Institutional tokenization with a twist

plus: crypto lending, the Fed, complacency, correlations and more

“The inevitable is always certain but not always punctual.” – Jim Grant ||

Hello everyone, I hope you’re all having a good week so far! Today, I’m taking a break from the intense macro swirl to focus on a couple of pieces of significant tradfi-crypto news from the past few days – as usual, I didn’t get to a fraction of what I wanted to, so more coming next week (banks + crypto, China tokenization, Russia’s CBDC, NFTs and more).

Programming note: I’m afraid I have to miss publication tomorrow, but will be back with the free weekly on Saturday!

The edited Bits & Bips episode is out! Steve Ehrlich, Ram Ahluwalia and I chat to Pantera Capital’s Cosmo Jiang. You can see that here (YouTube link) or listen here (Spotify link).

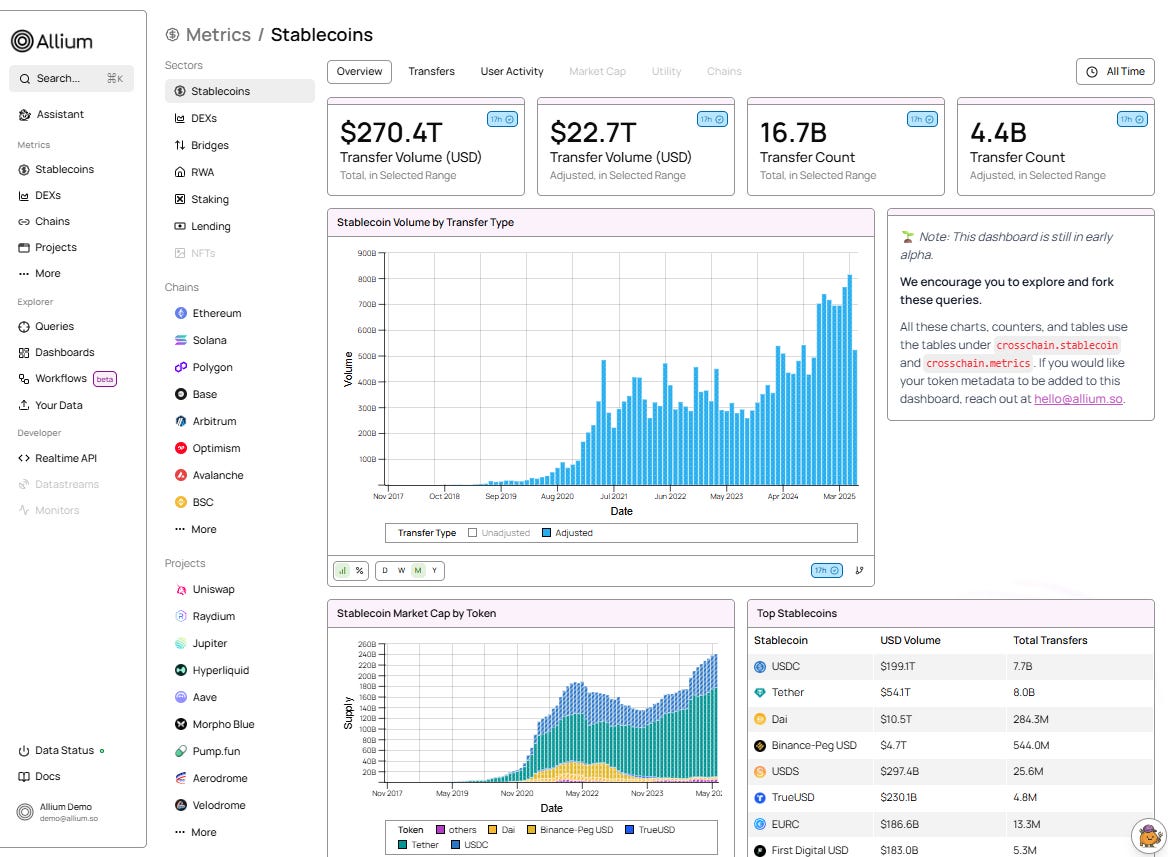

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

Allium provides blockchain data and analytics for institutions and fintechs, helping teams generate key insights from on-chain activity. Leaders like Visa, Stripe, and Grayscale rely on Allium to power mission-critical analyses and operations.

For more information: www.allium.so.

IN THIS NEWSLETTER:

BNY and Goldman: tokenization with a twist

Crypto lending and tradfi

Macro-Crypto Bits: the Fed, complacency and correlations

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

BNY and Goldman: tokenization with a twist

BNY and Goldman Sachs, two of the world’s largest financial institutions, have launched a blockchain platform to tokenize money market funds. This may sound relatively commonplace by now, but this initiative has a few intriguing twists: