Inflation expectations: it’s all in the wording

plus, tariff futility, institutional crypto interest, Greenland and more...

“When you are wrestling for possession of a sword, the man with the handle always wins.” – Neal Stephenson ||

Hello everyone!!! I hope most of you get to take advantage of the official holidays sprinkled between this week and next to take at least a bit of time off. It’s been an intense few weeks, and I expect there’s more of that ahead, so it’s important to recharge!

Production note: it’s Easter where I live this week, a big deal in Spain, and so I’ll be taking a much needed break from tomorrow through to Monday inclusive. There may be some chocolate consumption involved. And probably some strolling around our local park, where Spring flowers are in full bloom. 🌸

IN THIS NEWSLETTER:

Inflation expectations: it’s all in the wording

Inconsistency leads to futility

Crypto: Institutional interest

Macro-Crypto Bits: macro, markets, realignment, tariffs

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Inflation expectations: it’s all in the wording

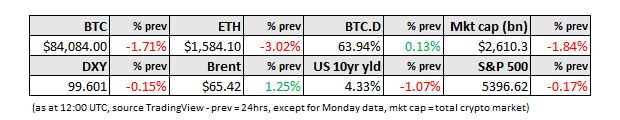

On Monday, we got the March consumer survey from the NY Fed, which showed markedly different results from the alarming University of Michigan consumer survey out on Friday.

The picture painted is still not good – inflation expectations for one year out rose to 3.6% from 3.1% in February.

(chart via @NickTimiraos)

Expectations of rising unemployment hit the highest level since the pandemic.

(chart via @NickTimiraos)

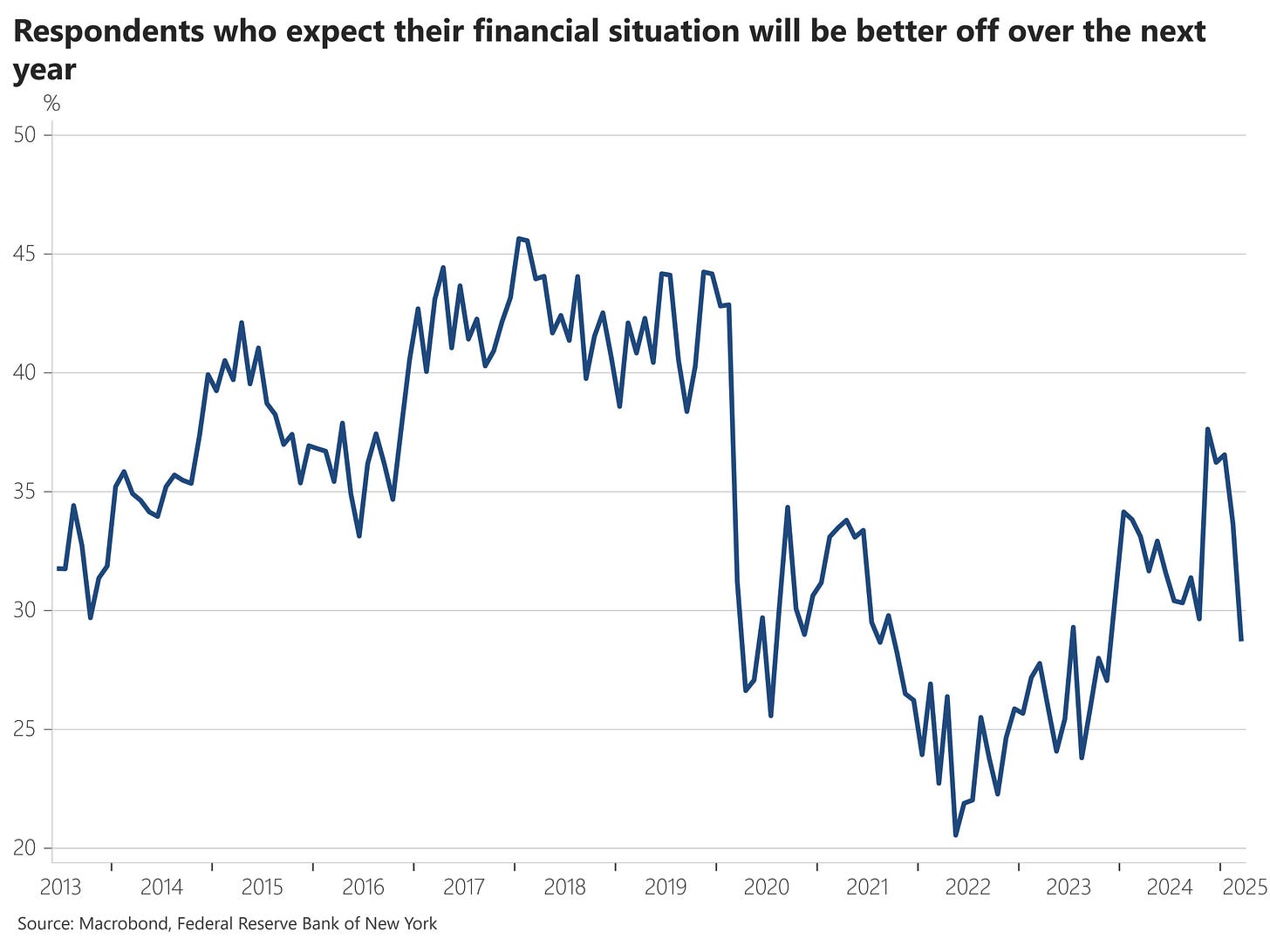

And the percentage of households that expect their financial situation to improve over the next 12 months fell to the lowest in over a year.

(chart via @NickTimiraos)

But… the University of Michigan read on Friday showed consumer expectations of inflation one year out at an eye-watering 6.7% (up from 5.0% in February). And the New York Fed’s survey showed inflation expectations five years out declining slightly to 2.9% from 3.0%, while the University of Michigan measure for 5-10 year inflation was 4.4%, up from 4.1% in February.

Why such a stark difference?