Market relief but with caution

Plus: why inflation expectations matter for crypto, what’s ahead this week, and more

Hello everyone! I hope you all had a good weekend – such gorgeous weather where I am, I literally spent part of yesterday touching grass. Just as well, given how this week is shaping up…

PUBLISHED IN PARTNERSHIP WITH: ✨ALLIUM✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

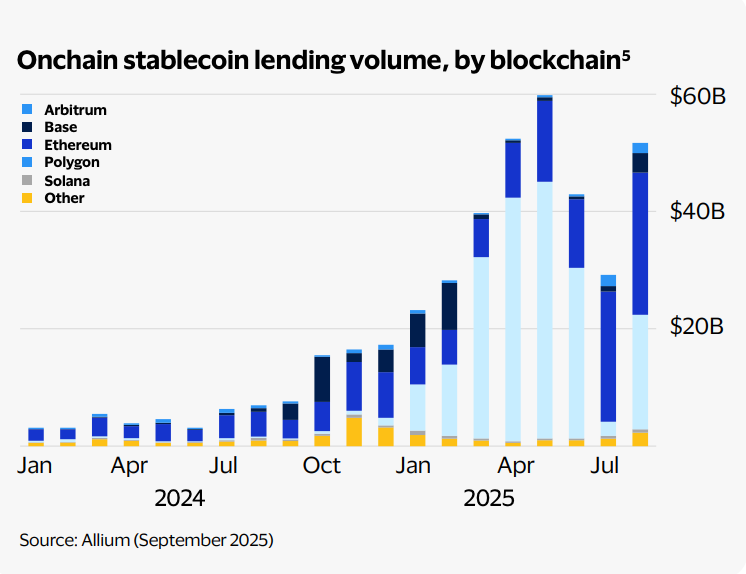

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets, as stablecoin lending volumes reached over $50bn in August 2025.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Coming up this week: Syria, small business sentiment, Fedspeak and more

Market relief but with caution

Why inflation expectations matter for crypto

WHAT I’M WATCHING:

Coming up this week:

It’s a relatively quiet week, thank goodness, since even if we do get an agreement from Congress to reopen the US government, things will take a while to get going again. And meanwhile, I’m thoroughly confused as to the schedule for official US economy data releases – some reports say we will get an October CPI report from the Bureau of Labor Statistics on Thursday, others say we won’t, so I guess we’ll wait and see?

On Monday, Syrian President Ahmed al-Sharaa will meet with President Trump at the White House, in the first official visit from a leader of the Middle East country since 1946.

Also, the COP30 climate summit kicks off in Brazil, but will as usual have no impact on anything other than headlines and private jet airmiles. What’s more, it drags on until Nov 21st. That said, it’s notable that so many heads of state and high-ranking officials are skipping it this year.

And we get the Conference Board Employment Trends Index for October which, in the absence of official employment data, will be especially relevant for rate cut sentiment.

On Tuesday, we get the latest sentiment report from National Federation of Independent Businesses (NFIB), which will give some insight into the economic mood.

On Wednesday, we have remarks from US Treasury Secretary Scott Bessent and New York Fed President John Williams at a Treasury Market Conference in New York – this just might give some insight into the Fed’s reaction to recent tension in the repo funding market.

And White House National Economic Council Director Kevin Hassett, the front-runner (according to Polymarket) for the Fed Chair role when Jerome Powell’s term ends next May, is interviewed at the Economic Club of Washington.

🍂 If you find this newsletter useful (or even if you just like my awesome music recommendations), would you mind sharing it with friends and colleagues and nudging them to subscribe? I’d appreciate it! ❤