Global crypto adoption: some surprising moves

also, IBIT options sentiment signals, and some risks in tokenization

“The great enemy of the truth is very often not the lie, deliberate, contrived and dishonest, but the myth, persistent, persuasive and unrealistic.” – John F. Kennedy ||

Hi everyone, I hope you’re all doing well!

I don’t want to freak anyone out, but there are only 41 days left of 2024. That’s… not a lot, and I for one do not yet feel ready for 2025.

Unless there’s a last-minute change, later today I’m on Maggie Lake’s Talking Markets show, which streams live at 4:00pmET – you should be able to see that here.

Today, I take a break from market commentary and share some highlights from the latest Chainalysis Global Crypto Adoption report. I tried to keep it brief, but there are sooooo many interesting takeaways.

I also update on the sentiment signals from the first day of IBIT options trading. And, a nerdy look at some tokenization risks.

IN THIS NEWSLETTER:

Global crypto adoption: some surprising moves

An update on the BTC spot ETF options launch

The risks of tokenization, according to the BIS

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as audio, relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Global crypto adoption: some surprising moves

After having the tab open on my computer for days, I finally had a moment to dive into Chainalysis’ Global Crypto Adoption report. This annual publication paints a picture of how various regions are doing in crypto asset activity, even breaking it down into types of services and assets. It’s a long report and here I’m only going to be able to share some high-level points that caught my eye – no doubt I’ll have plenty of reasons to revisit the charts and data as new regional narratives emerge in coming weeks. The whole document is worth a look if you want more detail.

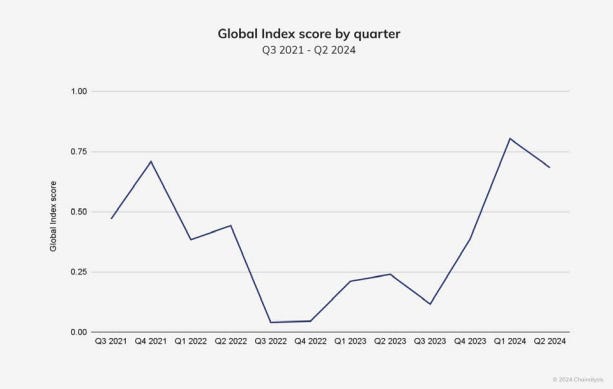

The main feature is a ranking of countries according to their use of different types of crypto asset services. The methodology is complex, and involves collating web traffic data in 151 countries, ranking the statistics, weighting the results by population size and purchasing power, and then normalizing on a scale of 0-1 to produce a more homogeneous measure. This is done for four sub-indices to reflect centralized exchange and DeFi activity, both overall and focusing on retail, with a geometric mean producing an overall rank.

Of course, using web traffic to estimate transaction volumes is at best a proxy, and is only tenuously relevant for DeFi activity, much of which doesn’t go through websites. Nevertheless, the annual findings do sketch geographical activity trends.

And the trend is up, with overall activity even higher than during the bull market of 2021.

(chart via Chainalysis)