It’s a Mar-a-Lago Pact, not an Accord

Plus, force mobilization, finger-pointing, ETFs and more

“One of the great mistakes is to judge policies and programs by their intentions rather than their results.” — Milton Friedman ||

Hello everyone, I hope you’re all doing well!

This is probably the longest Crypto is Macro Now EVER, but I tackle the Trump Administration strategy on tariffs and the dollar, and it’s complex (you’ll be relieved to know I ended up cutting quite a bit). Tomorrow’s newsletter will be much shorter, I assure you!

I also look at rating agency US warning, finger-pointing in the Black Sea, force mobilization in the Indian Ocean, a key ETF filing and more.

IN THIS NEWSLETTER:

It’s not a Mar-a-Lago Accord, it’s a Mar-a-Lago Pact

Macro-Crypto Bits: US debt warning, confidence hit, SOL spot ETF, force mobilization and more

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as audio, relevant links and music recommendations ‘cos why not.

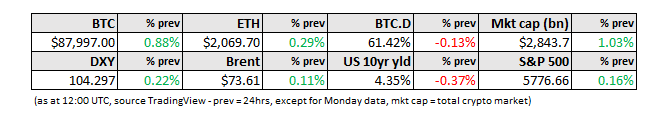

WHAT I’M WATCHING:

It’s not a Mar-a-Lago Accord, it’s a Mar-a-Lago Pact

Epoch-shifting global agreements are often romantically named after the place in which they were signed, transforming a location into a concept that spans continents and centuries. Almost all who went through the Western curriculum know the names “Versailles” and “Bretton Woods”, even though they may not have a clue where these places are.

Let’s take Bretton Woods as an example – a picturesque town in New Hampshire, surrounded by forest, its name is now synonymous with global financial structures and coordination. In 1944, 730 delegates from 44 allied nations gathered at the town’s Mount Washington Hotel to hammer out the shape and pillars of the new international order.