spite of more damaging revelations, the declaration of bankruptcy and the potential depth of the contagion.

On the other hand, we could be looking at full capitulation here, and this is the floor. Perhaps price-setters are as pessimistic as they’re going to get (this would echo conversations I’ve been having this week with industry insiders) and more bad news could feel like just another drop in the ocean.

It could be that the market movers see this as the final leg of the Terra contagion rather than another set of blows that the industry has to absorb. Most of us have been instinctively waiting for the other “shoe” to drop – maybe this is it. And my dusty book of age-old mystical wisdom reminds me that bad things usually come in threes (Terra, 3AC and now FTX).

I’m not saying that we’re done with the bad news (I fervently hope that we are, but I still somehow doubt it), and there could be another drop ahead. Technical analysts are citing $13,000 as the next support level for BTC. But BTC didn’t head there in the wake of the Genesis announcement as I had expected, and it’s not clear now what would send it there. What could top FTX for bad news? (My inner superstitions are screaming at me to not even ask that!)

Ok, there are some developments that would be really bad. A potential dissolution of Grayscale’s GBTC is one, but this feels unlikely given the political ramifications. Full miner capitulation is another, but this feels even more unlikely given glimmers of relief seen this week with Arkon Energy closing a funding round, Bitfarms paying down debt and Applied Digital securing a loan for expansion.

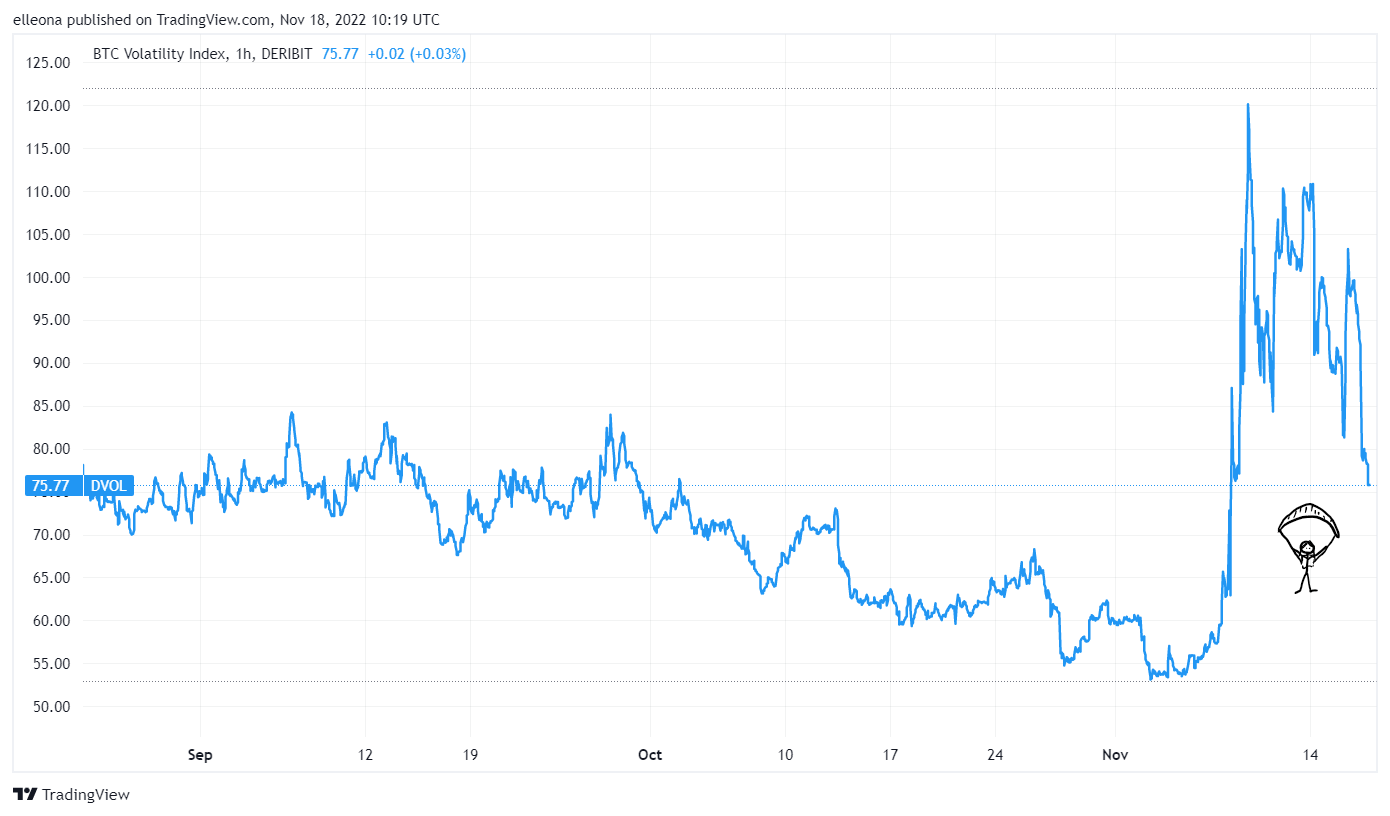

Some data points are pointing to a generalized “meh”, which is necessary to consolidate a floor. The DVOL index, which tracks BTC’s implied volatility, understandably shot up from unusually low levels, but has since drifted lower into September’s range.

(chart via TradingView)

The MVRV Z-score, which detects momentum shifts in the difference between BTC’s market value and the average acquisition cost, has already lasted longer in the “green zone” (value < 1.0, signalling undervaluation) than the 2018 bear market, although only by a couple of weeks.

(chart via glassnode)

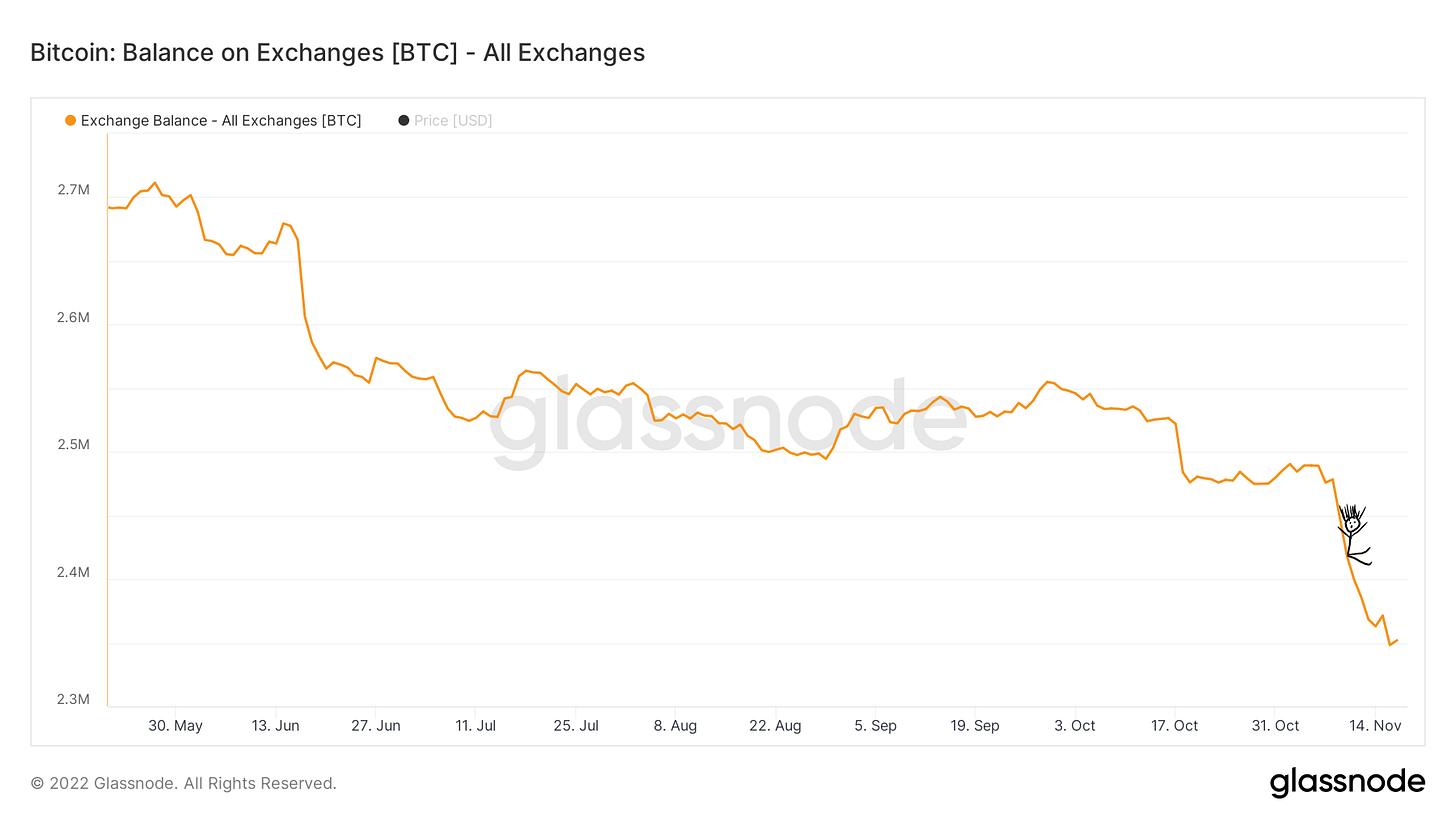

And while some long-term holdings are moving, holding behaviour is still strong. A record 67% of BTC has not moved in over a year. And the outflow of BTC from exchanges hints at further determination to hold as users move to self-custody. This metric can be misleading as not all exchange addresses are correctly labelled, and some BTC could be going to decentralized exchanges for trading – but the trend here is unusually clear

(chart via glassnode)

Markets are still confused

In contrast to Target’s disappointment on Tuesday, yesterday saw other key retailers such as Macy’s report better-than-expected earnings, giving some respite to a stock market showing signs of concern about a looming recession. St. Louis Federal Reserve President James Bullard did his best to dampen investing spirits to reiterate the message of the week: rate increases are far from over.

Part of the Fed’s frustration must stem from the market’s conflation of “lower increases” with “pivot”. They are not the same, and the former does not necessarily precede the latter. It is likely that we will see a slow-down in the pace of rate hikes. CME futures are pointing to an 80% probability of a 50bp rise in December (slightly less confident than earlier in the week, but still confident) and an almost 50% probability of a 25bp hike in January. This comes after four 75bp hikes. A good sign, no doubt, but if inflation remains stubborn and the economy resilient, we could see another escalation.

(chart via CME FedWatch)

While this is unlikely given the weakening economic outlook for next year (Bloomberg Economics now puts the probability of a recession in the US in 2023 at 100%), we can’t assume that hikes of less than 75bp is a “pivot”. It feels like a case of not noticing the boiling water we’re swimming in – 50bp is still a lot, and yet we are acting as if it means risk-on again. Have we gotten so used to 75bp that anything less is cause for celebration?

NEWS

Newcomers. The Sui Network, a new layer-1 blockchain developed by former Meta engineers, has launched a testnet to trial functionality and develop its community. I’m not yet fully up to speed on how this differs from the new Aptos layer-1 (or from much older networks, for that matter), but I’m intrigued by the continual evolution of blockchain technology and I welcome the reminder that market turmoil is just one part of what the industry is about these days.

Stablecoin halts. Binance and OKX have halted deposits of USDC and USDT on Solana, following a similar move by Crypto.com last week, although it seems that Binance has since resumed deposits for USDT on Solana. It is not yet clear why, as the Solana network is bruised by the FTX fallout but is still functioning as far as I know. It could be something going on under the hood with Solana that we have not yet heard about, or it could be part of what looks like a ramp-up in the stablecoin wars.

A new stablecoin. Speaking of which, a new stablecoin will join the stable (ha) next year when Cardano launches USDA, the first US dollar-backed, “regulatory compliant” stablecoin on the Cardano network. I put “regulatory compliant” in qualifiers because I’m not sure what exactly that means. I bet a whole lot of regulators aren’t, either.

Also:

I’ll go out on a limb here and say that I don’t think any bankruptcy statement has ever made such riveting reading as FTX’s. Written by the new CEO John Ray III, the tone is professional and yet somehow manages to ooze incredulity and astonishment. There are some great highlights here, and you can peruse the whole thing here.

You know how sometimes unjust criticism can motivate us to double our efforts? In that spirit I share this op-ed in the Financial Times, with the caveat of a health warning for those already dealing with too much anger. The authors do make some valid points (regulation confers legitimacy, finance is about trust, banks lending against crypto as collateral is not risk-free), but many others and the conclusion… well, have at ‘em. And then let’s get back to work.