Hong Kong’s stablecoin geopolitics

plus: market narratives, factory output and more

“The street finds its own uses for things.” – William Gibson ||

Hello everyone! I hope you’re all doing well, and remembering to touch grass when you can. The past few months have been exhausting for pretty much everyone, you deserve a break.

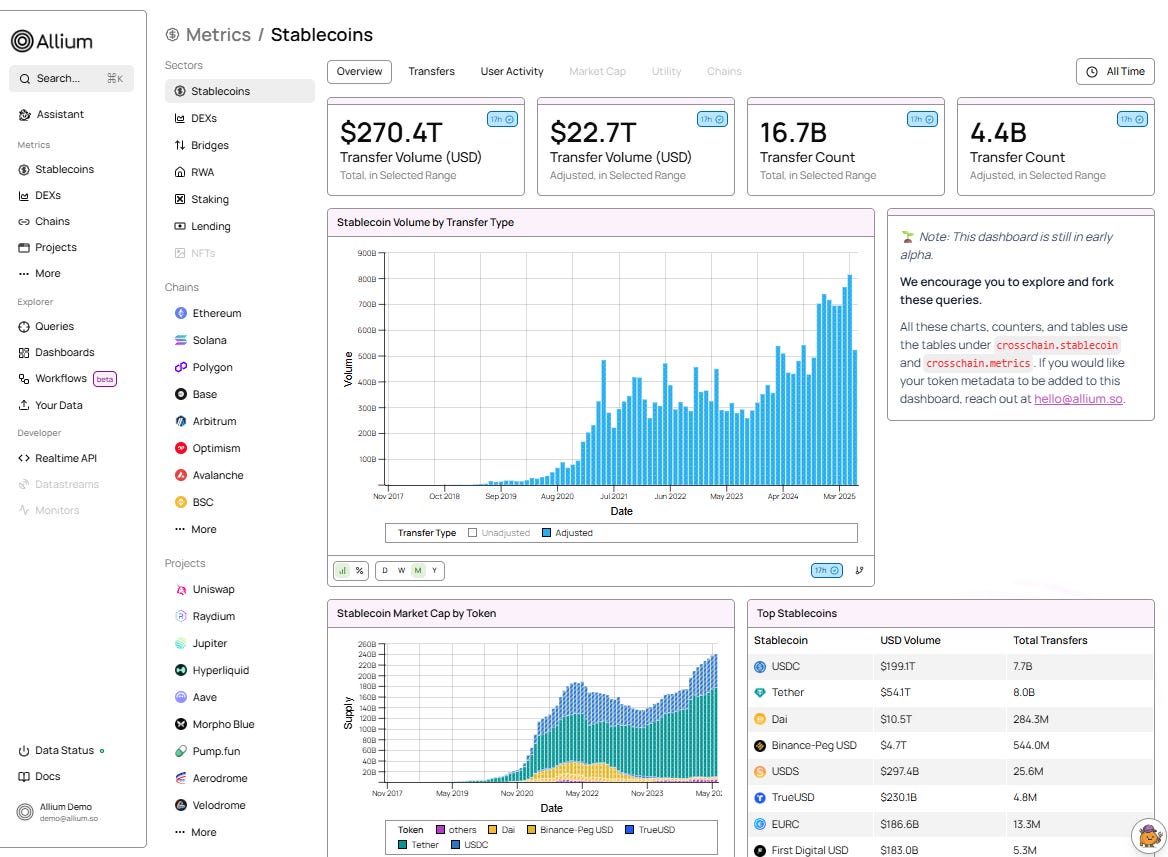

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Hong Kong’s stablecoin geopolitics

Macro-Crypto Bits: market narratives, factory output and more

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Hong Kong’s stablecoin geopolitics

On Friday, global stablecoins took a step forward. I’m not talking about developments in the US, although there’s plenty of progress there. Rather, I’m looking at the other side of the Pacific, where Hong Kong has joined the small set of jurisdictions with active stablecoin frameworks.

A month ago, I wrote about South Korea’s stablecoin frenzy, with share prices of contingent listed businesses soaring amid probably misplaced expectations of usage windfalls. Hong Kong has seen similar levels of froth, prompting two official warnings about bubbles over the past month from Hong Kong Monetary Authority (HKMA) CEO Eddie Yue Wai-man. For instance, ZhongAn Online P&C Insurance surged 80% over the past three months due to a subsidiary’s 8.7% stake in HKMA sandbox participant RD Technologies. LianLian DigiTech, RD’s partner, was also up 80% in the same period.

(ZhongAn Online P&C Insurance stock price on HKEX, chart via TradingView)

Last week, Yue tried to walk back expectations, explaining that there will be very few stablecoin licences granted and probably only to those who have participated in the sandbox. That’s a small subset of three: 1) a consortium including Standard Chartered, blockchain property rights innovator/investor Animoca Brands, and HK Telecom; 2) Jingdong Coinlink (a subsidiary of China’s ecommerce giant) and 3) as mentioned above, Hong Kong-based stablecoin issuer RD Innotech. And the first licenses probably won’t come until early next year.

Hong Kong does have history of going slowly with crypto-related authorizations. Its crypto asset framework went into effect in June 2023, and more than two years later, only 11 licenses have been issued, although as of earlier this month, it was reportedly processing nine more.

Yet there’s more at stake with this new license category in terms of geopolitics: mainland China is getting increasingly interested in stablecoins backed by the offshore yuan.