India: a CBDC-friendly stablecoin

plus: the digital euro legislative push, Fed messaging, jobs and more

“A moral monopoly is the antithesis of a marketplace of ideas.” – Thomas Sowell ||

Hello everyone, and happy Fed Day! I’ll be making popcorn.

I’m on The Market House show later today with the inimitable Maggie Lake – tune in at 4pm on the show’s YouTube channel, or on Substack (I should be able to send out a notification there closer to the time).

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

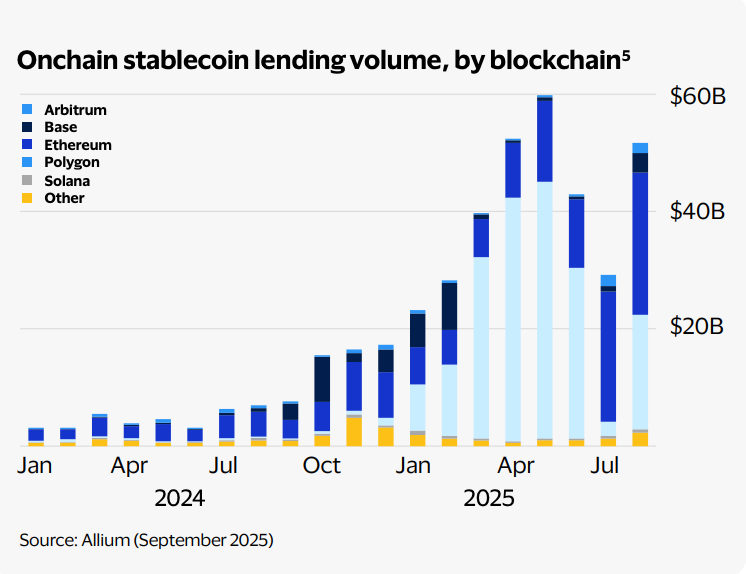

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

India: a CBDC-friendly stablecoin

Digital euro: legislative positioning

Macro: JOLTS

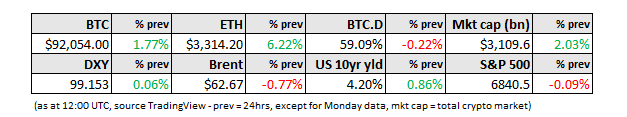

Markets: not the Fed you know

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

India: a CBDC-friendly stablecoin

With so much stablecoin bustle in the US and now increasingly in Europe, we’re missing some intriguing developments over in Asia.

Last month, it was revealed that India is working on a regulated, rupee stablecoin. When I first read the news, it threw me – how can the country have a regulated stablecoin with no stablecoin regulation? It turns out that’s not necessary if you have the right approvals.