Many layers of error

plus, what to keep an eye on this week

“It's no wonder that truth is stranger than fiction. Fiction has to make sense.” – Mark Twain ||

Hello everyone, and welcome to March! I’d say here’s hoping it’s less crazy than February, but so far, it doesn’t look like it will be…

Today’s email is long, sorry, will make up for it with shorter reads later in the week.

Below, I talk about why Trump’s post yesterday is so damaging.

I also introduce a new Monday section which will flag some relevant things to watch out for during the week. Feedback welcome!

IN THIS NEWSLETTER:

Upcoming: What to keep an eye on this week

Many layers of error

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as audio, relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

What to keep an eye on this week

(a new weekly section in which I’ll aim to give you a heads-up on possible market-moving events, as well as those that could shape the geopolitical and crypto stage)

Later today, we get US manufacturing activity data, expected to show the second consecutive month of expansion.

Barring a last-minute change, tariffs kick in tomorrow for Mexico and Canada (25%, and 10% on Canadian energy), and those imposed last month on China double to 20%. These should be already priced in (with perhaps a discount for possible cancellation) – what is not priced in are any retaliatory measures.

On Wednesday, China heads into the National People’s Congress, the annual gathering of the country’s legislature where we will get a glimpse of economic policy priorities and targets. More measures to ramp up consumption are expected, as is another increase in the budget deficit target.

Also on Wednesday, we get the US ADP payroll numbers, a private version of the official report due on Friday. This is expected to show a slowing in hiring numbers, but the two don’t always coincide in either magnitude nor direction.

And we get US services activity data, expected to show continued expansion.

The European Council is meeting on Thursday to discuss Ukraine aid and measures to boost defence spending, including a possible relaxation of fiscal rules – this could move the euro relative to the USD, feeding through to the DXY index and global risk appetite. Or, progress could be paralyzed by opposition within the bloc, with Hungary and Slovakia publicly opposing the idea of more aid.

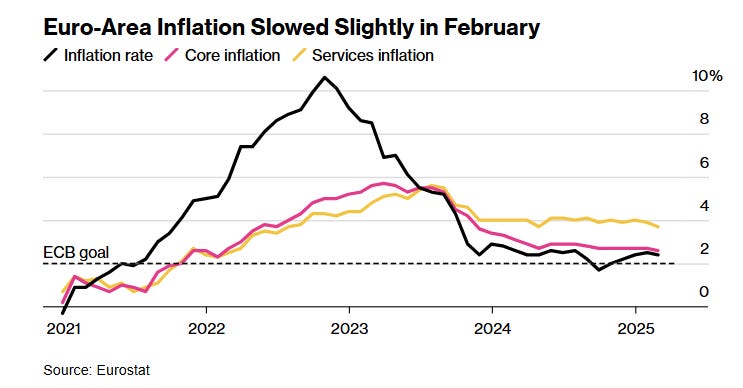

The ECB is expected to lower rates again on Thursday, possibly for the last time this cycle amidst signs of sticky services inflation – this morning’s release showed CPI for the economic bloc coming in higher than expected, with the core index delivering the highest month-on-month growth since last May. This also could impact the DXY index.

(chart via Bloomberg)

Also on Thursday, we get the US trade deficit – this adds the services account balance to the goods data we got last week, that pushed Atlanta Fed GDP growth expectations down into negative territory (I’ll be writing about this tomorrow).

And we get the US Q4 unit labour costs, an indication of wage trends, inflationary pressure, corporate margins and the health of the US jobs market.

On Friday, we have the first White House Crypto Summit, where members of the President’s Working Group will meet with industry CEOs and investors to discuss crypto policy and yesterday’s surprise announcement from Trump on a multi-coin Strategic Reserve (more on this below).

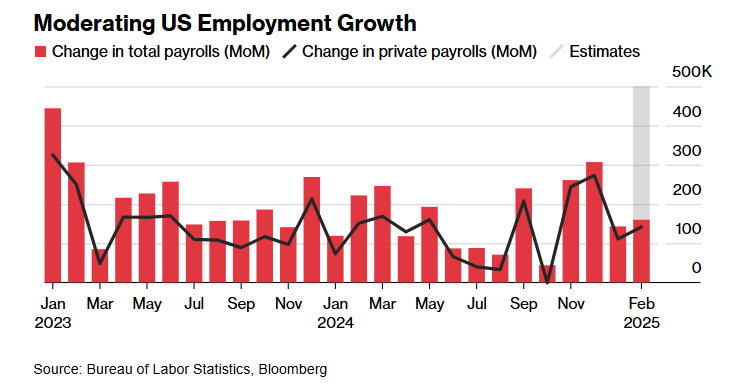

Also on Friday, we get the official US employment numbers. These are expected to show a pickup in job creation while the unemployment rate remains steady at 4% – this would be good news, but recent weekly jobless claims have hinted at an acceleration of layoffs, and we could see some impact from the federal hiring freeze.

(chart via Bloomberg)

And, on Friday, Fed Chair Jerome Powell is scheduled to speak at a monetary policy forum. I’ll be watching for any change of tone regarding the rate cut pause, inflation expectations and tariff uncertainty.

Many layers of error

It would be really nice to have just one weekend without any crypto-related drama.