Markets: bloody hell

Also: pain and pause elsewhere, US jobs, tokenization froth and more

“The fact that we live at the bottom of a deep gravity well, on the surface of a gas covered planet going around a nuclear fireball 90 million miles away and think this to be normal is obviously some indication of how skewed our perspective tends to be.” – Douglas Adams ||

Hi everyone! Yesterday was a shock for all of us in the crypto industry, no matter what our market outlook has been. I hope you’re all hanging in there – take care of yourself this weekend!

PUBLISHED IN PARTNERSHIP WITH: ✨ ALLIUM ✨

As traditional finance and crypto converge, trusted data is the missing infrastructure layer. Allium provides this data foundation for teams like Visa, Stripe and Grayscale.

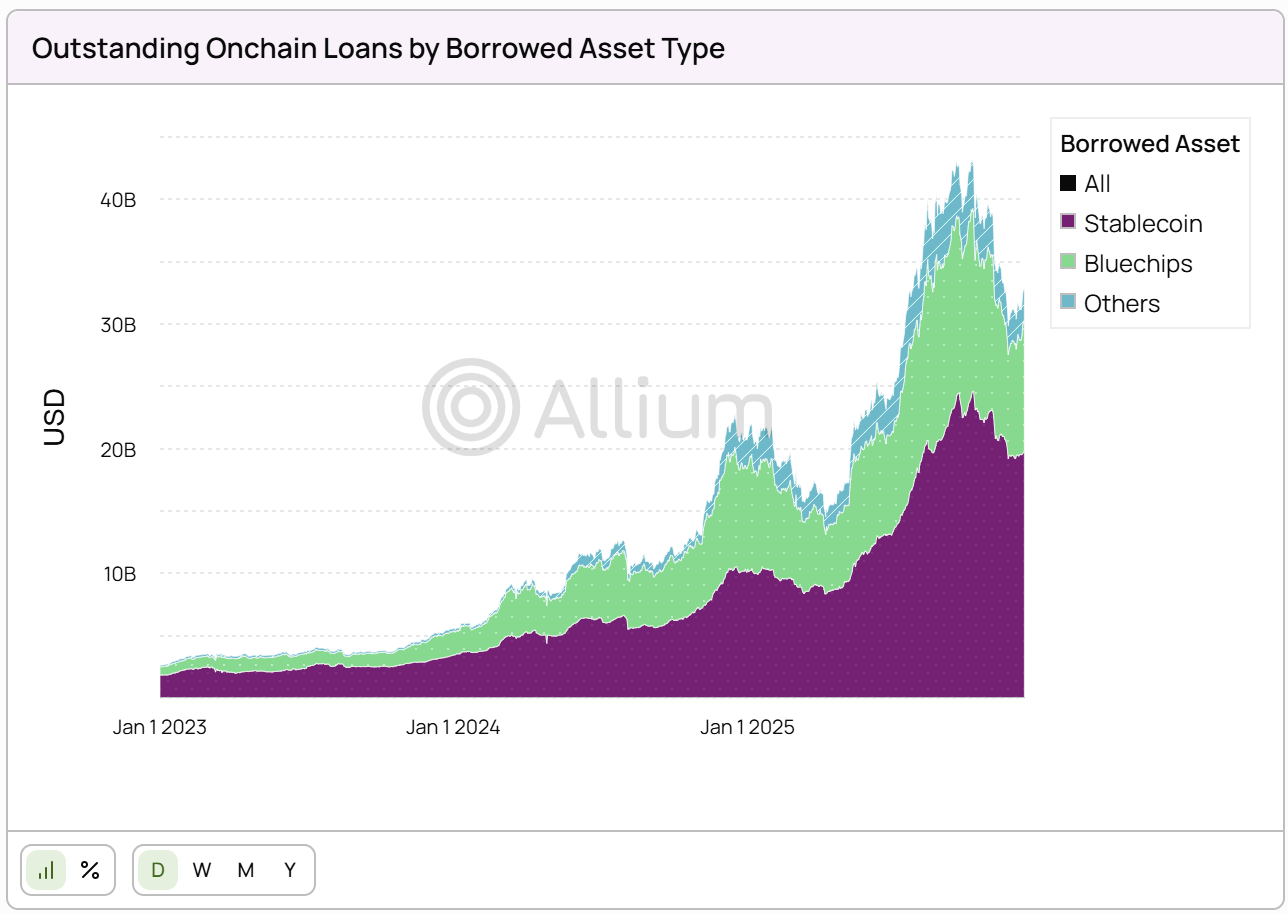

Our latest whitepaper published with Visa, Stablecoins Beyond Payments: The Onchain Lending Opportunity, examines how banks can access emerging credit markets. Looking at the data, outstanding onchain loans reached over $40Bn this year, with stablecoins making up more than half of borrowed assets.

If you’re producing institutional crypto research or analytics, start with trusted data. Explore a live demo.

IN THIS NEWSLETTER:

Markets: bloody hell

Markets: pain and pause

Macro: US jobs, again

Crypto: tokenization froth?

Crypto is Macro Now offers ~daily commentary and updates on the overlap between the crypto and macro landscapes. Plus links, a music recommendation (‘cos why not?), and more.

If you’re a premium subscriber, thank you!! ❤

WHAT I’M WATCHING:

Markets: bloody hell

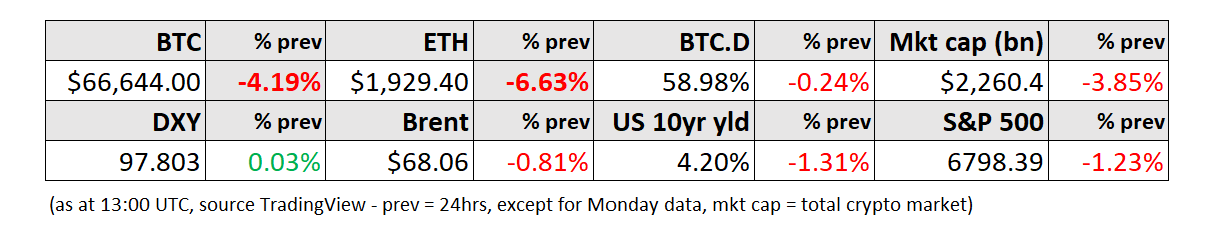

By now, you’ve probably seen the numbers: a few hours ago, BTC touched $60,000, a 24-hour drop of over 17% – this was even more in percentage terms than the black day in 2022 that FTX closed withdrawals. ETH did even worse, down 19%. SOL was down almost 27%.

(BTC/USD chart via TradingView)

I have to admit I was expecting some downward choppiness, but not the scale of what we saw.

As I type, there seems to be a brief respite, with BTC gingerly climbing towards $67,000.

So much to go into here, but we have to start with an attempt at some explanations. What happened?

The speed of the move suggests this was concentrated institutional selling, which rhymes with one or more large funds “blowing up” and having to unwind fast. In this macro environment, buyers stood back.

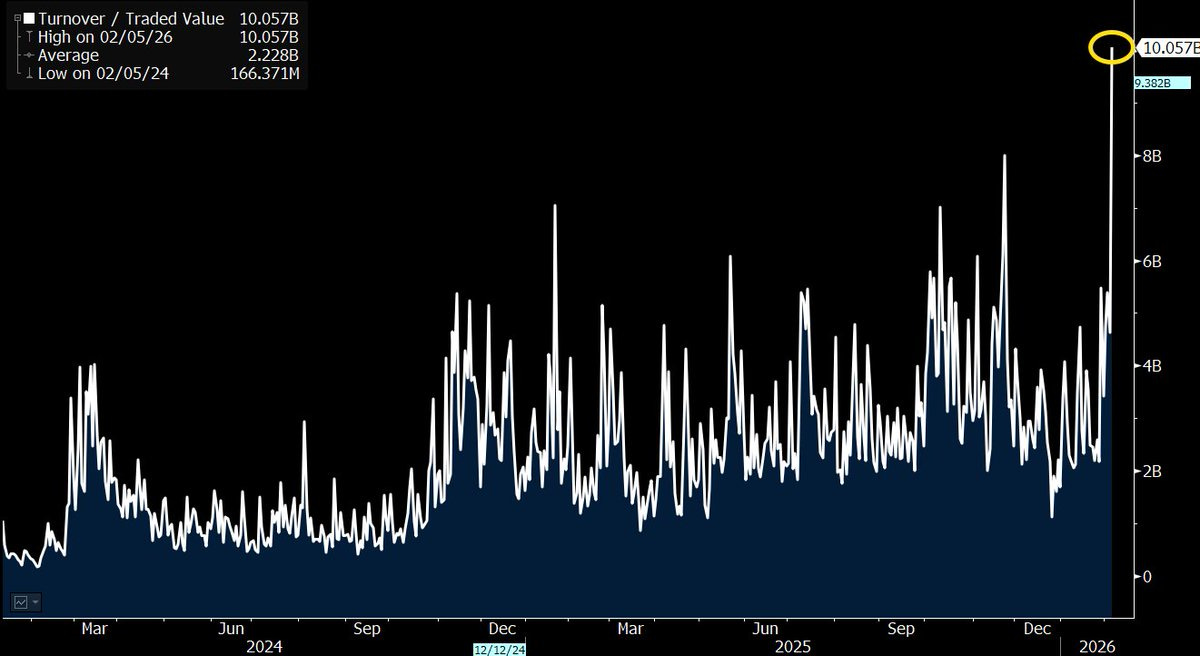

A plausible theory from @TheOtherParker_ on X is that the affected funds are based in Hong Kong, dedicated BTC funds with heavy positions in IBIT options, run by macro players and therefore under the crypto radar (they don’t use crypto exchanges nor interact much with other crypto investors, and large option positions won’t show up on any crypto investor dashboards). Yesterday was the highest volume on IBIT ever, and the highest volume for IBIT options. Parker posits that these macro players could have been loading up on silver positions to cover losses lingering on their BTC positions from the October 10th crash, and that yesterday’s silver rout tipped their leverage over the edge. Or, it’s possible that the window for redemptions from 10/10 ran out. Or both.

(chart via @EricBalchunas)

He also notes that, on January 21, Nasdaq hastily removed the cap on IBIT options positions, instantly enabling higher leverage without the standard review period – possibly at the urgent request of a prime broker? Speculation, but the timing is odd.

The reason we’re searching for an explanation is not just the age-old human coping strategy – it will say a lot about what happens next.

It may be some time before we get the full forensics of what really happened. But something broke yesterday. Back in 2022, we knew what it was – FTX suspended withdrawals, and its tendrils throughout the industry were, while not exactly clear at the time, at least relatively public. Even those of us, shall we say “lacking in optimism” of late, were surprised by yesterday’s ferocity.

There is potential upside in this: usually in active markets, sharp falls are followed by sharp rises.

Unfortunately, in crypto that could take some time. And the rout is not necessarily over, as yesterday’s move most likely killed other funds, which will have some unwinding to do.

Yet, buyers are seeing opportunity in these prices. If BTC manages to hold on to current levels for a couple of days, we should see them start to step in.

That said, the impact may at first be muted. Confidence has taken a hit and will need some time to recover. Investors nursing losses may choose to sell as soon as they hit breakeven, weighing on any rally.

Bigger picture, we’ve been here before. There are horrendous losses out there, as well as widespread fear. Funding for crypto projects could contract which will inevitably lead to projects winding down and people losing their jobs. That is sad, no upside there.

But we know the industry will recover.

And the main narratives are still intact – those insisting that no “store of value” can go down this much are judging Bitcoin on too short a timeframe. Debasement hedges are always long-term. What’s more, the utility of an asset that can act both a hedge against fractures in the global financial system and insurance against censorship and repression is arguably stronger than ever.

Over the years, I’ve found that even those who live in stable democracies with reliable financial systems understand the “debasement trade”, and see gold exposure via ETFs or derivatives as a good way to play it. But hardly any of that global subset fully appreciate the need for an insurance asset. Those that do, hold gold bars in their home safe or Bitcoin in a self-custodial wallet.

Unfortunately, most of the world doesn’t enjoy the stability and reliability privilege. They instinctively understand the insurance angle. And, going by recent headlines, their number is likely to grow, even in the West. For most of the world, access to insurance assets is not easy – but, in the case of Bitcoin, it’s getting easier. This narrative is quiet and won’t move the price in the short-term. But it is unfortunately real and, over time, we will see its hand in the longer-term effect.

In sum, I know that I’ve said before that down is better than sideways. But ouch. This market is painful for all, and the fear is extending well beyond crypto. I hope you and your friends and family are doing ok. This is a time to reach out to others, to trim expenses where we can, and to remember that, for everyone, watching a regime change is both terrifying and foundational.

Markets: pain and pause

Crypto was not the only market to suffer yesterday, although its pain was the most intense. Yesterday, the S&P 500 fell 1.2%, Nasdaq dropped 1.6%, extending its deepest slide since April. Fingers are pointing to Anthropic’s AI models that threaten established software businesses, but I’m not buying it – it feels more like investors are finally connecting the dots between a FOMO-fueled capex race, uncertainty as to the ROI, and the corporate and social cost if AI does prove to be as disruptive as the valuations suggest.

There’s more at work, of course – and liquidity has to go somewhere. Japanese stocks climbed in today’s trading, Europe is cautiously green, and US index futures are pointing to a bounce on today’s open.

After sharp falls yesterday, gold and silver are also bouncing this morning.

Check out this curious chart:

(chart via TradingView)

Gold, silver and BTC all bottoming at the same time. This reinforces the theory (see above) that the crypto dump was driven by macro fund liquidations, and the bounce is driven by macro buying. Happy to hear other explanations!