Friday, Sept 30, 2022

“The silly question is the first intimation of some totally new development.” – Alfred North Whitehead ||

Greetings from Kingston-on-Thames, where my family is gathering to celebrate my father’s 91st birthday. The vibe here is a bit tense, with the UK still reeling from the week’s market moves, and national train strikes set to disrupt weekend plans. Some are suggesting that the best investment for Brits at the moment is sweaters and thick blankets. No matter how bleak things may look, however, we all know there are always things worth celebrating, and hitting the age of 91 in full physical health is definitely one of them.

This is the Friday edition of the daily premium Crypto is Macro Now newsletter. If you find any of this useful, please consider sharing!

Best,

Noelle

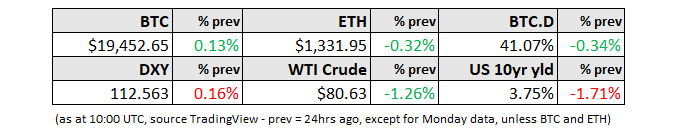

MARKETS

According to The Block Data, the trading volume of BTC on exchanges has pulled even further ahead of that for ETH.

Deribit’s BTC DVol index – which measures the forward expectation of annualized volatility based on BTC options pricing – has been increasing for the past few days and is close to its peak for the month. The DVol index for ETH, on the other hand, is climbing slightly, but is nowhere near its 1-month peak. This hints that some sort of momentum is building in the bitcoin market.

Yesterday I shared a chart that showed that the put/call ratio for BTC was increasing, which on the surface points to a build-up of bearish sentiment – but put options are often used to hedge long spot positions, which hints that the increased spot activity on BTC could be accumulation.

Meanwhile, the BTC/ETH ratio is holding steady after a few weeks of climbing, which suggests that, for now, the prices are moving in tandem.

One potential catalyst for the uptick in interest in BTC could be the continued strength of the USD combined with intensifying turmoil in currency markets globally. As I’ve mentioned before, BTC and the USD tend to be inversely correlated. And as John Authers points out in his excellent Bloomberg column today, an index that tracks the inflation-adjusted value of the dollar is now at its highest level since inception in 1989, not long after the 1985 Plaza Accord in which the finance ministers and central banks of the world’s leading economies at the time planned a coordinated intervention to weaken the dollar.

(Chart via Bloomberg)

Authers suggests that markets are starting to think wistfully of that agreement, and the pickup in BTC activity could be some investors positioning for a similar round of intervention. That is probably still a way off - but it’s hard to deny that the currency markets are flashing worrying signals.

NEWS

Crypto exchange Bittrex, custodian BitGo and six other firms have joined the Crypto Market Integrity Coalition (CMIC), joining Coinbase, Bitpanda, Gemini, Circle, Solidus, Chainalysis and 24 other firms in a commitment to furthering market transparency and good conduct. There´s always been an overhanging question as to how much the crypto industry can police itself. However, while the coalition is not technically an SRO (private self-regulated organizations with some degree of government oversight – some examples are FINRA, the Chicago Board of Trade and the New York Stock Exchange), it could consolidate policy channels of communication and reinforce regulators’ trust in market participants’ intentions and willingness to work within established standards.

After months of testing, NFT functionality has gone live on Instagram – US-based users can connect wallets from Coinbase, Dapper Labs, MetaMask, Rainbow and Trust, and can crosspost their NFTs to their Facebook accounts. Although this potentially reaches over 159 million people (the number of Instagram users in the US, according to Statista), it is unlikely to have much of an impact on today’s lackluster NFT market, at least to start with (although a Crypto Punk did sell earlier this week for over $4.4 million – we can consider that an anomaly, though). Nevertheless, it is a small step in the march towards mainstream acceptance. Even if the final use case of NFTs has yet to take form, greater engagement and experimentation is good for innovation and also funding, especially given the weaker market’s absence of hype.

(I use Bitcoin with uppercase for the network, BTC or bitcoin with lowercase for the asset. It looks confusing, I know.)