Inflation is part of the plan

plus: China and US debt, Intel, WEF, cuts vs yields, and more

“If all the economists were laid end to end, they’d never reach a conclusion.” – George Bernard Shaw ||

Hello everyone! I hope you’re all doing well.

As of tomorrow I’m in Hungary for a wedding. I’m not the most relaxed of travellers, and fantasize about being able to one day just hop on a plane with nothing more than a shoulder bag, and have everything I need waiting for me at my destination. Instead, tonight I’ll be exhausting myself with mental lists of all the potions and clothing and cable needs for the next few days (will it rain? are these shoes comfortable? where’s my extra battery?). Invariably, as I’m schlepping to the airport on public transport, I always regret deciding to go anywhere (home is nice); but then just as invariably, I’m always glad I did.

Yesterday, I was guest host on Scott Melker’s Macro Monday show, and had great time talking to the usual gang Dave Weisberger, Mike McGlone and James Lavish. You can watch the replay here.

And later today, I’m on a Real Vision Pro panel, we kick off at 11:00amET – if you’re a member, tune in!

Production note: This newsletter will take a short break from tomorrow, back on Monday! 🌞

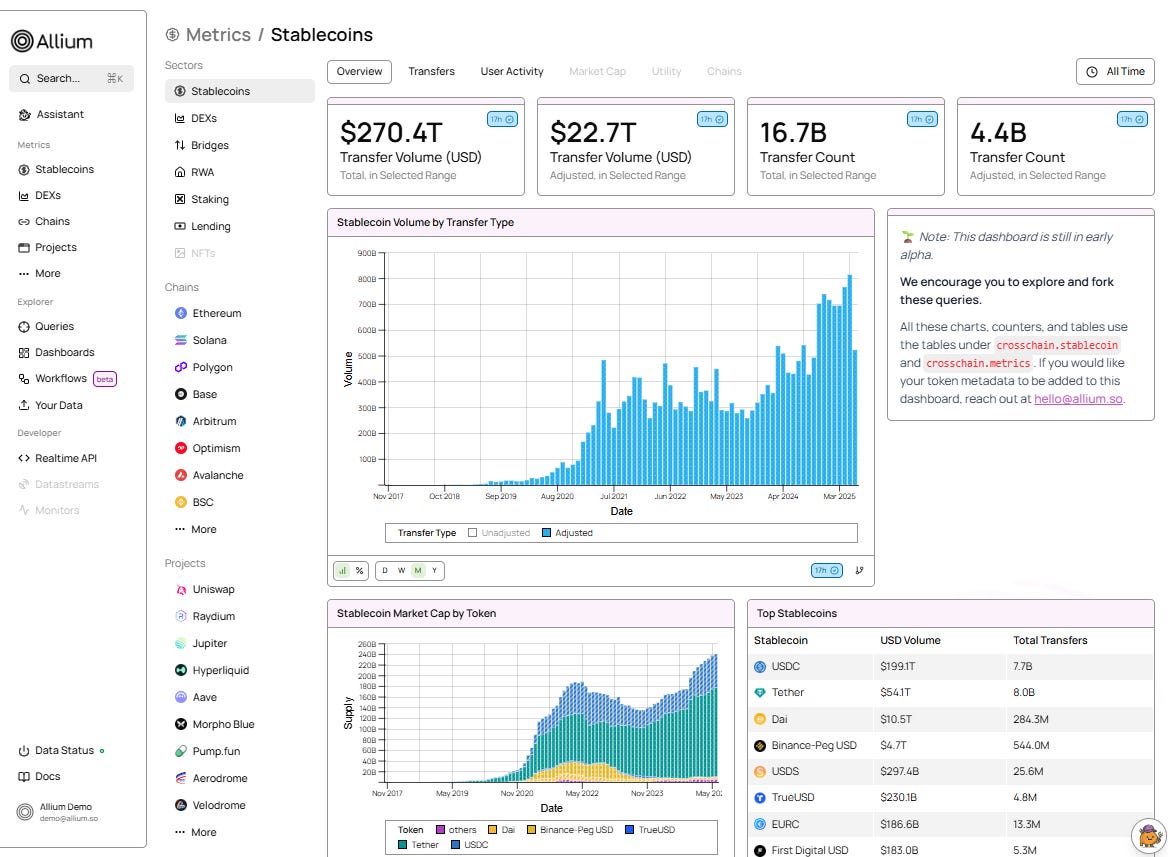

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

Inflation is part of the plan

China and US debt

Macro-Crypto Bits: UK rate cuts and yields, the WEF, capitalism

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

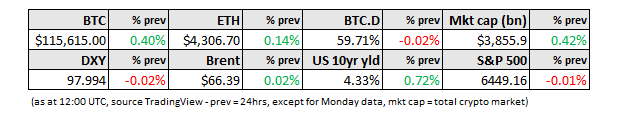

WHAT I’M WATCHING:

Inflation is part of the plan

Regular readers will know that I don’t think the Fed should lower rates in September – inflation is sticky, likely to head up further, and while the jobs market is looking a bit softer these days, it’s far from in a crisis. What’s more, inflation is a much bigger threat to the economy and to markets than higher unemployment as it affects everyone, especially those in the lower income bracket.

But, regardless of what Chair Powell signals on Friday, US Treasury Secretary Scott Bessent is loudly signalling that rate cuts are necessary.

Many have assumed that it’s because he wants lower yields and therefore lower interest payments to keep the deficit increase in check. But I don’t think it’s that – of course, he wouldn’t object to lower yields, but he’s a smart man and no doubt knows that monetary policy is not the main driver of the bond market.

Rather, I think his proclamations are about something else: talking down the dollar.

Before we get into why, let’s look at what he’s been saying.