Identity, Japan, markets, sentiment and more

plus: what's coming up this week

“The goal of forecasting is not to predict the future but to tell you what you need to know to take meaningful action in the present.” – Paul Saffo ||

Hi everyone! I hope you all had a good weekend and took some quality time away from your screens. Another week begins…

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

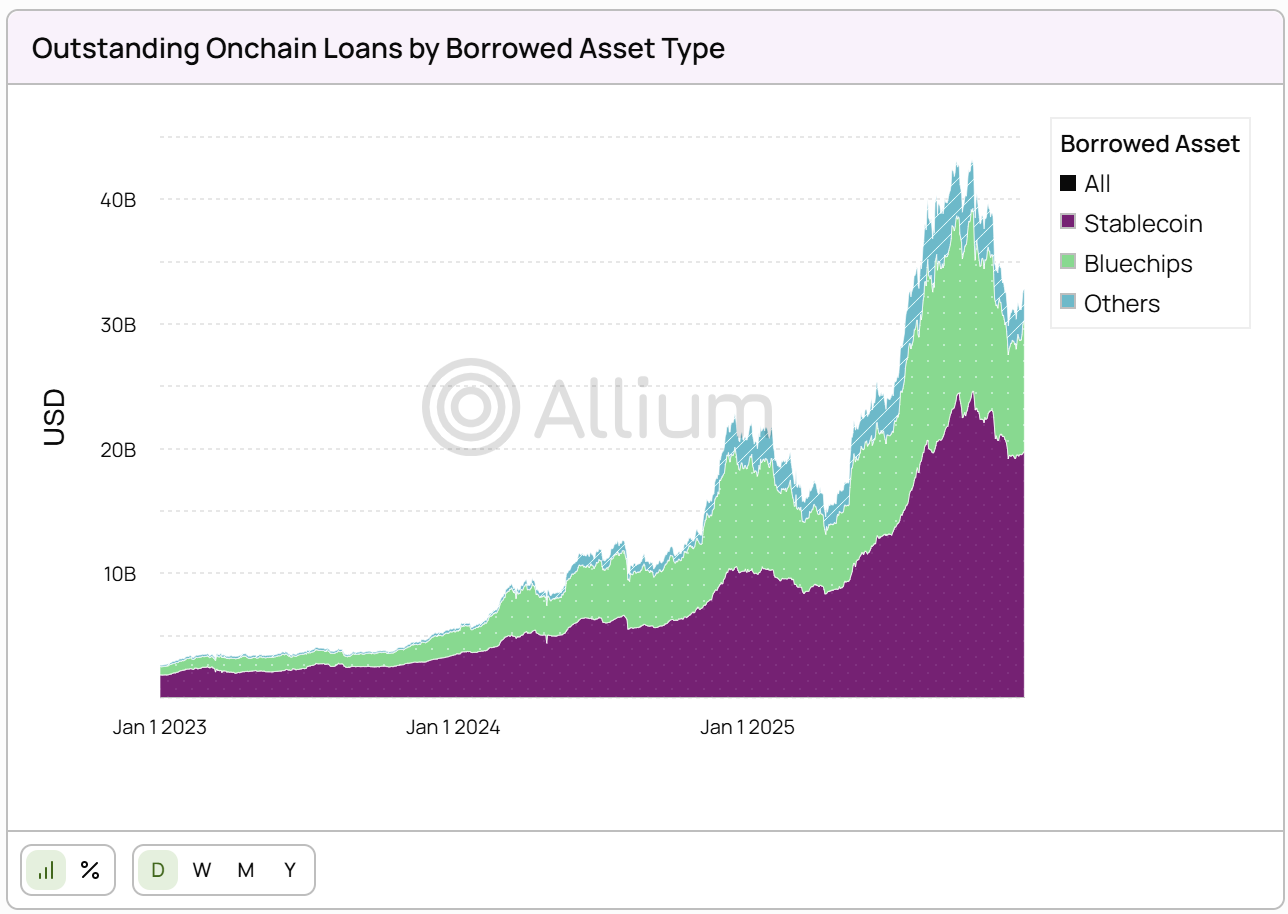

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Coming up this week: US jobs, inflation, crypto/banks and geopolitics

Monday mood: identity

Macro: Japanese elections

Markets: a different type of rotation

Macro: US consumer sentiment

(Tomorrow: China’s RWA ban, the EU’s DLT Pilot Regime and more)

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

Coming up this week:

A hectic week of US macro data, with jobs, inflation, retail sales, wage indices, import prices and more…

On Tuesday, we get the US NFIB small business optimism index. We also get the Q4 employment cost index, the Fed’s preferred gauge of wage inflation – this is expected to show a slight deceleration. Plus, the US import and export price indices report should give us a hint as to tariff impact. And the year-on-year impact of retail sales for December is forecast to drop from 3.3% to 2.9%.

Also on Tuesday, representatives from the crypto and banking industries gather again at the White House to continue hashing out the impasse on stablecoin rewards. Unlike the previous meeting which got nowhere, this one reportedly will have representatives from banks in attendance, rather than just the bank lobbies. This is encouraging, as it’s possible the banks don’t care as much as the bank lobbies, whose job it is to make a fuss.

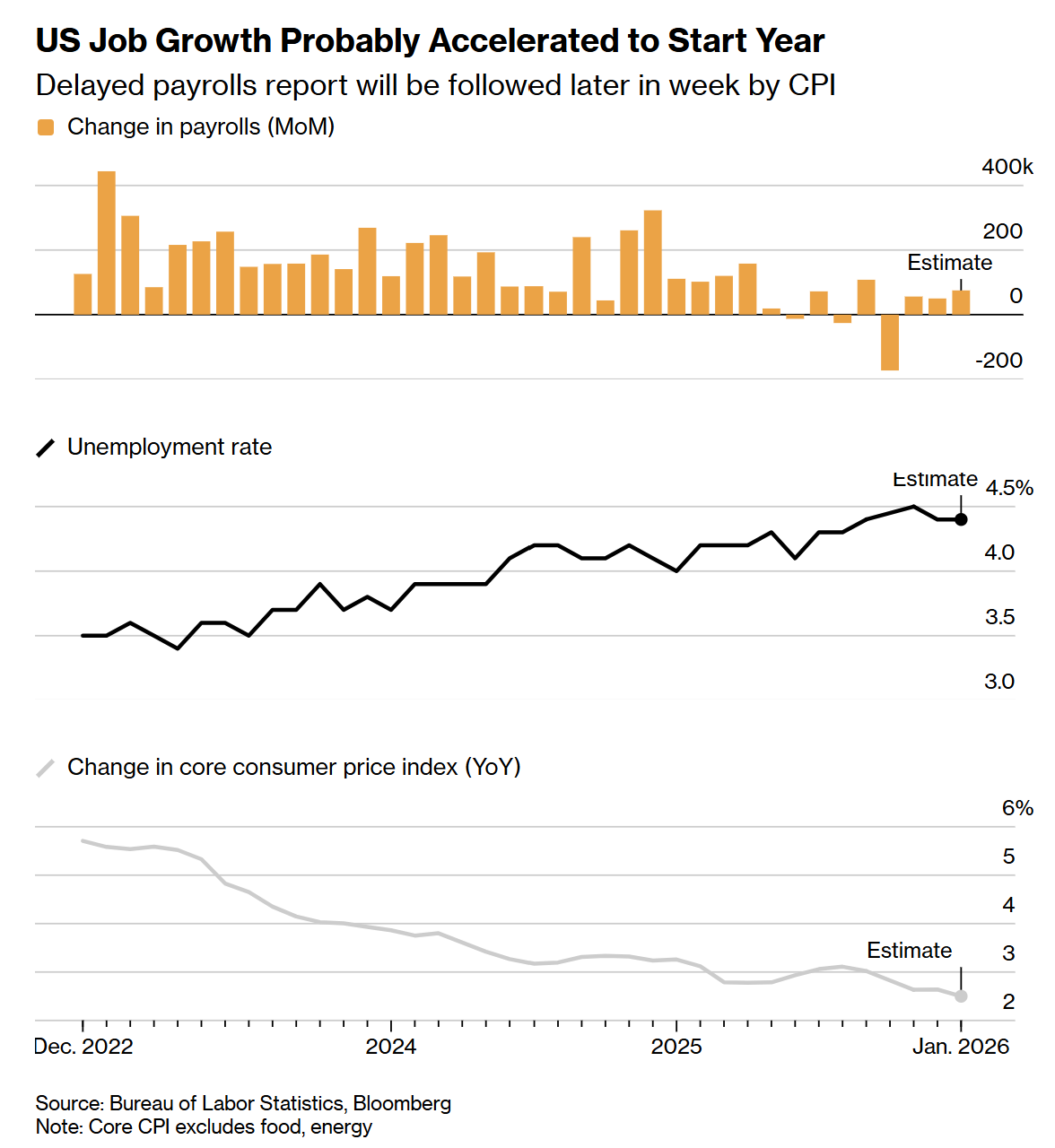

On Wednesday, we get the delayed official US jobs report for January. This one goes beyond delivering payrolls growth, the unemployment rate, and breakdowns of each. It also publishes the annual revision to the jobs count – brace yourself, as we should see a notable downward revision to the growth seen through March 2025. True, it’s now history, but it could change confidence in the current trajectory of economic growth. The consensus estimate for January’s payrolls increase is a not insignificant 69,000, which would be the best in four months. The unemployment rate is forecast to hold steady at 4.4%.

(chart via Bloomberg)

Also on Wednesday, we get China’s latest CPI and PPI reports.

The star of Friday is the US CPI inflation data, with the core index growth expected to drop from 2.6% in December to 2.5%. This would mark the lowest rate since early 2021.

Friday also sees the kickoff of the Munich Security Conference – last year’s event is remembered for Vice President Vance’s speech that criticized the deterioration of free speech protections in Europe, and jolted military leaders in attendance into contemplating the possibility that the world order was changing. It feels like it would be hard to top that for shock value.

And this weekend, China begins a week-long holiday for their New Year, ushering in the Year of the Horse.

Monday mood: identity

(My attempt at a regular Friday vibe check got totally steamrolled by accelerating events – I guess I should have seen that coming. Switching to Mondays as they tend to be less crazy, she says hopefully.)