SWIFT and tokenized settlement

plus, jobs day, and Visa's onchain cash

“It is what you read when you don't have to that determines what you will be when you can't help it.” – Oscar Wilde ||

Hi everyone, and happy Friday! Also, happy “jobs day” to all the macro watchers out there, as we get the US official payroll and unemployment data at 8:30amET.

For a change (!!), this newsletter will be going out before then as I have a schedule squeeze. That’s also why it’s a bit shorter than usual (you’re welcome!).

Below, I also talk about two huge financial firms building large-scale blockchain services: you don’t get much bigger than SWIFT and Visa.

IN THIS NEWSLETTER:

Jobs day!

SWIFT and tokenized settlement

Visa and onchain cash

If you’re not a premium subscriber, I hope you’ll consider becoming one! It’s the price of a couple of New York coffees a month, and you get ~daily commentary on how macro moods are influencing crypto markets, and also on how crypto is impacting the macro economy.

WHAT I’M WATCHING:

Jobs day!

Yes, the US employment data out later today is important. Yes, it will trigger a bout of market volatility. No, it won’t affect the Fed’s cautious stance.

Now that US macro focus has well and truly pivoted from inflation reads to jobs numbers, the macro event of each month is the official release of the Bureau of Labor Statistics data, which details the evolution of both employment and unemployment trends.

Last month, unemployment ticked down from 4.3% to 4.2%, while payrolls increased by 142,000. The growth was less than the expected 164,000, but it was up from July’s downwardly revised 89,000. In other words, the US labour market is not collapsing.

This month, unemployment is expected to hold steady at 4.2%, with non-farm payroll growth accelerating slightly to 150,000.

What’s more, recent unemployment insurance claims have showed an easing, with Thursday’s read of the initial claims four-week moving average slipping to the lowest since early June. And Wednesday’s private ADP nonfarm payrolls grew by 143,000, notably higher than the consensus forecast of 124,000, and than August’s 103,000.

(chart via Bloomberg)

Also, job openings climbed to a three-month high. This metric is noisy as job openings are easy to post and often “just in case”, but they’re not signalling panic.

There are signs of weakness: for instance, the three-month moving average of ADP growth eased to 119,000, the lowest since 2020.

Job hiring dropped to the lowest rate since 2013.

(chart via Bloomberg)

Reported job cuts for September, out yesterday, were 54% higher than the same period last year.

And the Institute of Supply Management report out this week showed a steeper-than-expected contraction in the manufacturing sector, with the lowest share of companies reporting rising employment since 2020.

(chart via Bloomberg)

So, there’s some softening, but not enough to encourage the Federal Reserve to do another 50bp cut at the next meeting. In Powell’s comments on Monday, he yet again stressed that the central bank was not in a hurry, and that rates would come down “over time”.

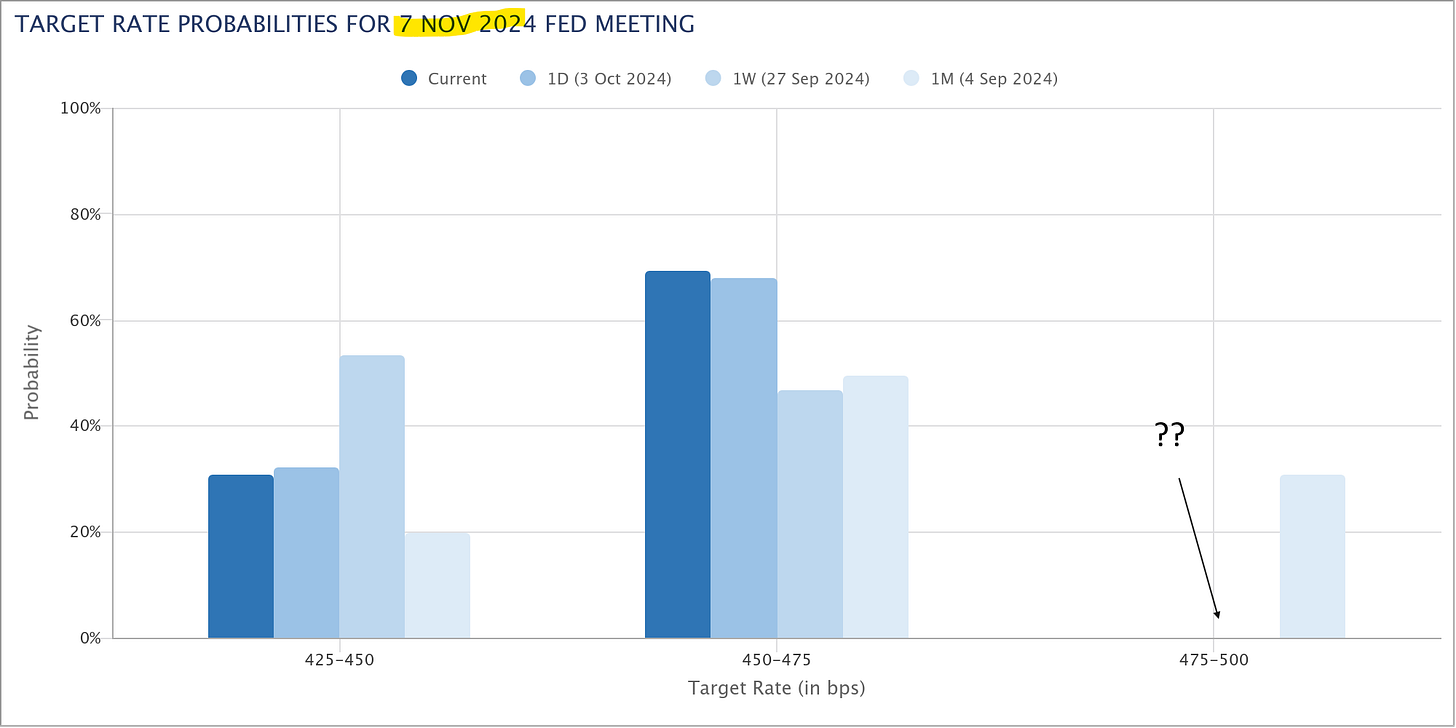

This has brought down the CME-priced odds of a double cut in November to around 30%, from over 50% last week. But absolutely no-one thinks the Fed will hold in November, despite the mixed data and despite what the Chair is saying.

(chart via CME FedWatch)

And odds of a 75bp cut by the end of the year are around 54%, which still feels way too overpriced. (“Optimistic” doesn’t feel like the right word, since that speed of reductions would only happen if the Fed was spooked about the economy.)

Could the November rates expectation adjustment be behind the poor start to the month for BTC? Are we seeing its liquidity sensitivity in play? If so, how much disappointment is already priced in?

(chart via TradingView)

The answers to the above questions are probably, yes and I’m not sure but I think most of it.

If we get some employment disappointment later today, there could be a BTC rally – but it may be short-lived as there’s most likely more rate expectations adjustment ahead.

As usual, however, liquidity expectations are only a key driver on a short-term horizon. Longer-term investors are looking at BTC’s “hedge” qualities: a non-jurisdictional asset with a hard supply cap that is liquid and portable.

Gold’s climb this year reflects hedge interest from large institutions and small savers – its history and simplicity make it easy to understand, and relatively straightforward to acquire and store. BTC represents the same characteristics, but with a lower price entry point for those wanting to self-custody (BTC can be fractionalized, a bar of bullion not so much), and with 24/7 trading hours.

Plus, we can’t overlook the appeal of getting a foothold in crypto assets for governments hoping to boost their digital economies and to attract innovative startups.

I’ll have plenty more to say on the differences between Bitcoin and gold in coming weeks: for now, BTC could be choppy according to the fickle macro mood, but the longer-term tailwinds continue to build.

SWIFT and tokenized settlement

A couple of weeks ago, I wrote about SWIFT’s goal of becoming a tokenized securities settlement network. This is moving forward, with the confirmation yesterday that the network will support live bank digital asset pilots starting in 2025.

In this case, “support” means handle the messaging needed to coordinate delivery-versus-payment (DvP) transactions, which is orders of magnitude more complicated than what SWIFT does now.