Market jitters, the trigger and the overreaction

kicking the drama to next year

“To understand the man you have to know what was happening in the world when he was twenty.” – Napoleon Bonaparte ||

Hi everyone! I hope you’re all doing ok, despite yesterday’s market whiplash.

Today, I discuss the stark shift in the Fed’s focus, and why markets reacted the way they did. It’s relatively short, but with a ton of charts so I’ll probably still get Substack telling me off for length. 😝

The latest episode of Bits & Bips is out (recorded on Monday) – this week we were joined by Mauricio Di Bartolomeo, cofounder and CSO of Ledn. You can see it here, and listen to it here.

Production note: The holidays are upon us, and this newsletter will be taking next week (23rd-28th) off. Back on Monday 30th! I hope you all get some downtime as well – it’s going to be a crazy Q1.

IN THIS NEWSLETTER:

Market jitters

The trigger and the overreaction

If you’re not a premium subscriber, I hope you’ll consider becoming one! You get ~daily commentary on markets, tokenization, regulation and other signs that crypto IS impacting the macro landscape. As well as audio, relevant links and music recommendations ‘cos why not.

WHAT I’M WATCHING:

Market jitters

Well, that was dramatic.

In the released statement after the December FOMC meeting, Fed met market expectations of a 25bp cut, but opened the door to it possibly being the last one for a while.

As I mentioned earlier this week, the key information was in the updated economic projections (SEP), which contained some notable changes (more details below).

On Monday, I wrote that we would most likely see upward revisions in expectations for rates, inflation and GDP growth, with a flat or downward adjustment in unemployment. We got all that. What most surprised me was how much the market was surprised by this.

(chart via TradingView)

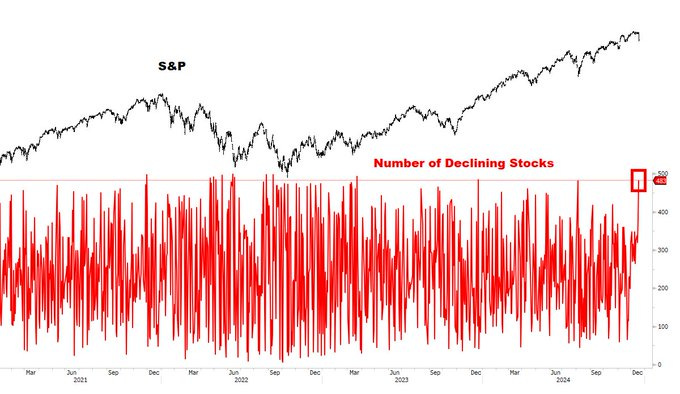

The S&P 500 dropped almost 3%, the worst “FOMC decision day” performance since 2001, and the worst after a Fed meeting since the pandemic. The adjustment hit all sectors and delivered the broadest selling wave of the year, with fewer than 20 stocks finishing up on the day.

(chart via @MacroCharts)

The smaller-cap Russell 2000 fell by 4.4%, its steepest decline since June 2022, at the beginning of the Fed’s aggressive hiking cycle.

The 10-year benchmark treasury yield soared past 4.5% and stayed there for the first time since June, marking its sharpest daily move since the taper tantrum of 2013.

(chart via TradingView)

Rates expectations have also moved sharply, with the CME-priced probability of zero cuts next year jumping from a negligible 6% to 20%.

(chart via CME FedWatch)

The shift is even more stark when you compare rates expectations now to those in the runup to the September economic projections update.