Friday, Oct 20, 2023

beware the steepening, regulatory capture?, leading indicators and more

“There is a crack in everything, it’s how the light gets in.” – Leonard Cohen ||

Hello everyone! I hope you’re all doing ok, and that you’re going to be able to take a mental health break this weekend. It’s worth sparing a thought for all those who won’t be able to. But tense times are draining, and we need to take care of our energy levels.

You’re reading the daily premium Crypto is Macro Now newsletter, where I look at the growing overlap between the crypto and macro landscapes. There’s also usually some market commentary, but NOTHING I say is investment advice. For full disclosure, I have held the same long positions in BTC and ETH for years, and have no intention to either buy more or sell in the near future.

If you’re not a subscriber, I do hope you’ll consider becoming one! It would help enable me to continue to share what I learn as I work on figuring out where we’re going. It’s only $8/month for now, with a free trial.

And if you find this newsletter useful, would you mind hitting the ❤ button at the bottom? I’m told it boosts the distribution algorithm.

Also, I’m now host of the CoinDesk Markets Daily podcast – you can check that out here.

Programming note: I won’t be able to publish the daily newsletter on Monday, Oct 23 - but back in your inboxes on Tuesday!

IN THIS NEWSLETTER:

Beware that yield curve steepening

Is any regulation better than no regulation?

We do not want to go where the Leading Index is leading

“Sustainable” loses its glitter

WHAT I’M WATCHING:

Beware that yield curve steepening

A few days ago, I wrote about the term premium. This is the additional yield assigned to longer-term bonds, as compensation for the risk of locking up funds for a greater amount of time.

There are several ways of measuring this, but all seem to agree that it is climbing. What’s more, it is not climbing because of higher interest rate expectations. Rather, it’s risk perception and supply/demand imbalance that is changing the relationship between longer-term and shorter-term yields.

This was reinforced yesterday by Fed Chair Jerome Powell’s comments at the Economic Club of New York, which acknowledged that the bond market is inflicting enough pain via yields for the Fed to take a pause. This led to the US 2-year yield pulling back from over 5.25% to below 5.15%, while the 10-year yield continued to climb.

Why it matters:

This is especially relevant now because the bump in longer-term yields relative to short-term ones is de-inverting the yield curve.

This is significant for several reasons.

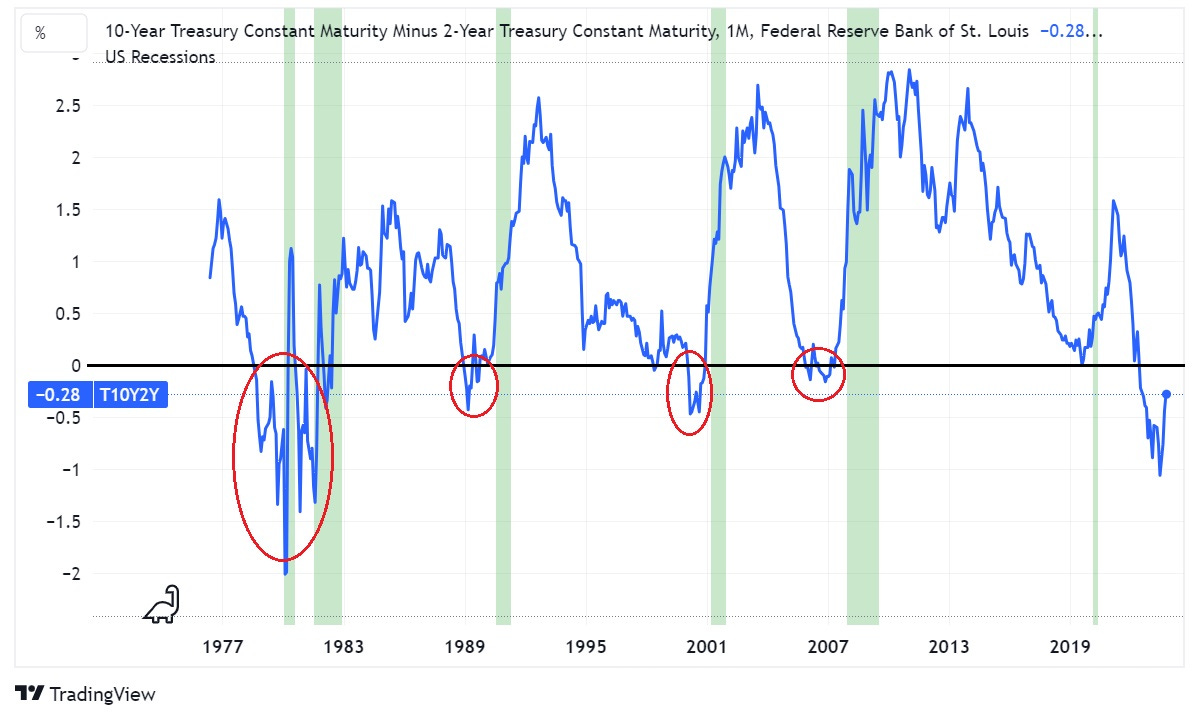

One is that an inverted yield curve (defined here as the 2-year treasury yield being greater than the 10-year treasury yield) has historically always been a signal of a pending recession, with a lag of between 15-19 months. The yield curve first inverted 16 months ago.

(chart via TradingView)

As an aside, at one stage the inversion reached its deepest level since 1981. Probably nothing.

Another reason this is the signal the steepening (as opposed to the inversion) sends. Historically, when the yield curve de-inverts, the stock market plummets.