JPMorgan: banking goes onchain

Plus: what’s ahead for the week

“There is all the difference in the world between treating people equally and attempting to make them equal.” – Friedrich Hayek ||

Hi all! I hope you had a good weekend with fresh air and seasonal colour.

We’re coming into a stretch with some irregular publishing, apologies – I’m travelling at the end of this week, and will miss Friday’s and Saturday’s publications. Following weeks have a sprinkling of national holidays, and then yikes it’s Christmas and the end of the year festivities. This time of year is always manic.

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

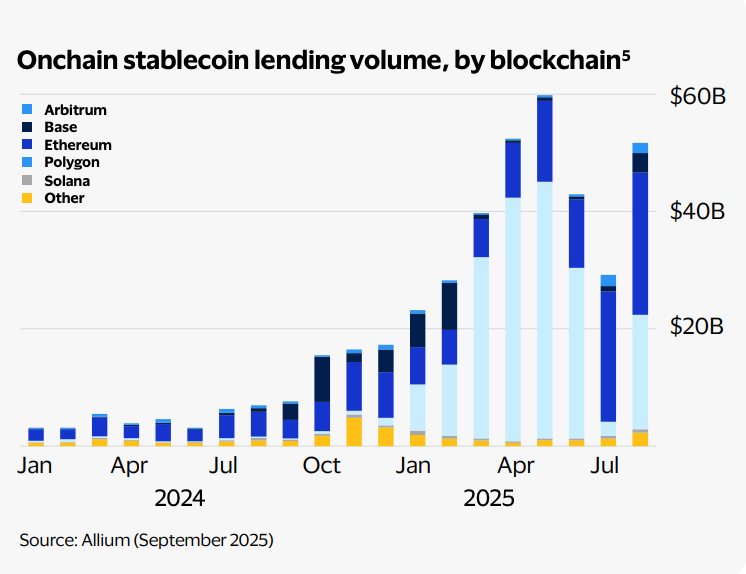

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

(I haven’t done my usual perusal of headlines this morning as I was heads-down untangling the timeline of JPMorgan’s various blockchain initiatives for the weekly profile – not nearly as clear-cut as you’d think, but I eventually got there although I am now officially exhausted.)

Coming up this week: US jobs data, MBS in the White House, a digital euro hearing and more

JPMorgan: banking goes onchain

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes.

WHAT I’M WATCHING:

Coming up this week:

It looks like we’ll get some official US economic data releases this week! And there is a steady flow of Fedspeak, with central bank officials giving remarks at a lot of different events – these will of course be scrutinized for signs of which way they’ll vote at the upcoming FOMC meeting.

Today, the European Parliament Committee on Economic and Monetary Affairs holds a hearing on the digital euro, with participation from ECB Governor (and digital euro enthusiast) Piero Cipollone.

We get some insight into US economic activity with the Empire State Manufacturing Index.

And we get the official outlook for the European Union in 2026, with a likely cut in expected growth.

On Tuesday, in his first official trip to the US since 2018, Crown Prince Mohammed bin Salman meets with President Trump in the White House. Renewed security pact incoming? Will Saudi Arabia join the Abraham Accord?

On Wednesday, we get the minutes from the latest FOMC meeting, and perhaps a glimpse into just how contentious the decision to cut was – this in turn just might shed further light on who stands where on a December cut.

And, arguably even more important for market sentiment, we get Nvidia Q3 earnings after the market close. Good news could revive flagging market spirits; bad news could accelerate the exit from high-flying AI-related valuations.

On Thursday, we in theory get the official US jobs report for September. This will include the unemployment rate from the household survey as the data was collected before the shut-down – it’s next month’s unemployment rate report that will be skipped because of a lack of data.

And Walmart earnings should give a glimpse of how the US budget-conscious consumer is doing.

On Friday, we get the official US real earnings report for September.

And we get the November consumer sentiment report from the University of Michigan.

This weekend sees the kickoff of the G20 meeting in South Africa, with the notable absence of the leaders of the world’s two largest economies – so you sort of have to wonder what’s the point. More photo-ops, I guess, with perhaps some grumblings about the US and China plus some trade deals on the side?

🍂 If you find this newsletter useful, or even if you just enjoy my excellent music recommendations and fun gifs, I hope you’ll consider sharing it with friends and colleagues and nudging them to subscribe! 🍂

JPMorgan: banking goes onchain

Here you go, the second of my tradfi-crypto profiles, a weekly series in which I dive into blockchain work from traditional institutions, in an attempt to get a feel for trends that are likely to impact the structure of finance. This one was particularly ambitious as JPMorgan is not only one of the largest banks in the world (which means it has plenty of resources to allocate), it was also one of the earliest to carve out a niche for onchain services. This means there are many threads to follow, and a few rebrands to keep up with. But it’s a fascinating case study for not only bringing various onchain explorations under the same umbrella, but also integrating them with traditional applications as soon as feasible.

Below is a timeline of sorts, but with some jumping around as I’ve tried to group threads on specific features. It was the only way I could think of to tease out an easy-to-follow narrative.