Geopolitics rattles markets

plus: the week ahead, tariffs, riots and more

“The only organization capable of unprejudiced growth, or unguided learning, is a network.” – Kevin Kelly ||

Hello everyone, and welcome to June! So much for a nice quiet start to the month… 😕

So much has happened in the crypto/macro overlap over the past few days that I won’t be able to fit everything that’s grabbing my attention into even a longer-than-usual newsletter – more filling in gaps tomorrow (OPEC+, staking, Pakistan, China, stablecoin use and a lot else).

IN THIS NEWSLETTER:

Coming up: trade talks, jobs data, an election and more

Poland’s sharp shift

Sabre-rattling with teeth

What the new face of warfare means for trade

Macro-Crypto Bits: tariffs, markets and riots

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Coming up:

This week both houses of Congress return from their recess to pick up deliberations on the “Big Beautiful Bill” and the stablecoin legislation.

Delegations from Ukraine and Russia are in Istanbul for the second round of face-to-face peace talks. See below why expectations are not high for any progress.

And White House economic adviser Kevin Hassett said yesterday that he expected a call between President Trump and Chinese leader Xi Jinping this week – but, we’ve heard this before.

Today, we get the S&P Global and ISM indicators of US manufacturing activity, as well as construction spending.

Tomorrow, we get the latest report on US job openings (JOLTS), factory orders and durable goods.

Also tomorrow, South Korea goes to the polls. Both candidates have promised a supportive crypto framework, in what is already one of the most crypto-enthusiastic countries in the world in terms of percentage of population involved (and where in December crypto trading volumes exceeded those of stocks).

Wednesday brings more US jobs data in the form of the private ADP payrolls report. We also get the S&P Global and ISM US services activity indices, and the latest Federal Reserve Beige Book which takes the temperature of on-the-ground business sentiment.

On Thursday, we get Challenger job cuts and the US trade balance.

Also on Thursday, Germany’s new chancellor Friedrich Merz will meet with President Trump in Washington. I wonder what they’ll talk about.

And expectations are building for another visit to the US at the end of the week for trade talks from Japan’s chief negotiator Ryosei Akazawa.

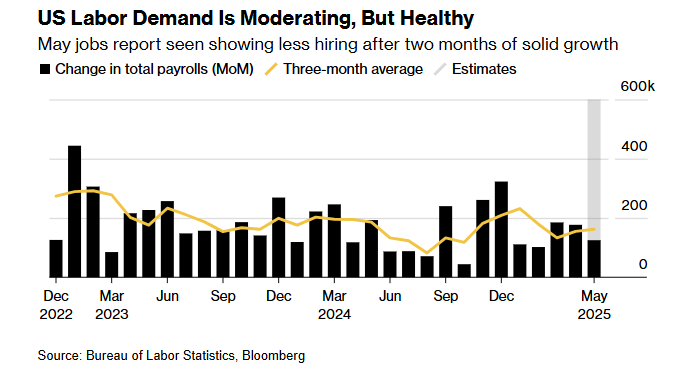

On Friday, we get the big event: official US employment data. Expectations point to a softening in job creation from 177,000 in April to around 125,000 in May, with the unemployment rate holding steady at 4.2%.

(chart via Bloomberg)

Poland’s sharp shift

With the votes counted, Poland’s presidential election was won by nationalist candidate Karol Nawrocki by the slimmest of margins: 50.9%. It’s hard to overstate how much of a shock this is to European political observers as, just a month ago, Nawrocki was trailing with 25% support, and Polymarket betting contracts had his odds of a win at around 20% even the morning of the polls.