Glimmers of institutional momentum

plus, custody competition

“A dead thing can go with the stream, but only a living thing can go against it.” – G. K. Chesterton ||

Hi everyone! I hope you’re all doing well.

This is a short (and late, sorry!) email as I have a senior pup who is not doing very well, and the relatively little time I have been able to spend at my desk today, I’m sure you can probably appreciate it’s a bit harder than usual to concentrate. He seems to be a bit better now, here’s hoping.

Below, I update on institutional crypto activity, both via interesting moves revealed in SEC filings and signs of new big-name custody players.

IN THIS NEWSLETTER:

Glimmers of institutional momentum

Custody competition

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as audio, relevant links and music recommendations ‘cos why not.

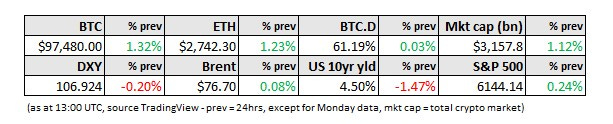

WHAT I’M WATCHING:

Glimmers of institutional momentum

Crypto chatter has been crowing that “the institutions are coming!” for almost eight years now. Back in the day, I would get into debates with colleagues about whether this was good or bad, with me arguing for the former – it seemed obvious to me that, while crypto for sure didn’t “need” the institutions to function just fine, it would benefit from the strong inflows of funding for both projects and asset accumulation. It could also be strengthened by the validation and “protection” institutional involvement should confer on the nascent sector in the face of any regulatory resentment.

In 2020, we started to get some signs that this was more than just an exercise in logic as Paul Tudor Jones, Stanley Druckenmiller and other investing greats disclosed positions. We heard of big-name banks exploring crypto services. Traditional market infrastructure companies were talking to clients about their crypto interest.

But even then, these notices and anecdotes were outliers – they fed narratives, they no doubt accounted for part of the price-driving inflows, but they did not represent the bulk of the fund management industry. And then Terra and FTX happened, and things went painfully quiet for a while.

Today, we now have large crypto ETFs, a pro-crypto Administration is in charge, banks are brushing up their digital asset credentials, and markets are more sophisticated.

That said, we’re still early, we’re still at the edge of institutional involvement.

Although there are signs that go beyond promises and anecdotes that this is starting to change.

For instance, the recent spate of 13F reports show that interest is picking up.