Good grief, Charlie Brown

Plus: crypto power, market moves, macro data, and more

“The electric light did not come from the continuous improvement of candles.” – Oren Harari ||

Hi everyone! I hope you’re all taking care of yourselves because, holy cow, this week has more than its fair share of drama…

Programming note: It’s a US holiday on Monday, and while I’m not in the US, most of my readers are – so, I’m going to take advantage of the lower traffic, skip publication and use the time to catch up on my many half-finished pieces.

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

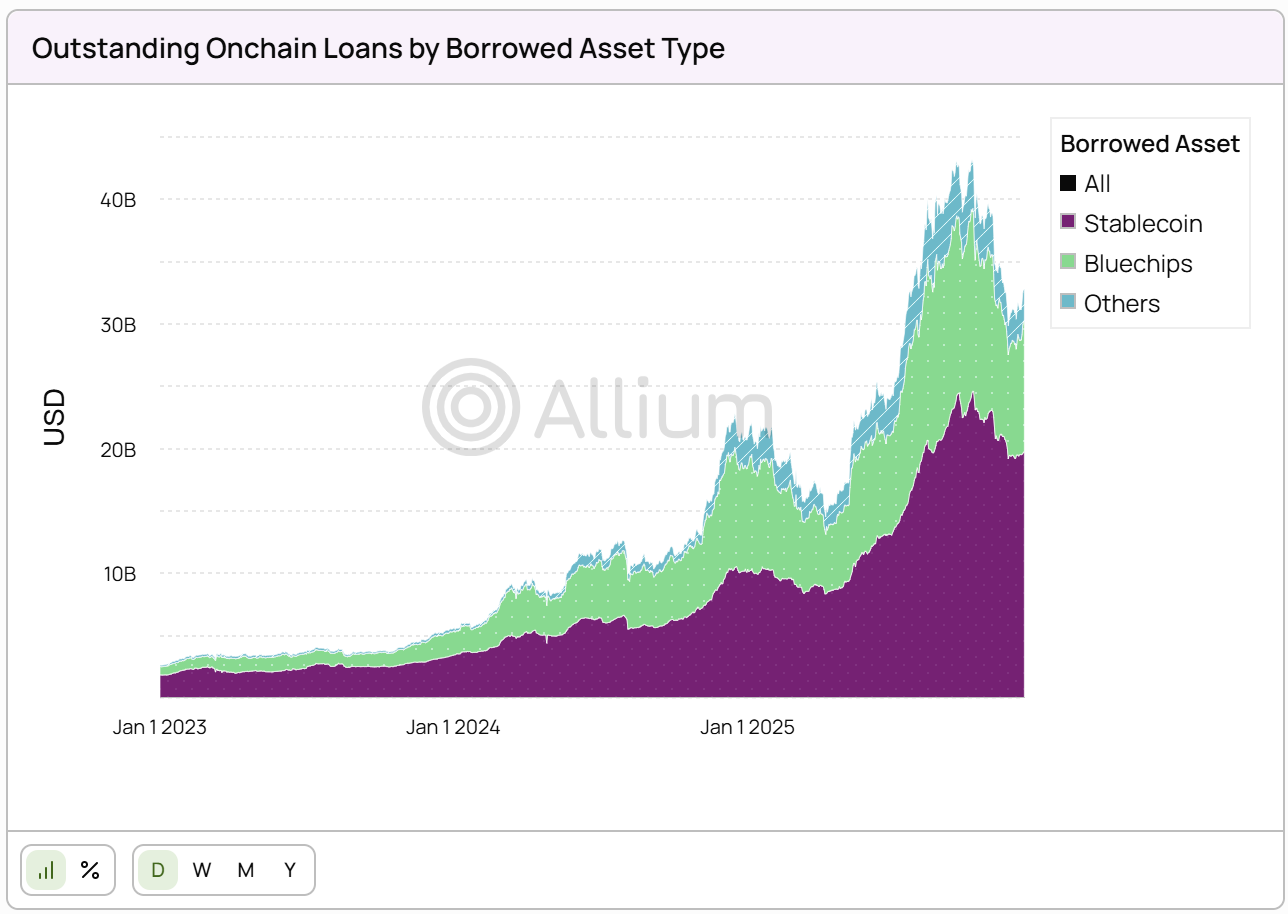

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Good grief, Charlie Brown

Where power lies

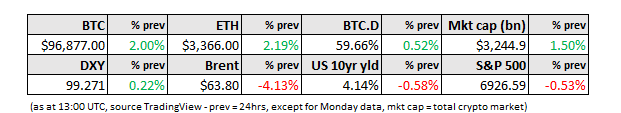

Markets: woven threads

Macro: US retail sales

Macro: US wholesale inflation

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

❤ If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

Good grief, Charlie Brown

After weeks of excitement build-up and yesterday’s frenzy of document parsing, we got the jug-of-cold-water news that the Senate Banking Committee markup of the CLARITY Act crypto framework, originally scheduled for today, has been postponed.

The story behind the stunning announcement last night is that at the figurative 11th hour, Coinbase announced that it would not support the bill in its current version and was “walking away”.

If you’re wondering why this is so significant, since Coinbase is not a regulator, you’re not alone. You’re probably also not American. The close relationship in the US market between regulators and business owners is not replicated elsewhere, especially over here in Europe where few lawmakers have ever worked in business and entrepreneurs are often treated as a threat.

In the US, the support of the crypto industry for a crypto bill is seen as essential, and while most big names came out in support of the draft – Circle, Kraken, Ripple, a16z as well several key advocacy groups – the largest of them all didn’t, saying it would “rather have no bill than a bad bill”.

It’s understandable: once a bill is passed, it’s law. Undoing it would be a colossal effort generally only reserved for times of distress. And there are many worrying restrictions and gaps in the draft. Despite this, the general acceptance was based on “not great but better than nothing and we can work with this”.

But Coinbase has some red lines. According to CEO Brian Armstrong, the text included: